Proposed changes for Seafarers in Budget,2025

- Budget 2025 introduced the concept of Tax Year which will come in New Income Tax bill w.e.f. 01 April,2026. Hence You need not to decide two different years. There will be concept of one single year for taxation purpose i.e. “Tax Year”.

- Basic exemption limit for filing income Tax return has been increased from Rs. 3 lakh to Rs. 4 lakh under new regime with new Income slabs & tax rates, which will reduce the tax liability of Seafarers also, given below

| Net Income Range | FY 2025-26 (AY 2026-27) |

| Upto Rs. 4,00,000 | NIL |

| From Rs. 4,00,001 to Rs. 8,00,000 | 5% |

| From Rs. 8,00,001 to Rs.12,00,000 | 10% |

| From Rs. 12,00,001 to Rs. 16,00,000 | 15% |

| From Rs. 16,00,001 to Rs. 20,00,000 | 20% |

| From Rs. 20,00,001 to Rs. 24,00,000 | 25% |

| Above Rs. 24,00,000 | 30% |

- Time limit to file ITR U updated has been increased from 24 months to 48 months from the end of the relevant Assessment year. It means, Seafarers can file ITR upto 5 years from the end of “Tax Year” if they missed to file before.

- Like other Resident Individuals, NRI’s & Seafarers can also claim the value of two self occupied properties as “Nil” u/s 23(2) without any condition. Earlier there was a limit u/s 23(4) to claim second house property as “NIL” only if that is not occupied because of the reason of Profession/employment at another place.

When Income Tax return (ITR) filling is mandatory

As per Section 139(1)(b), every individual, if his total income exceeds the maximum amount which is not chargeable to income tax shall file his return before giving any benefits of any deduction under Chapter VI-A (like LIC, medical premium, school fees etc. provided under section 80C) shall furnish his return of income. Filing return of income is also mandatory, if you: –

- has deposited an amount of Rs 1 crore in one or more current accounts; or

- has incurred expenditure exceeding Rs 2 lakh for himself or any other person for travel to a foreign country; or

- has incurred expenditure exceeding of Rs 1 lakh towards consumption of electricity or Rs 50,000 in specific area; or

- If you make deposits aggregating more than Rs 50 lakh in one or more savings bank accounts in a financial year; or

- TDS/TCS of Rs 25,000 or more or in the case of senior citizens Rs 50,000 or more, has been deducted in FY 2022-23 or any later years; or

- if his total gross receipts in profession exceeds ten lakh rupees during the previous year; or

- if his total sales, turnover or gross receipts, as the case may be, in the business exceeds sixty lakh rupees during the previous year; or

- fulfils such other conditions as may be prescribed.

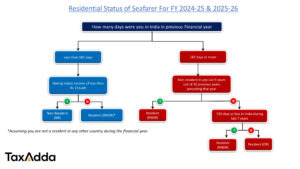

Maximum amount which is not chargeable to tax is as follows for the financial year 2024-25 (Assessment year 25-26)

| Details | Maximum Amount under old Regime (Rs) | Maximum Amount under New Regime (Rs) |

| Non-resident of any age group | 2,50,000 | 3,00,000 |

| Resident below the age of 60 years | 2,50,000 | 3,00,000 |

| Resident having age of 60 year or more but below 80 years | 3,00,000 | 3,00,000 |

| Resident having age of 80 years or more | 5,00,000 | 3,00,000 |

To know the Income tax rates applicable under Old & New Regime click here Income Tax Rates for F.Y. 2024-25

FAQ on filing return of income

- I have been sailing for the last 5 years and never filed a return. Shall I start filing return?

Yes, you should file your income tax return even if the income is not chargeable to tax. The reasons are as follows: –- Sometime seafarers are not able to complete the sea time period for claiming NR status. In that scenario, it is compulsory to file the return of income if you have a total income exceeding Rs 2,50,000. This creates a gap in the system of income tax department as you are filing the return and paying tax in a couple of years and not filing return in other years which raise the alarm in the Government system and may receive a notice for return filing. However, if you are filing returns in every year then the government will have complete records of return and can check that you are non-resident in most of the years and does not require to pay tax in India.

- ITR will be helpful in case you have some income on which TDS has been deducted. The most common is interest on NRO bank balance, purchase of car exceeding Rs 10 lakh, starting from FY 20-21 TDS will be deducted on dividend income received from Mutual funds, public companies etc.

- ITR will be helpful in case you want to apply for housing loans, purchasing life insurance, visa for a country etc.

- If you are planning to purchase a property it is mandatory to provide your PAN card for registry. The details will be shared with the IT Department and if IT Department does not find any records of yours then you may get a notice to explain the source of income for paying the property consideration.

- Your bank is required to share your various details like cash deposits, transaction exceeding specific limits, cash withdrawals with IT Department and if IT Department does not find any records of yours then you may get a notice to explain the nature of transaction.

- I have maintained my non-resident status from last 4 years but never filed ITR. Can I get a notice for non-filing of income tax return?

Yes, you may receive a notice for non-filing of income tax return. If you have maintained non-resident status and your total gross income from India is less than taxable limit, then it is not mandatory to file income tax return. However, it is advisable to file your income tax return irrespective of your Indian income to safe yourself from the eyes of income tax department.

- Salary for the month of March shall be taxable in which financial year?

In India, the financial year runs from April to March. The running financial year is April 2024 to March 2025. As per section 15 of the Income Tax, salary is taxable on due or receipt basis, whichever is earlier. If the salary of March has been credited to your bank account in the month of March itself then it is taxable in the same year. However, if the salary is credited in April 2025 then it will be taxable only if it is due on or before 31st March 2025 irrespective of the actual payments.

Generally, in the case of Merchant Navy, salary is due on or before 31 March and required to be added at the time of calculating income for that financial year even it is credited in the month of April.

- I am unable to complete my non-resident status for the financial year 2024-25. What if I can take most of my salary as cash on the ship rather than sending it my bank account to save tax?

You are required to report your total salary as income rather than the amount transferred into your bank account against salary. In case, if the filed return gets selected for scrutiny, you have to provide the salary slips, signed contract etc. to validate the deposit into your bank account.

- In which head shall I report the salary income? I have completed my non-resident status.

There is no option to report salary income in the income tax return as it is not an income for the purpose of income tax.

- What is the last date for filing income tax return?

The Due date to file Income Tax Return for Financial Year 2024-25 (Assessment Year 2024-25) is 31 July 2025. It can be filed up to 31 December 2025 with Late Fees.

| Date of Filing | Total Income Below Rs 5 Lakh | Total Income Above Rs 5 Lakh |

| Till 31st July,2025 | NIL | NIL |

| From 1st Aug till 31st Dec 2025 | Rs 1,000 | Rs 5,000 |

| ITR U after 31st Dec 2025 | Rs 1,000 + Penalty of 25% or 50 % of the Additional tax + Interest on the Income missed to be reported | Rs 5,000 + Penalty of 25% or 50 % of the Additional Tax + Interest on the Income missed to be reported |

Time limit to file the ITR-U is as follows: –

| Financial Year | Last Date of Filing ITR-U |

| 2021-22 (AY 22-23) | 31 March 2025 |

| 2022-23 (AY 23-24) | 31 March 2026 |

| 2023-24 (AY 24-25) | 31 March 2027 |

- Which income tax return form should be filed for financial year 2024-25?

Income tax return forms get changed and updated every year. Generally, it is ITR-2 for the non-resident sea farers.

- Can I file my income tax return for financial year 2024-25 before 31st March 2025?

Income tax return can be filed only after the end of the financial year i.e. 31st Mar 2025. Moreover, the income tax department releases the form and the date after which an individual can file their return which is generally around 20th April every year.

- I worked for an India company as Chief Engineer which is deducting my TDS @ 10% under section 194J. I am unable to complete my non-resident status during the financial year 2024-25. Shall I declare the receipt as Salary or income from profession under section 44ADA?

Income is chargeable to tax as salary if the employer-employee relationship exists. You must review your contract to find out the correct nature of relationship and report the income in correct heading irrespective of the section in which TDS is deducted by the company.

Assuming, the relationship is as of contractor, you can report 50% of your receipt as taxable income under section 44ADA.

- Assuming, in the above case, what will be scenario if I am employed by foreign company as Chief Engineer and unable to complete my non-resident days outside India?

The answer is same. You have to review your terms of engagement and if the relationship of employer-employee exists then 100% of the income is chargeable to tax under the head salary. If there is no such relationship, then you can take the benefit of section 44ADA and pay tax on 50% of the income.