Proposed changes for Seafarers in Budget,2025

- Budget 2025 introduced the concept of “Tax Year” which will come in New Income Tax bill w.e.f. 01 April,2026. Hence You need not to decide two different years. There will be concept of one single year for taxation purpose i.e. “Tax Year”.

- Basic exemption limit for filing income Tax return has been increased from Rs. 3 lakh to Rs. 4 lakh under new regime with new Income slabs & tax rates, which will reduce the tax liability of Seafarers also, given below

| Net Income Range | FY 2025-26 (AY 2026-27) |

| Upto Rs. 4,00,000 | NIL |

| From Rs. 4,00,001 to Rs. 8,00,000 | 5% |

| From Rs. 8,00,001 to Rs.12,00,000 | 10% |

| From Rs. 12,00,001 to Rs. 16,00,000 | 15% |

| From Rs. 16,00,001 to Rs. 20,00,000 | 20% |

| From Rs. 20,00,001 to Rs. 24,00,000 | 25% |

| Above Rs. 24,00,000 | 30% |

- Time limit to file ITR U updated has been increased from 24 months to 48 months from the end of the relevant Assessment year. It means, Seafarers can file ITR upto 5 years from the end of “Tax Year” if they missed to file before.

- Like other Resident Individuals, NRI’s & Seafarers can also claim the value of two self occupied properties as “Nil” u/s 23(2) without any condition. Earlier there was a limit u/s 23(4) to claim second house property as “NIL” only if that is not occupied because of the reason of Profession/employment at another place.

Meaning of Seafarer

A sailor, seaman, mariner or a seafarer is a person who navigates water bone vessels or assists as a crew member in their operation and maintenance.

Seafarer holds a variety of ranks and professions, each of which carries unique responsibilities which are integral to the successful operation of an ocean-going vessel. A common deck crew for a ship includes Captain / Master, Chief Officer/ Chief mate, Second officer/ Second mate, Able seaman, Ordinary seaman, Deck cadets etc. A common engine crew will include Chief Engineer, 2nd Engineer, 3rd Engineer, 4th Engineer (optional), Engine Cadet, Fitter, Motorman, Oiler etc. Other than this saloon staff will comprise of Chief Cook and General Stewart but the number and rank of crew members serving on a ship will vary according to the size of the vessel, trade area of the vessel, Minimum Safe Manning certificate, administration etc.

How Seafarer Earns

Seafarer generally receives remuneration in the form of salaries from the companies. As per general agreement terms, seafarer have employer-employee relationship with the employer companies (not a contractor relationship). So, the income earned by a seafarer, has to be taxable under the head Salary not Profession/Business (not under Section 44ADA).

If you want to report your income under Section 44ADA, then you must have defined relationship in the contract to get the benefit of reporting 50% of your earning as income.

Income Tax on Seafarer for FY 2024-25

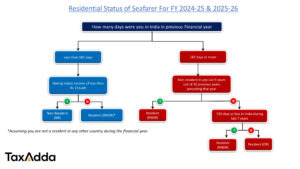

The taxability of salary received by a seafarer is based on the residential status of the seafarer.

RESIDENT SEAFARER

The salary received by a resident seafarer will be taxable as per the laws of the Income-tax department. No special exemption is available.

NON-RESIDENT SEAFARER

The salary of a non-resident seafarer will NOT be included in the total taxable income of the seafarer.

Meaning of Non-Resident Seafarer

An individual is said to be Non-Resident Seafarer if he is outside India for 184 days or more during the financial year (185 days or more in case of a leap year) for the purpose of employment. If he is not then he will be treated as a resident seafarer. You can read about Residential Status of a Seafarer in this article in more details or use our NRE days calculator to find out your residential status for any financial year.

Taxability of Various Income

Salary

Salary received by a non-resident seafarer is tax free in India. You can read about Taxability of Salary in this article in more details.

Other Income

Any other income which accrues or arise in India is taxable here in India under section 5(2)(b). So other income earned by assessee like bank interest, capital gain on sales of investment or property in India, dividends, commission etc. are taxable and required to be reported at the time of filing your return of income.

Note – Only the interest earned on the NRE saving bank or NRE term deposit are exempt from tax under section 10(4)(ii).

FAQ

Do Indian seafarers have to pay tax?

If you are outside India for more than 184 days (or 185 days in a leap year) as per your CDC/passport then you are not required to pay taxes on your merchant navy receipts.

Are seafarers NRI?

Yes, if you are outside India for more than 184 days (or 185 days in a leap year) as per your CDC/passport then you are considered Non-Resident India under Income Tax Act 1961.

Which bank is best for seafarers?

You can have NRE/NRO account in any PSU or private banks like ICICI, Kotak Mahindra Bank, SBI etc.

What is the difference between NRO and NRE account?

In NRE account only foreign currency or a check from another NRE account can be deposited. However, NRO is a saving account for non-resident in which you can deposit Indian currency or any cheque from normal saving account.