GST on Second hand goods and Margin Scheme

With the rise of the resale and refurbishment market, understanding how Goods and Services Tax (GST) applies to second-hand goods has become crucial for businesses

With the rise of the resale and refurbishment market, understanding how Goods and Services Tax (GST) applies to second-hand goods has become crucial for businesses

Section 40b determines the maximum amount of remuneration and interest on capital payable to a partner under Income Tax Act. The amount over the specified

Section 44AD This section is for presumptive taxation for eligible small businesses to declare a fixed percentage of their turnover as taxable income, eliminating the

Section 44ADA Section 44ADA was introduced for presumptive income for Freelancers & professionals. This section is similar to section 44AD for traders. Under this section

What is GSTIN ? GSTIN stands for Goods and Services Tax Identification Number. It is a unique 15-digit alphanumeric number assigned to every registered taxpayer

Changes effective from 01 April 2025 (A.) 30 days limit for E-Invoice generation now applicable on turnover Rs.10 Crore or more : From 1 April

Mandatory Registration under GST for Ebay Sellers Ebay is an e-commerce company registered outside India. It doesn’t have any place of business in India. But

Ebay Commission Charges For each fulfilled order Ebay charges commission from sellers. Now question arises whether GST under RCM is payable on such a commission

Will India Impose the New 28% Tax on the Online Casino Market The Indian online gambling sector has soared over the past years, and the

Details, as furnished in Details of outward supplies in Form GSTR-1, will be available to the composite dealer in Form GSTR – 4A. The dealer

Services provided by the hotel is a taxable service in GST. The place of supply will always be the state/union territory where the hotel is

Introduction Composition scheme under GST law is for small businesses. This is to bring relief to small businesses so that they need not be burdened

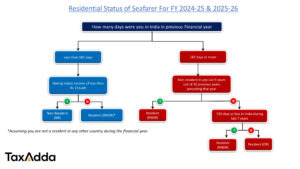

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

Provisions of this section is applicable from 1st June 2017 A new section 194IB has been introduced from 01st June 2017. This section requires certain

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

Proposed changes for Seafarers in Budget,2025 Net Income Range FY 2025-26 (AY 2026-27) Upto Rs. 4,00,000 NIL From Rs. 4,00,001 to Rs. 8,00,000 5% From

One of the best way to save income tax is to utilize the deduction available under section 80C. The current maximum threshold limit is Rs.

Each tax payer in India under the direct orders of Central Board of Direct Taxes (CBDT) is allotted a Permanent Account Number by the Income

Equity Linked Savings Scheme, commonly known as ELSS, is a diversified, open-ended, equity-oriented mutual fund scheme. In ELSS, 80% of the portfolio amount is required