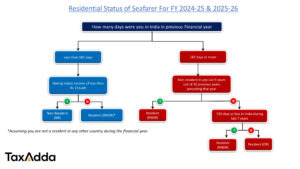

Residential Status for Seafarers (Merchant Navy)

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

Understand GST late fees for all types of GST returns like GSTR-1, GSTR-3B, GSTR-9 etc along with relevant GST notification/circulars.

Provisions of this section is applicable from 1st June 2017 A new section 194IB has been introduced from 01st June 2017. This section requires certain

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

A person can make an application for refund of GST before expiry of two years from the relevant date in such form and manner as

Rule 138 of CGST Rules defines the provisions of e-way bill. The provisions of this rules is applied by various states on different dates. The

What is Reverse Charge? Normally, GST is to be collected by the person who is selling good and services. But in some cases GST is

A new functionality has been introduced on the GST portal for the surrendering of GST Registration. If you want to cancel your GST registration, follow

As per the GST law, generally a taxpayer pays tax under normal rates i.e 5%, 12%, 18%, 28% and avails cenvat credit on inputs, input

What is Input Tax Credit (ITC) Input Tax Credit refers to the tax already paid by a person at time of purhase of goods ro

Anyone whose total taxable income exceeds the basic exemption limit is required to file an Income Tax Return (ITR) during the relevant assessment year. If

TDS, also known as Tax Deducted at Source is a direct taxation mechanism that facilitates direct tax collection from the source at the time of

As in many Asian countries, online gambling has been on the rise in the last several years in India. At the same time, India has

Following an increasing internet penetration in India, more and more Indians are beginning to make use of so-called online betting sites which allow users to

There are various ways in which you can verify your e-return, one of which is using bank account details. This option comes handy when you

Meaning of Clubbing In general, clubbing means including the income of any other person into the Assessee’s total income for the purpose of taxation. Certain