Introduction

Goods and Service Tax (GST) is applicable in India from 1st July 2017.

Before 1st July 2017, service tax applies to services and vat, excise duty, etc. apply to goods.

After 1st July 2017, GST applies to trading and manufacturing of goods as well as on providing services.

GST is not applicable to alcohol, crude petroleum, motor spirit, diesel, aviation turbine fuel and natural gas. VAT, CST and excise duty is still applicable to them.

Here is a list of taxes which are applicable before GST and is no longer applicable.

Central Indirect Taxes – Central Excise Duty, Additional Excise Duties, Service Tax, Additional Customs Duty (CVD), Special Additional Customs Duty, Central Surcharges and Cess

State Indirect Taxes – VAT/Sales Tax, Entertainment Tax, Central Sales Tax, Octroi and Entry Tax, Purchase Tax, Luxury Tax, Tax on Lottery, State Cesses and Surcharges

Basic customs duty and anti-dumping duty is also applicable in addition to GST in case of import of goods.

Businesses who are liable to collect GST

The persons who are required to get compulsorily register in GST is provided in GST act. All such persons are required to collect GST from their customers and pay to the government.

A person can also register voluntarily under GST and he is also required to collect GST after registration. All provisions of the GST Act is also applicable to him.

Services on which GST is not applicable

GST is not applicable to certain services such as

- Salary and wages

- Electricity

- Interest

- Government Fees (such as MCA fees, land registration fees etc.)

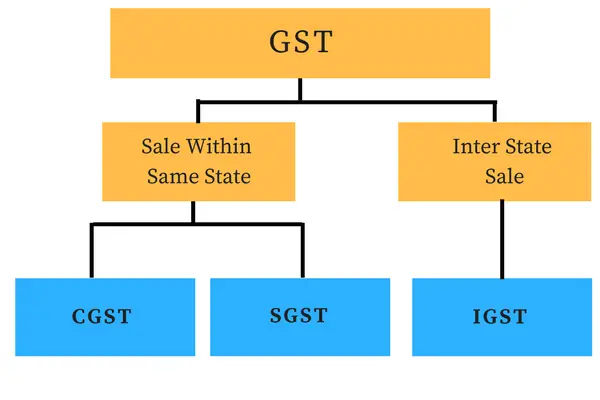

What are 3 types of GST – CGST, SGST AND IGST?

The GST system in India contains three types of GST. They are

- Central GST (CGST) – levied by central government

- State GST (SGST) – levied by a state government

- Integrated GST (IGST) – levied by the Central government on an inter-state supply of goods and services

On a sale of goods/service either IGST is to be charged or SGST & CGST both to be charged. If the business is in union territory, then UTGST will apply in place of SGST. The difference is only in name; the concept is the same.

Applicability of different types of tax

| Transaction Type | Type of GST Applicable | Example |

| Intra-state (i.e. sale within the same state) | CGST + SGST | A dealer in Delhi makes a sale to another dealer in Delhi. GST rate is 18%, so CGST of 9% and SGST of 9% will be applicable. |

| Inter-state (i.e sale outside state) | IGST | A dealer in Mumbai makes a sale to a dealer in Delhi. GST rate is 5%, so 5% IGST will be applicable. |

Inter-state sales or Intra-state sales

When the location of the supplier and place of supply is the same state/union territory, then it is considered as Intra-state sales, if they are different then it is considered as inter-state sales.

Now the question arises: What is a place of supply?

In general, a place of supply in case of goods is the location of goods at the time at which the movement of goods terminates for delivery to the recipient. For example – A person in Gujarat sells the goods to a person in Rajasthan and therefore handover to the transport company to deliver in Rajasthan. Therefore, the place of supply is Rajasthan and it is an inter-state sales.

Place of supply in case of services will be the location of the recipient if he is a registered person. If the recipient is not a registered person, then the place of supply will be the location of the recipient where the address on record exists otherwise it will be the location of the supplier.

How to calculate GST?

GST can be calculated simply by multiplying the Taxable amount by GST rate. If CGST & SGST/UTGST is to be applied then CGST and SGST both amounts are half of the total GST amount.

GST = Taxable Amount x GST Rate

If you have the amount which is already including the GST then you can calculate the GST excluding amount by below formula

GST excluding amount = GST including amount/(1+ GST rate/100)

For example, GST including amount is Rs. 525 and GST rate is 5%.

GST excluding amount = 525/(1+5/100) = 525/1.05 = 500

GST is calculated on the transaction amount and not on the MRP.

Calculation of GST Amount payable to Government

A registered person needs to pay the difference of GST on sales and GST on purchases made in a month. The purchase may be of goods, services or capital goods.

Capital goods are those goods which you had NOT purchased for the purpose of reselling. For example – Furniture in your shop, machine for production etc.

For example, A person made intra-state sales of Rs. 1 lakh in January and collected CGST of Rs. 2,500 and SGST of Rs. 2,500 at the rate of 5%. In the same month, he had made purchases of Rs. 80,000 and paid CGST and SGST of Rs. 2,000 each at a rate of 5%. He had also paid a bill of internet of Rs. 1,000 plus GST of Rs. 180.

Rs. 4,180 is allowed as a deduction from the Gross tax payable of Rs. 5,000. And therefore a net of Rs. 820 is payable to the government.

Deduction of GST paid on the purchase of goods, services or capital goods is called input tax credit. There are certain limitations and restrictions on taking the input tax credit. You can read more about it from here – Input Tax Credit Under GST

GST Rates

GST rates are as under

- 0% (necessity items like milk, wheat flour)

- 0.25% (rough diamonds)

- 3% (gold, silver etc.)

- 5%

- 12%

- 18%

- 28%

Most of the goods fall in the category of 5%, 12% and 18%, while most of the services fall in the category of 18%. GST of 28% is applicable on some items like cement, car, tobacco. There is also a Cess which is applicable only on a handful of goods like car, tobacco, pan masala.

There are also goods/services on which GST is applicable at NIL rate or which are exempted. Read our article regarding Difference between NIL rate, 0% GST rate and exempted goods/services.

You can easily calculate GST amount using our GST Calculator.

Advantages/Benefits of GST

The main benefits of GST are

- Single indirect tax for the whole of India

- Input tax credit can be taken for taxes paid in another state

- Easy transfer of goods from one state to another

Still has a question? Write a comment below and I will try my best to answer quickly.

Additional Read – Why there is a need for 3 types of GST – CGST, SGST & IGST