Proposed changes for Seafarers in Budget,2025

- Budget 2025 introduced the concept of “Tax Year” which will come in New Income Tax bill w.e.f. 01 April,2026. Hence You need not to decide two different years. There will be concept of one single year for taxation purpose i.e. “Tax Year”.

- Basic exemption limit for filing income Tax return has been increased from Rs. 3 lakh to Rs. 4 lakh under new regime with new Income slabs & tax rates, which will reduce the tax liability of Seafarers also, given below

| Net Income Range | FY 2025-26 (AY 2026-27) |

| Upto Rs. 4,00,000 | NIL |

| From Rs. 4,00,001 to Rs. 8,00,000 | 5% |

| From Rs. 8,00,001 to Rs.12,00,000 | 10% |

| From Rs. 12,00,001 to Rs. 16,00,000 | 15% |

| From Rs. 16,00,001 to Rs. 20,00,000 | 20% |

| From Rs. 20,00,001 to Rs. 24,00,000 | 25% |

| Above Rs. 24,00,000 | 30% |

- Time limit to file ITR U updated has been increased from 24 months to 48 months from the end of the relevant Assessment year. It means, Seafarers can file ITR upto 5 years from the end of “Tax Year” if they missed to file before.

- Like other Resident Individuals, NRI’s & Seafarers can also claim the value of two self occupied properties as “Nil” u/s 23(2) without any condition. Earlier there was a limit u/s 23(4) to claim second house property as “NIL” only if that is not occupied because of the reason of Profession/employment at another place.

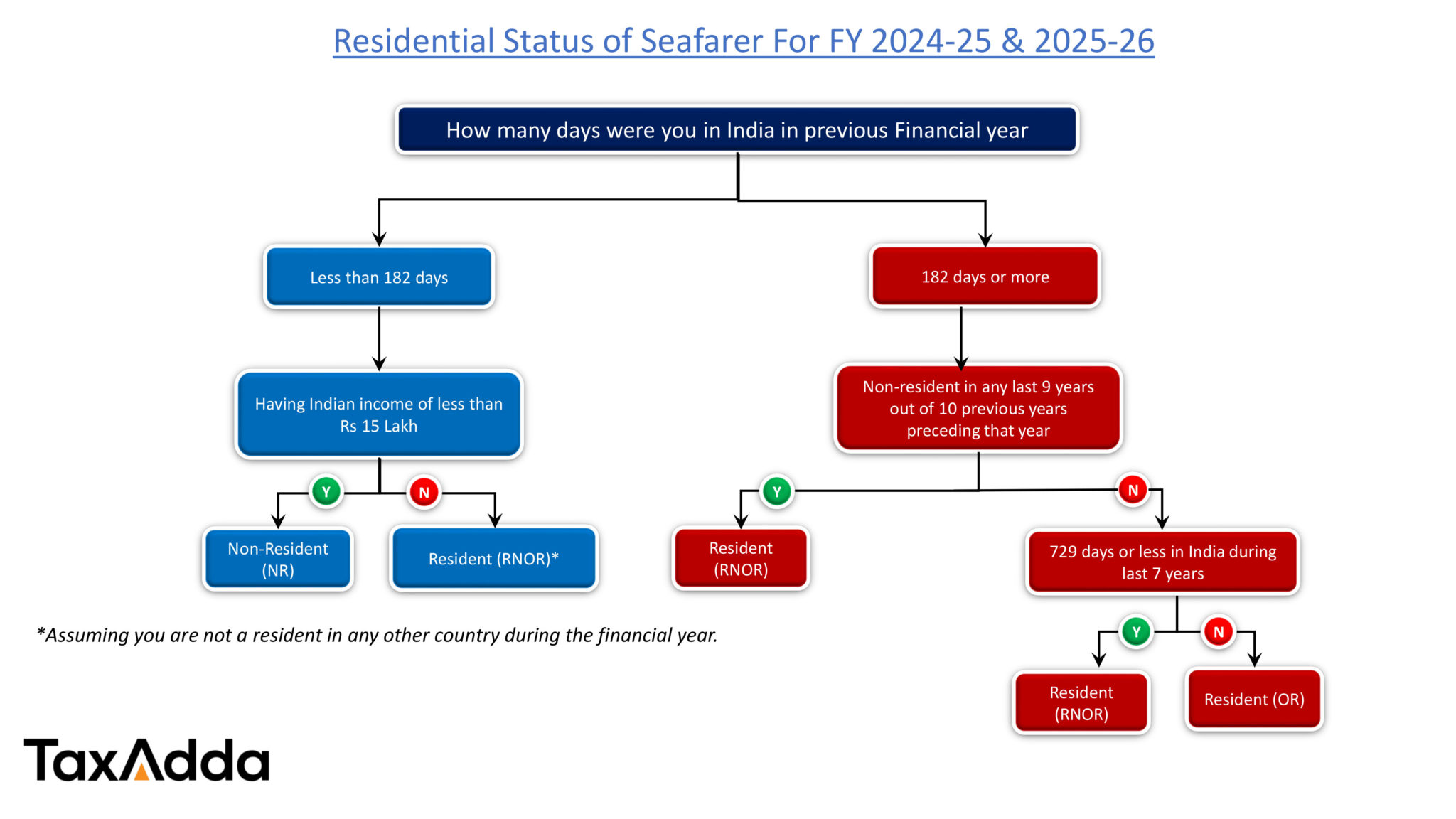

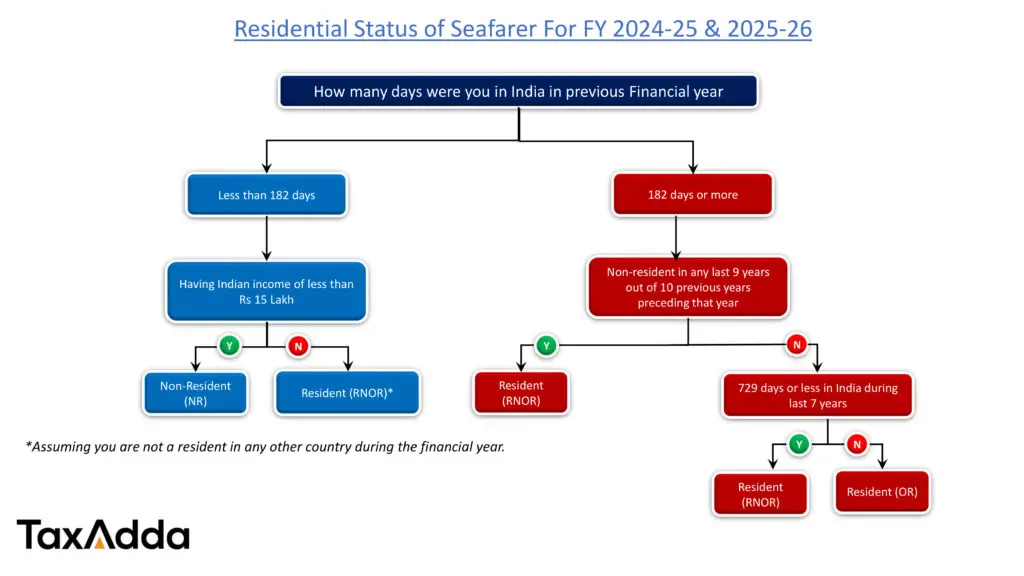

Residential Status for Seafarers

A Seafarer’s salary is tax free in India if he is out of India for 184 days or more (185 days in case of a leap year) during a financial year. Check your residential status from our NRE Days Calculator for Seafarer.

Residential status is the most important concept for income tax applicability on seafarers. It is required to find out for every financial year to compute your tax in India.

If you are a non-resident (NR) or resident but not ordinarily resident (RNOR) for a financial year then your salary receipts are not taxable in India whereas if you are a resident (OR) in India then all the salary receipts are taxable here in India irrespective of any other condition or laws in force.

As per Section 6 of the Income Tax Act, a person is said to be resident in India in a financial year, if he : –

- is in India during that financial year for a period or periods amounting in all to one hundred and eighty-two days or more; or

- having within the four years preceding that financial year been in India for a period or periods amounting in all to three hundred and sixty-five days or more and is in India for a period or periods amounting in all to sixty days or more in that financial year.

There is a special benefit provided under Explanation 1(a) of Section 6 which specify: –

- person being a citizen of India, who leaves India in any financial year as a member of the crew of an Indian ship as defined in clause (18) of section 3 of the Merchant Shipping Act, 1958 (44 of 1958), or

- for the purposes of employment outside India.

the above condition of sixty days gets extended to one hundred and eighty-two days.

In other words, a seafarer is a non-resident if he is out of India for 184 days (or 185 days in case of leap year) for the purpose of employment. But the things get further complicate after adding of deemed resident provision from FY 20-21.

Note – The condition of 120 days mentioned in the Explanation 1(b) of Section 6(1) is not applicable on seafarer as it’s apply to person comes to a visit in India. Only Explanation 1(a) applied to Indian seafarer which is explained above.

New Deemed Resident Provision for Taxability from Financial Year 2020-21

A new Section 6(1A) has been inserted by Financial Act 2020 which is applicable beginning from financial year 2020-21 (01st April 2020 to 31st March 2021). As per this new section, an individual, being a citizen of India, having total income, other than the income from foreign sources, exceeding fifteen lakh rupees during the previous year shall be deemed to be resident in India in that previous year, if he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature;

At the same time another amendment has been inserted in Section 6(6) to consider the individual covered under above section 6(1) as resident but not ordinarily resident which make sure the earning earned outside Indian will not be taxed in India.

The plain reading of this section suggests that all the non-resident are considered as Resident (RNOR) if they have an Indian income of above Rs 15 Lakh but that’s not the case. To clarify the applicability of this new section 6(1A), CBDT has issued a clarification via press release on 02 Feb 2020. As per this clarification, Section 6(1A) is an anti-abuse provision to cover those Indian citizens who shift their stay in low or no tax jurisdiction to avoid payment of tax in India. The new provision is not intended to cover those Indian citizens who are bonafide workers in other countries like in the Middle East as they are not liable to tax in these countries. Moreover, it is clarified that in case of an Indian citizen who becomes deemed resident of India under the section 6(1A), the income earned outside India by him shall not be taxed in India unless it is derived from an Indian business or profession. Also, the person will be considered as a resident but not ordinarily resident so the only Indian income will be liable to tax (not his global income).

So, the new section does not impact taxability of salary receipt by sea fearers and they will enjoy the benefit of tax-free salary as they have currently even they become resident but not ordinarily resident as per new Section 6(1A).

Note – As per my point of view, even a non-resident Seafarer having an Indian income of more than Rs 15 Lakh, he can still claim status of non-resident as section 6(1A) is a anti-abuse section which is same clarified by the Income Tax Department in the press release. However, if you do not want to get engaged in litigation later, you can report yourself as Resident (RNOR) as you do not need to pay tax on your merchant navy receipts

Missed Residential Status in a Financial Year?

As per Section 6(6) of the Income Tax Act, an individual person is said to be non-ordinarily resident in India in a financial year, if he : –

- is a non-resident in 9 out of 10immediately preceding financial year; or

- he is in India for a period of 729 days or less during the 7 immediately preceding financial year.

If you satisfy any of the above condition then you are considered as Not Ordinarily Resident (not exactly non-resident) and the income accrues or arises to him outside India during the financial year shall not be included unless it is derived from a business controlled in or a profession set up in India as per Section 5(1) of the Income Tax Act. So, you can still save your hard-earned salary from tax in India if your qualify for Resident but not ordinarily resident.

Quick Summary

- Non-Resident (NR)

- If you are out of India for more than 184 days (or 185 days in a leap year) and does not have Indian income exceeding Rs 15 Lakh.

- If you are out of India for more than 184 days (or 185 days in a leap year) and does not have Indian income exceeding Rs 15 Lakh.

- Resident But Not Ordinarily Resident (RNOR)

- If you are out of India for more than 184 days (or 185 days in a leap year) and have an Indian income exceeding Rs 15 Lakh.

- If you are out of India for less than 184 days (or 185 days in a leap year) and fulfil any of the condition mentioned in Section 6(6) above.

- Resident (OR)

- If you are out of India for less than 184 days (or 185 days in a leap year) and does not fulfil any of the condition mentioned in Section 6(6) above.

FAQ on Residential Status

I was outside India for 186 days during the financial year 2019-20 (01st April 2019 to 31st Mar 2020). Is my salary receipt taxable in India?

Your salary will be tax-free as you were outside India for more than 185 days (leap year) for the purpose of employment.

I was outside India for 180 days during the financial year 2019-20. Is my salary receipt taxable in India?

The whole salary will be taxable in India as you were not able to complete 185 days or more outside India.

I am a Deck Cadet. Is my salary taxable if I am outside India for 185 days during FY 2019-20?

The conditions which are required to be fulfilled for tax-free salary are: – * Outside India for the purpose of employment. * Outside India for 185 days or more As you were outside India for 185 days, your salary is tax-free.

I was outside India for 100 days and not able to re-join the ship due to my courses. Is my salary taxable in India?

The whole salary will be taxable in India as you were outside India for only 100 days. The reason is irrelevant in computing the taxability of your salary.

I am maintaining my non-resident status from the last 5 years but unable to maintain it in the financial year 2019-20. Shall I have to pay tax in India?

Yes, you will be taxed as a normal resident and all the incomes are chargeable to tax.

Concept of Financial Year & Assessment Year

Financial year/ Fiscal year in India start from 01st April and end on 31st March of next year. The income earned during the financial year is computed and will be taxed in the next financial year which is called Assessment Year.

| Financial Year | Relevant Assessment Year |

| 2024–25 (01st Apr 2024 to 31st Mar 2025) | 2025-26 |

| 2023-24 (01st April 2023 to 31st Mar 2024) | 2024-25 |

| 2022- 23 (01st Apr 2022 to 31st Mar 2023) | 2023-24 |

| 2021-22 (01st Apr 2021 to 31st Mar 2022) | 2022-23 |

The financial year is also called as the previous year for the purpose of Income Tax. Also, do not get confused calendar year with fiscal year as the calendar year runs from 01 Jan to 31 Dec every year.

In a leap year like the financial year 2023-24, for becoming a non-resident person, you have to be out of India for the purpose of employment for 185 days or more.

Calculation of Period Outside India

Seafarer has to compute his total period outside India for a financial year by computing days outside India for each voyage (joining and sign-off) done by him during that financial year. Passport stamping dates are the basic criteria for computing the days outside India.

Check your residential status from our NRE Days Calculator for Seafarer.

Other Points

- The day of departure is always considered outside India as per Sec 9 of the General clauses Act which explains commencement and termination of time, that if a word uses “from”, then, first day in a series of days shall be excluded, likewise if the word uses “to” day in the last series is to be included same withheld in the Income Tax Appellate Tribunal – Kolkata Samir Kumar Ghosh, Howrah vs Ito, Wd-16(4), Kolkata.

- The day of arrival is also considered outside India as withheld in the Income Tax Appellate Tribunal – Kolkata Samir Kumar Ghosh, Howrah vs Ito, Wd-16(4), Kolkata or calculation is required to be done on an hourly basis as withheld in the Income Tax Appellate Tribunal – Lucknow Shri Sharad Mishra Vs ITO.

- Also, the purpose for the visit should be for employment. If you are leaving India for any purpose other than employment like holidays etc. then the trip should not be included in the calculation of period outside India.

- If you have more than 184 days (or 185 days in case of leap year)as per your Continuous Discharge Certificate (CDC) outside India, then it will be best conclusive proof of the employment which cannot be challenged by any officer at the time of scrutiny of your income tax return.

Rule Applicable for Voyages Start or End in India- Explanation 2 of Section 6(1)

As per Notification No. 70/2015/ F.No.142 /12/2015-TPL, period beginning on the date entered into the CDC in respect of joining the ship by the individual for the eligible voyage and ending on the date entered into the CDC in respect of signing off by that individual from the ship in respect of such voyage should be considered as period outside India.

“Eligible voyage” shall mean a voyage undertaken by a ship engaged in the carriage of passengers or freight in international traffic where-

(i) for the voyage having originated from any port in India, has as its destination any port outside India; and

(ii) for the voyage having originated from any port outside India, has as its destination any port in India.

Other Points

- If a ship spent time in Indian territorial waters then it will be counted as period outside Indian if it is part of the eligible voyage.

FAQ on calculation of period outside India

1) I have the following stamping dates in my passport. How should I calculate my period outside India for the financial year 2019-20?

| Departure Date | Arrival Date |

| 20th Mar 2019 | 06th Jun 2019 |

| 10th July 2019 | 25th Sep 2019 |

| 03rd Nov 2019 | 15th Jan 2020 |

| 28th Mar 2020 | 08th Apr 2020 |

Calculation of period outside India for financial year 2019-20 will be as follow: –

| Departure Date | Arrival Date | Days Outside India |

| 20th Mar 2019 | 06th June 2019 | 67 days* |

| 10th July 2019 | 25th Sep 2019 | 77 days |

| 03rd Nov 2019 | 15th Jan 2020 | 73 days |

| 28th Mar 2020 | 08th Apr 2020 | 4 days** |

| Total | 221 Days |

* The financial year 2019-20 starting from 01st April 2019 so the period outside India shall be counted from 01st April 2019 to 06th June 2019.

** The financial year 2019-20 ends on 31st March 2020 so the period outside India shall be counted from 28th March 2020 to 31st March 2020.

In the above example, the departure date is considered outside India whereas the arrival date is considered in India on a safer side.

2) I am short for 8 days. Can I leave India for vacation and maintain my NRE status and save tax?

No, as per Income Tax Act, only the period outside India for the purpose of employment shall be considered. You may ask to submit documentary evidence to prove the visit is for the purpose of employment in case the scrutiny is initiated against the filed return.

3) I have joined two ships during the financial year 2019-20. The first ship is a foreign-flagged shipped which I joined from USA and gets sign off from New Zealand. The second ship was Indian flagship which I joined from Cochin and get sign off from Gulf. Should I use my passport or CDC to count the days outside India?

You should use passport stamping dates for counting period outside India for the first foreign-flagged ship. CDC stamping dates should be used for second Indian flagship as you have joined the ship from India.

4) I have joined a foreign-flagged shipped from USA and get sign off from Mumbai. Should I use my passport or CDC to count the days outside India?

You should use your CDC stamping dates for counting days outside India as your voyage ends in India.

5) I have changed my shipping company. Does it impact my taxation in any manner?

No, it will not. You just have to complete 184 days (or 185 in case of a leap year) to maintain your non-resident status.

6) I am out of India for 15 days for attending a seminar on behalf of my company. Shall I count that 15 days to find out my resident status?

You may count these 15 days outside India for the purpose of employment. You must have some documentary evidence from your company which proves that the purpose of the visit is for employment.

7) I signed off in Australia on 07th May 2019 and ask my company to arrange my travel back to India on17th May 2019 so I can explore complete Australia. Which date should I use to count days outside India?

As per the Income Tax, you should take 07th May 2019 for counting days outside India even you have 17th May 2019 as passport stamping date as you have stayed in Australia for 10 days which is not for the purpose of employment.

8) I missed to board my ship due to some unavoidable circumstances and have to get back in India. Can I count them in my days outside India?

Yes, you can. As you have leave India for the purpose of employment, you can count them.

9) I went to Panama on 14th May 2019 for joining the ship. However, due to some unavoidable circumstance, I able to board the ship on 28th May 2019. Which date should I use for counting my days outside India?

You should take 14th May 2019 for counting your period outside India as you left India for the purpose of employment on 14th May 2019.

10) What will be my scenario if I signed on the same ship in Gujarat?

If you sign on from India, the stamping dates mentioned in CDC will be used for counting your period outside India. So, you have to use 28th May 2019 in place of your actual date of departure.

11) How should I compute my days out of India if I joined a Indian flag ship from Hongkong and after 3 months of sailing it become Indian coastal ship?

You time period till the ship converted to Indian coastal ship shall be counted as period outside India. Once a ship is converted into Indian coastal ship the time period spent in Indian coastal waters should not be counted.

No Relief in Residency Status for COVID-19 for FY 2020-21a

Many people stuck in India during financial year 20-21 due to the outbreak of COVID. As the country was under lockdown during April 20 and restrictions on international flights make it quite impossible for the seafarers to leave India for maintaining their non-resident status. During the financial year 2019-20, CBDT gives relaxation via Circular 11 of 2020 on 08th May 2020 and promise the similar relaxation for financial year 20-21 which was not provided later.

Recently, on 03rd March 2021, CBDT issued Circular 2 of 2021 for determining the residential status of the person stuck in India due to COVID. This circular is released by CBDT on the writ petitioner filed by Mr. Gaurav Baid on 10th Feb 2021 in Supreme Court. Supreme court direct Mr. Gaurav Baid to file the representation to CBDT within three days and ask CBDT to consider the matter within the period of three weeks from the date of representation filed by Mr. Gaurav Baid. This circular does not provide any special relief to the seafarers due to COVID lockdowns and availability of international flights . The circular only elaborates the provision of Income Tax along with DTAA.

So, for the financial year 20-21, no special exemption is available and you have to out of India for the purpose of employment for more than 184 days to claim non-resident status and make your salary tax free in India.

Relief in Residency Status for COVID-19 for FY 2019-20

On 08th May 2020, CBDT gives relaxation in the residency status due to COVID-19 lockout via Circular 11 of 2020 which is as follows: –

Various representation has been received that various individual who had come to visit to India during the previous year 2019-20, were not able to leave India due to outbreak of COVID-19 and declaration of lock down. As they have to prolong their stay in India which result in genuine hardship as they may not be able to maintain their status as Non-Resident or Resident but not ordinarily resident.

- has been unable to leave India on or before 31st March 2020, his period of stay in India from 22nd March to 31st March 2020 shall not be taken into the account; or

- has been quarantined in India on account of COVID-19 on or after 01st March 2020 and has departed on an evacuation flight on or before 31st March 2020 or has been unable to leave India on or before 31st March 2020, his period of stay from the beginning of his quarantine to his date of departure or 31st March 2020, as the case may be, shall not be taken into the account; or

- has departed on an evacuation flight on or before 31st March 2020, his period of stay in India from 22nd March 2020, to his date of departure shall not be taken into account.

Note – It is mentioned in the circular that is applicable for the person visiting India. No mention is available whether it is applicable on the person who were unable to leave India for the purpose of employment due to lockdown. As per our view, it should be applicable to seafarers. A similar circular will also be released for the financial year 20-21 as mentioned by the Income Tax Department in their tweet of 08th May 2020 depending on the normalization of/resumption of international flights which was not denied later on 03rd March 2021.