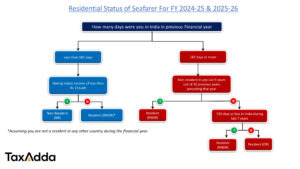

Proposed changes for Seafarers in Budget,2025

- Budget 2025 introduced the concept of “Tax Year” which will come in New Income Tax bill w.e.f. 01 April 2026. Hence You need not to decide two different years. There will be concept of one single year for taxation purpose i.e. “Tax Year”.

- Basic exemption limit for filing income Tax return has been increased from Rs.3 lakh to Rs.4 lakh under new regime with new Income slabs & tax rates, which will reduce the tax liability of Seafarers also, given below

| Net Income Range | FY 2025-26 (AY 2026-27) |

| Upto Rs. 4,00,000 | NIL |

| From Rs. 4,00,001 to Rs. 8,00,000 | 5% |

| From Rs. 8,00,001 to Rs.12,00,000 | 10% |

| From Rs. 12,00,001 to Rs. 16,00,000 | 15% |

| From Rs. 16,00,001 to Rs. 20,00,000 | 20% |

| From Rs. 20,00,001 to Rs. 24,00,000 | 25% |

| Above Rs. 24,00,000 | 30% |

- Time limit to file ITR U updated has been increased from 24 months to 48 months from the end of the relevant Assessment year. It means, Seafarers can file ITR upto 5 years from the end of “Tax Year” if they missed to file before.

- Like other Resident Individuals, NRI’s & Seafarers can also claim the value of two self occupied properties as “Nil” u/s 23(2) without any condition. Earlier there was a limit u/s 23(4) to claim second house property as “NIL” only if that is not occupied because of the reason of Profession/employment at another place.

Non-resident seafarers are allowed to have following types of bank accounts

Non-resident Ordinary Account (NRO)

It is a rupee-denominated saving account for managing income earned in India by the non-resident. Interest earned on this account is not tax-free and TDS is deducted by the bank @ 31.2%. It is highly advisable to file an income tax return if your bank has deducted any TDS on interest earned during the year as you may get a refund of the whole amount deducted under TDS as a non-resident seafarer does not have any income in India and enjoy tax-free limit of Rs 2,50,000 per year in old Regime & Rs 3,00,000 per year in new Regime (FY 24-25). Also, if you do not file the return then the income tax department may send you a notice for filing of return as you have some income on which TDS has been deducted but not claimed by you.

Non-resident External Account (NRE)

It is a rupee-denominated saving account for transferring the foreign income of the non-resident to India. Interest earned on this account is generally tax-free under section 10(4)(ii), so no TDS is deducted by the bank. But this doesn’t mean the interest is always tax free. In the following cases, the interest will be taxable: –

- If your status is resident (Ordinarily Resident) during the year.

- If you are not allowed to maintain NRE account as per FEMA or RBI provision.

Foreign Current Non-Resident Account (FCNR)

It is a fixed deposit account opened for transferring foreign income of the non-resident to India. The account is maintained in foreign currency and the interest earned on this account is generally tax-free under 10(15)(iv)(fa) so no TDS is deducted by the bank.

NRE Fixed Deposits/NRO Fixed Deposits

It is similar to the normal deposit which is allowed to normal resident. However, the TDS rate is 31.2% if the Deposit is made from NRO bank account whereas no TDS is deducted if the Deposit is made from NRE bank account. The taxability of deposit interest is exactly similar as in case of NRO and NRE bank interest.

FAQ on bank accounts

Can a non-resident seafarer maintain normal saving account in India?

Non-resident citizens are not allowed to maintain normal saving account in India as per rules of FEMA. It is illegal to have normal saving account and it is a duty of non-resident to close or convert the normal saving account to non-resident ordinary (NRO) account.

I am having NRE and NRO bank account from last 5 year and was completing my non-resident status regularly. I am not able to complete my non-resident status during the financial year 20-21 due to my courses. Shall I close my NRE/NRO bank account?

As you are going to become resident in India for the financial year 20-21 so you cannot maintain NRE/NRO bank accounts in India as per FEMA. Either you have to close the account or convert them as below within a reasonable time. No time period is defined anywhere but it is your duty to inform your bank and should get the account converted within a reasonable time period (around 1-3 months):

NRO Bank Account – You can ask your bank to convert it into normal ordinary saving account.

NRE Bank Account – You can ask your bank to convert it in Resident Foreign Currency Saving account or Resident Rupee Saving account. You can enjoy tax free interest if you are a resident but not ordinary resident

Is joint holder is allowed with NRE/NRO accounts?

Yes, joint holders are allowed with NRE/NRO bank accounts. You can have a resident as join holder for your NRO bank account for the NRE bank account the joint should also be a non-resident.

Interest earned on NRE bank account is tax free even if I become resident in India for a financial year?

No, interest is tax-free only when you are allowed to have an NRE bank account as per the provision of FEMA. The interest earned by you will become taxable in India. For more details, click here.

I have quit sailing now. Can I transfer the balance in my NRE/NRO bank account to a new normal saving account? Is there any tax liability?

Yes, you can transfer the balance available in NRE/NRO bank account to your normal saving account. No tax is applicable on such transfer.

Can I filed 15G/15H for non-deduction of TDS?

No, 15G/15H can be filed by a person who is not a Non-Resident. Even, you do not qualify for Non-Resident during the year, still you cannot submit 15G/15H as you are not allowed to have NRE/NRO bank accounts.