Deduction of Interest on Housing Loan – Section 24b

Introduction Section 24b of income tax act allows deduction of interest on home loan from the taxable income. Such loan should be taken for purchase or construction or repair or reconstruction of house property. Such deduction is allowed on accrual basis, not on paid basis. In other words, the interest payable for the year is […]

TDS on Income from Units of Business Trust – Section 194LBA

This section is inserted by Finance Act 2014 and is applicable from 1st Oct, 2014. Tax is to be deductible if a business trust distributes any income referred to in section 115UA being of the nature referred to in section 10(23FC) to its unit holder. Time of deduction – Tax is deductible at the time […]

TDS from insurance commission – Section 194D

Person responsible for paying to a resident commission or otherwise for soliciting or procuring insurance business including continuance, renewal or revival of policies is required to deduct TDS. TDS is required to be deducted at the time of credit of such amount or payment thereof whichever is earlier. TDS is required to be deducted only […]

TDS from winning of lotteries or crossword puzzles – Section 194B

TDS is deductible from the payment of winnings from lotteries, puzzles, card games or other games, exceeding Rs. 10,000 at the rate of 30% . Where the prize is partly in cash and partly in kind, then TDS is deductible on total prize i.e cash + value of prize in kind, from the cash portion […]

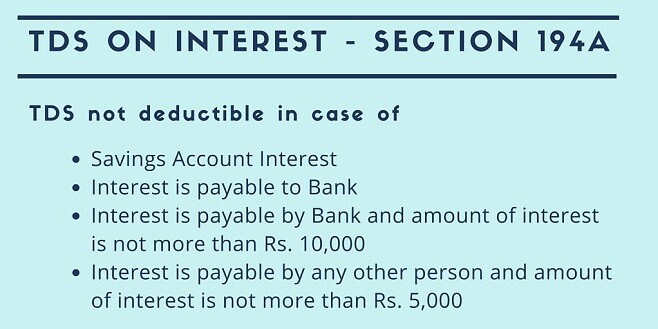

Section 194A – TDS on Interest – The Complete Guide

What is Section 194A? Section 194A of Income tax act contains provisions regarding TDS to be deducted on interest payable like interest on fixed deposit, interest on unsecured loan. Interest on securities are not covered under this section but covered under Section 193. Payment on which TDS to be deducted TDS is required to be […]

Section 192 – TDS from Salary

Section 192 of income tax act contains provisions regarding tds on salary. An employer is required to deduct tds from the salary payable to the employees. Topics covered in this article – Employers which are required to deduct TDS Time of Deduction Calculation of tax to be deducted Calculation of salary Calculation of tax deductible […]

Declaration to Deposit Lower TDS

If as a deductor, you have reasonable reasons for lower deduction/payment of TDS in the current period as compared to previous period, then the deductor can file declaration to deposit lower TDS via TRACES. It is an advisory issued from the Centralised Processing Cell (TDS) to file this declaration if there is substantial reduction (no […]

GST on Goods Transport Agency

Among all the other confusions among the GST provisions, one of the important one is regarding applicability of GST on Goods Transport Agency (GTA). Every person who deals in goods needs their services and also it is listed among the services in which GST is payable on reverse charge when services is provided to a […]

Profits and gains of business of plying, hiring or leasing goods carriages – Section 44AE

Eligible Assessee – This section is applicable to assessee who is engaged in the business of plying, hiring or leasing of goods carriages and who doesn’t own more than 10 goods carriages at any time during the year. Even if the no. of goods carriages exceeds 10 at any time during the year, then this […]

Audit of Accounts – Section 44AB

The following persons are required to get their accounts audited by a practicing Chartered Accountant – (a) A person carrying on business If the total sales, turnover, gross receipts exceeds Rs. 1 crore in the relevant year. If a person files his return under section 44AD and his turnover is up to Rs. 2 crore […]