Proposed changes for Seafarers in Budget,2025

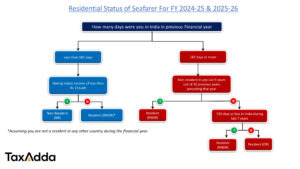

- Budget 2025 introduced the concept of “Tax Year” which will come in New Income Tax bill w.e.f. 01 April,2026. Hence You need not to decide two different years. There will be concept of one single year for taxation purpose i.e. “Tax Year”.

- Basic exemption limit for filing income Tax return has been increased from Rs. 3 lakh to Rs. 4 lakh under new regime with new Income slabs & tax rates, which will reduce the tax liability of Seafarers also, given below

| Net Income Range | FY 2025-26 (AY 2026-27) |

| Upto Rs. 4,00,000 | NIL |

| From Rs. 4,00,001 to Rs. 8,00,000 | 5% |

| From Rs. 8,00,001 to Rs.12,00,000 | 10% |

| From Rs. 12,00,001 to Rs. 16,00,000 | 15% |

| From Rs. 16,00,001 to Rs. 20,00,000 | 20% |

| From Rs. 20,00,001 to Rs. 24,00,000 | 25% |

| Above Rs. 24,00,000 | 30% |

- Time limit to file ITR U updated has been increased from 24 months to 48 months from the end of the relevant Assessment year. It means, Seafarers can file ITR upto 5 years from the end of “Tax Year” if they missed to file before.

- Like other Resident Individuals, NRI’s & Seafarers can also claim the value of two self occupied properties as “Nil” u/s 23(2) without any condition. Earlier there was a limit u/s 23(4) to claim second house property as “NIL” only if that is not occupied because of the reason of Profession/employment at another place.

Taxability of Salary Income

Salary income received by a non-resident seafarer working on a Foreign Flag Ship (sailing outside India) is not taxable in India. Section 5(2)(a) provides that only such income of non-resident shall be subjected to tax in India that is either received or deemed to be received in India. In other words, the salary credit to NRE bank account is just a remittance to an Indian bank account so section 5(2)(a) shall not be applicable.

Clarification issued by Central Board of Direct Tax (CBDT)

As per Circular No. 13/2017 issued by CBDT on 11th April 2017, salary accrued to a non-resident seafarer for services rendered outside India on a foreign ship shall not be included in the total income merely because the said salary has been credited in NRE account maintained with an Indian bank by the seafarer.

This circular specifically clarify if below conditions are met then the salary received shall not be included in the total income of the individual: –

- Non-Resident seafarer

- Service rendered outside India

- Foreign Ship

- Credited to NRE Bank account

However, it does not mean if you have received a salary from an Indian flagship or the amount is credited to NRO bank account then it is taxable as above circular is silent in this case but it is highly suggestable to get the salary credited only in your NRE bank account to safeguard yourself from any later appeals or proceedings.

The above circular is just a clarification issue by CBDT on the application made by Indian’s leading merchant navy unions (MUI and NUSI) against the decision passed in Tapas Bandopadhyay case in August 2016 by Kolkata Income Tax Tribunal mandating Indian merchant navy workforce to pay tax in India.

Taxability of Other Income

Any other income which accrues or arise in India is taxable here in India under section 5(2)(b). So other income earned by assessee like bank interest, capital gain on sales of investment or property in India, dividends, commission etc. are taxable and required to be reported at the time of filing your return of income.

Note – Only the interest earned on the NRE saving bank or NRE term deposit are exempt from tax under section 10(4)(ii).

FAQ

I have completed my non-resident status but salary in crediting in my NRO bank account. Is it going to be taxable in India?

No, the salary will not be taxable in India. However, it is highly suggestable to remit the salary into your NRE bank account only to avoid any litigation.

I have completed my non-resident status. I am working for an Indian company which is deducting my TDS. Is my income is taxable in India?

No, the salary will not be taxable in India. You have to file your income tax return to claim back the TDS amount deducted by your company as refund.

I have taken $3,000 as cash in India at the time of sign off from the ship. I have completed my non-resident status. Is this $3,000 is taxable?

No, as $3,000 is a part of your salary. You should convert it in Indian Rupees and deposit them into your NRE bank account.

I have completed my non-resident status and receiving rent of Rs 5,00,000 per year for renting my house situated in Delhi. Is Rs 5,00,000 exempted from tax?

The income from property situated in India is taxable for all person (resident or non-resident). So, you are required to file your return and pay taxes (if applicable) on the income earned from renting of property situated in India.

My bank has deducted TDS on the interest earned on NRO bank account whereas I have completed my non-resident status? What should I do?

Interest earned on NRO bank account is considered as Indian income and liable to tax in India. You can file your income tax return and claim the refund of the TDS deducted on NRO bank account interest. However, the interest earned on NRE bank account is exempt under section 10(4)(ii) so no TDS shall be deducted by the bank.

I have earned Rs 1,00,000 on sales of mutual funds and shares in the last financial year. Is it taxable as the tax-free income is Rs 2,50,000?

Yes, capital gain is taxable at a flat rate. No exemption of tax-free limit is available to non-resident against capital gain.

Is PPF interest earned by me is tax free?

A non-resident cannot open a PPF account. However, if you have open a PPF account before becoming a non-resident then you can continue such account till the lock in period of 15 years from the date of opening. Interest earned is exempt from tax under section 10(11) of the Income Tax Act. Also, the amount deposit into PPF shall qualify for the deduction under section 80C of the Income Tax Act.