Important Changes in GST w.e.f. 01 April 2025 & 01 June 2025

Changes effective from 01 April 2025 (A.) 30 days limit for E-Invoice generation now applicable on turnover Rs.10 Crore or more : From 1 April

Changes effective from 01 April 2025 (A.) 30 days limit for E-Invoice generation now applicable on turnover Rs.10 Crore or more : From 1 April

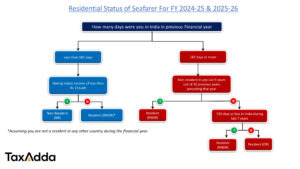

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

Understand GST late fees for all types of GST returns like GSTR-1, GSTR-3B, GSTR-9 etc along with relevant GST notification/circulars.

Provisions of this section is applicable from 1st June 2017 A new section 194IB has been introduced from 01st June 2017. This section requires certain

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

Which GST Returns are required to be filed? (From 1st January 2021) A registered person is required to file following returns: GSTR-3B (Quarterly or Monthly)

A person can make an application for refund of GST before expiry of two years from the relevant date in such form and manner as

Rule 138 of CGST Rules defines the provisions of e-way bill. The provisions of this rules is applied by various states on different dates. The

What is Reverse Charge? Normally, GST is to be collected by the person who is selling good and services. But in some cases GST is

A new functionality has been introduced on the GST portal for the surrendering of GST Registration. If you want to cancel your GST registration, follow

As per the GST law, generally a taxpayer pays tax under normal rates i.e 5%, 12%, 18%, 28% and avails cenvat credit on inputs, input

Resident & Non-Resident Individuals (all age group) under the New Tax Regime under section 115BAC for FY 2024-25 Net Income Range FY 2024-25(AY 2025-26)

The German pension system is known for its strict regulations and procedures. Many expatriates and workers who have contributed to the German pension fund might

Doing the books of accounts for an e-commerce seller is different from maintaining traditional books of accounts. It gets further complicated if the e-commerce seller

An Income Tax Return (ITR) is a form that enables the taxpayer to declare his income, expenses, tax deductions, investment, and taxes. There are a

Each year, individuals earning income higher than the basic exemption limit are required to file their income tax returns (ITRs) online. If you belong to

Anyone whose total taxable income exceeds the basic exemption limit is required to file an Income Tax Return (ITR) during the relevant assessment year. If