If as a deductor, you have reasonable reasons for lower deduction/payment of TDS in the current period as compared to previous period, then the deductor can file declaration to deposit lower TDS via TRACES. It is an advisory issued from the Centralised Processing Cell (TDS) to file this declaration if there is substantial reduction (no specific guideline for this, in our view if the reduction is more than 35%-40%) in the amount of tax deposited in comparison with the previous period.

Step by step guide to file declaration of non-filing of TDS statement

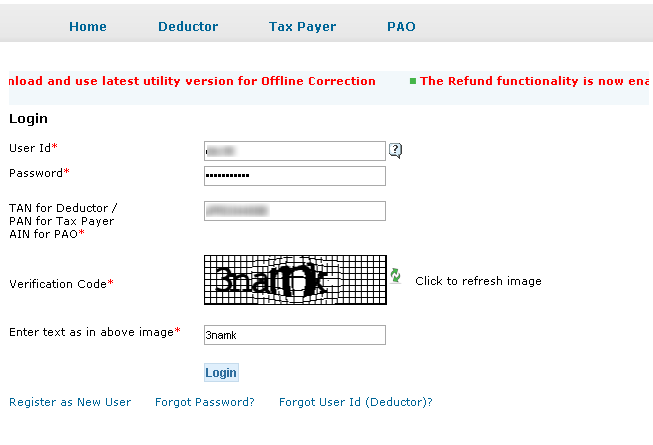

Step 1 – Login into Traces

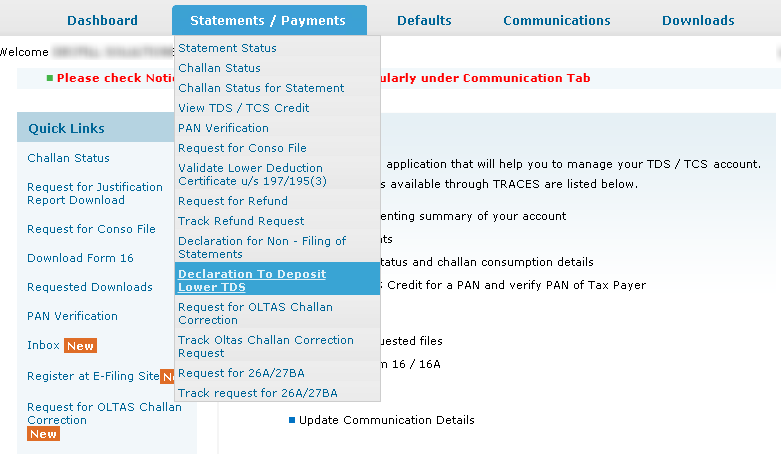

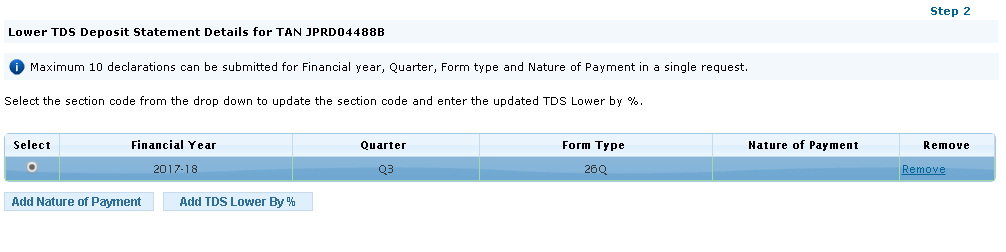

Step 2 – Select the option of Declaration to Deposit Lower TDS under Statements/Payments Declaration to Deposit Lower TDS

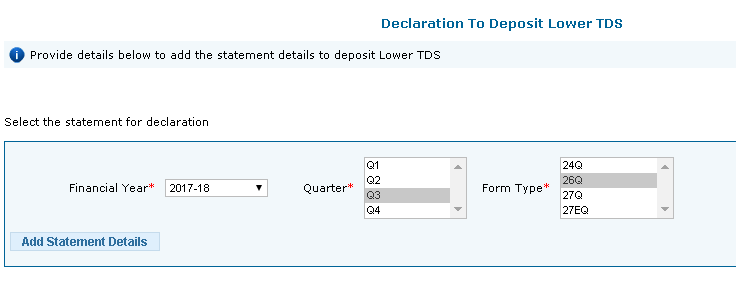

Step 3 – Add the details of the statement for which lower TDS declaration is being field

Step 4 – Click on Add Statement Details button once you select Financial Year, Quarter and Form type.

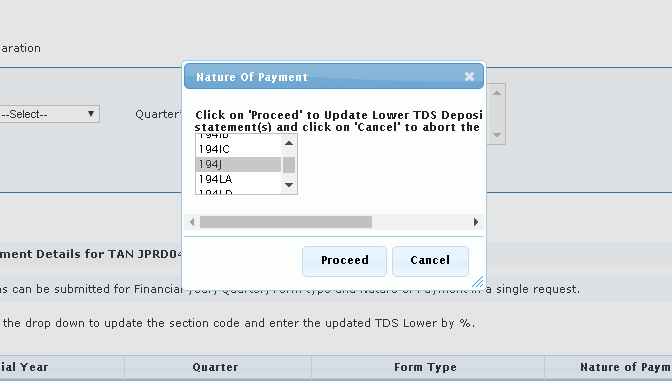

Step 5 – Click on Add Nature of Payment button and select the relevant nature of payment for which you have to report lower declaration.

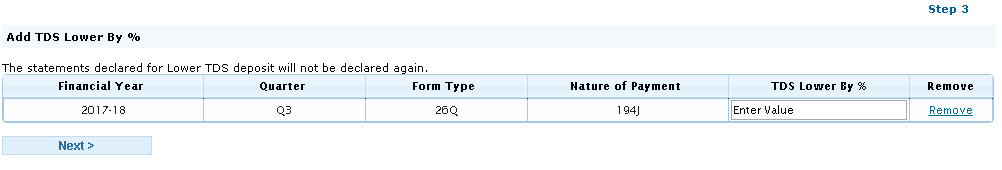

Step 6 – Click on Add TDS Lower by % button and enter the % by which the TDS is lower deducted in TDS Lower By %

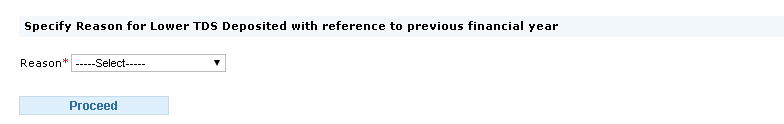

Step 7 – Click on Next and specify the reason for lower TDS deposited with reference to the previous financial year

Following reason are available

- Tax deposit rate has been changed

- Threshold limit has been changed

- Temporarily business closed

- Permanently business closed

- Excess deposit was made last year by mistake/otherwise

- Volume of transaction reduced

- Centralisation of deposit at corporate level

- Change of TAN due to shift of office

- Not able to pay in time due to cash crunch in business

- Any other reason – Select this if you want to enter any other reason

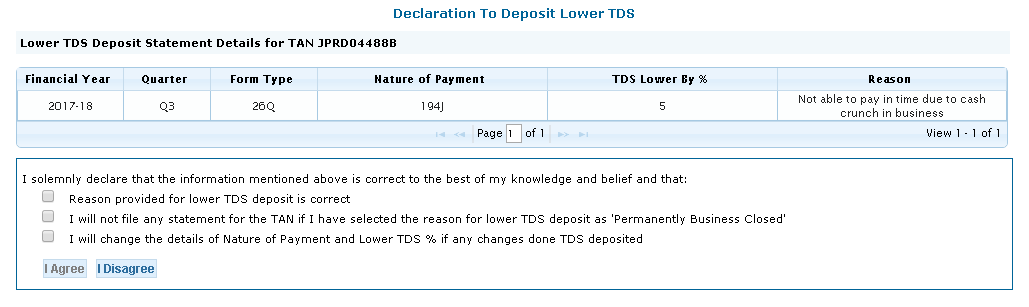

Step 8 – Review the details and select all the checkboxes and then click on I Agree button

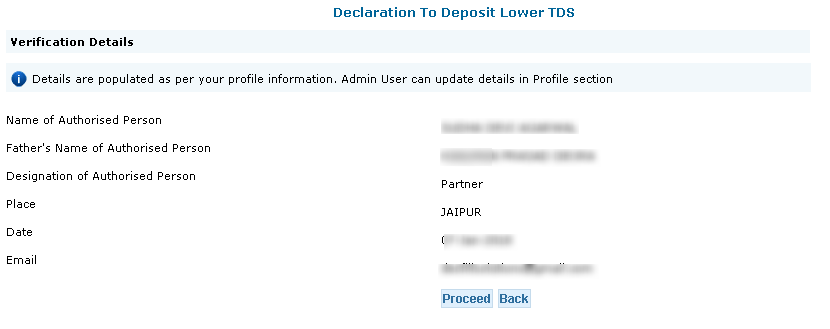

Step 9 – Verification details will be displayed of the user along with Proceed button for final submission. Click on Proceed for submission or Back to cancel or make any changes in the declaration.

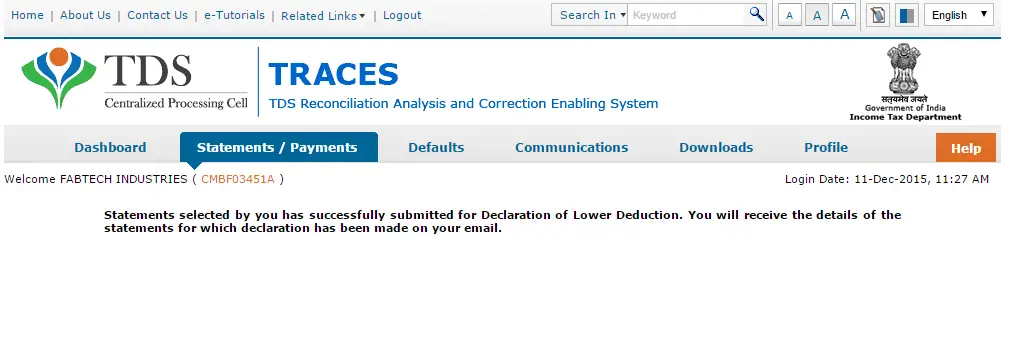

Step 10 – Confirmation message will be displayed after successful filing.