What is Demand Notice?

If any demand for tax, interest, penalty, fine or any other sum is raised by the Assessing Officer as per the provision of Income Tax Act, 1961 then he shall serve a notice of such demand to the assessee u/s 156 specifying the amount payable.

Time Limit

As per Section 220, amount specified in demand notice, shall be paid within a period of thirty days from the date of service of notice.

As per Section 220(3), an assessee can make an application of the Assessing Officer before the expiry of the notice period, to extend the time for payment or allow payments by installment.

Note: – The period of thirty days can be reduced by the assessing officer with the prior approval of the Joint Commissioner, if he has a reason to believe that allowing a period of thirty days will be detrimental to the Income Tax Department.

Penalty for Delay

If the payment for the demand notice has not been made with the specified period as mentioned in the demand notice then the assessee is liable for the following penalties: –

Interest u/s 220(2) – Interest at a rate of one percent per month or part of the month commencing from the day immediately following the due date of payment up to the day on which such amount is paid. Such interest shall be payable by the assessee even if Assessing officer has approved the application for extension of time period for the payment or allow payment by installment.

Penalty u/s 221 –A penalty may be imposed by the Assessing Officer up to the amount demanded in demand notice.

Step-by-step Guide for Responding to a Demand Notice

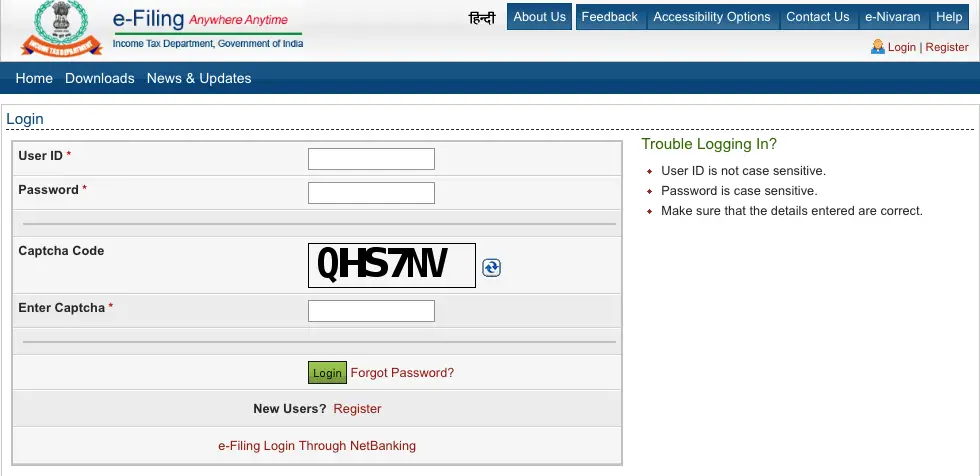

Step 1 – Login into your income tax e-filling portal with your userid and password.

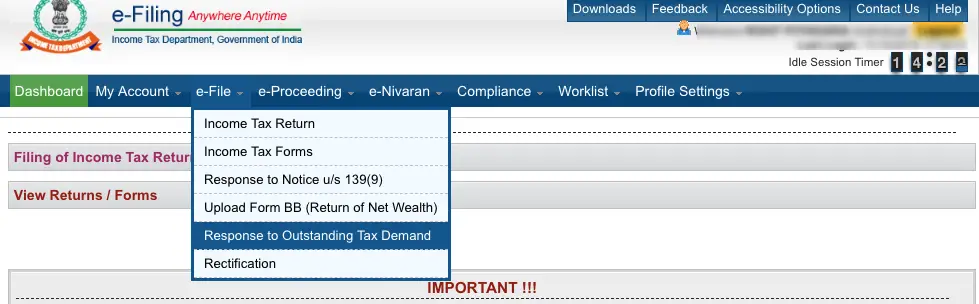

Step 2 –Select the option of E-file -> Response to Outstanding Tax Demand

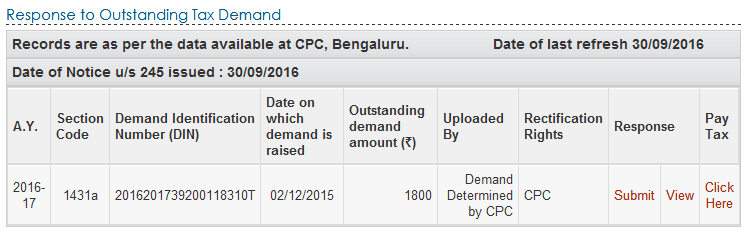

Step 3–On the next scree, all the outstanding demand will be show in a tabular form having the following details: –

- Assessment year

- Section code

- Demand notification number (DIN)

- Date on which demand is raised

- Outstanding demand amount

- Uploaded by

- Rectification rights

- Response – Submit and View

- Pay Tax

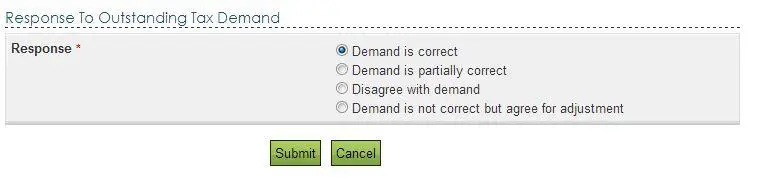

Step 4– You are required to click on the Submit option available for submitting the response. You will get the belowoptions for response

- Demand is correct.

- Demand is partially correct.

- Disagree with demand

- Demand is not correct but agree for adjustment

Demand is correct

If assessees selects “Demand is correct”, then a pop up is displayed as “If you confirm Demand is correct then you cannot Disagree with the demand”. Click on submit button and a confirmation message is displayed on the screen for accepting the demand and –

- If any refund is due, the outstanding amount along with interest will be adjusted against the refund due.

- In any other case, you must repay the demand immediately using the option of Pay Tax available in the table of all the demands.

Demand is partially correct

Once you select this option, two new boxes will appear on screen i.e.

- Amount which is correct – Enter the amount which is correct.If the amount entered here is equal to the demand amount, then one pop is displayed “Since the amount entered is equal to outstanding demand amount, please select the option “Demand is correct”.

- Amount which is incorrect: Difference between the outstanding amount and amount which is correct will get auto filled in this box.

Assessess is mandatorily require selecting one or more reasons for the amount which is not correct: –

- Demand

Paid

- Demand paid and challan has CIN

- Demand paid and challan has no CIN

- Demand already reduced by rectification/revision

- Demand already reduced by Appellate Order but appeal effect to be given

- Appeal

has been filed

- Stay petition filed with

- Stay granted by

- Instalment granted by

- Rectification / Revised Return filed at CPC

- Rectification filed with AO

- Others

Based on reason selected, assessee needs to provide additional information as below:-

| REASON OPTED | ADDITIONAL DETAILS REQUIRED |

| Demand paid and challan has CIN | |

| BSR Code | |

| Date of payment | |

| Serial Number | |

| Amount | |

| Remarks | |

| Demand paid and challan has no CIN | |

| Date of payment | |

| Amount | |

| Remarks | |

| Upload copy of challan | |

| Demand already reduced by rectification/revision | |

| Date of Order | |

| Demand after rectification/ revision | |

| Details of AO | |

| Upload Rectification / Giving appeal effect order passed by AO | |

| Demand already reduced by Appellate Order but appeal effect to be given | |

| Date of Order | |

| Order passed by | |

| Reference Number of Order | |

| Appeal has been filed – Stay petition filed with | |

| Date of filing of appeal | |

| Appeal Pending with | |

| Stay petition filed with | |

| Appeal has been filed – Stay granted by | |

| Date of filing of appeal | |

| Appeal Pending with | |

| Stay granted by | |

| Upload copy of Stay | |

| Appeal has been filed – Instalment granted by | |

| Date of filing of appeal | |

| Appeal Pending with | |

| Instalment granted by | |

| Upload copy of stay/instalment order | |

| Rectification / Revised Return filed at CPC | |

| Filing Type | |

| e-Filed Acknowledgement No. | |

| Remarks | |

| Upload Challan Copy | |

| Upload TDS Certificate | |

| Upload Letter requesting rectification copy | |

| Upload Indemnity Bond | |

| Rectification filed with AO | |

| Date of application | |

| Remarks | |

| Others | Others |

Note: Total Attachments size should be up to 50 MB.

Disagree with demand

Assessess is mandatorily require selecting one or more reasons for the disagreement along with the reason. Reason are similar as available under ‘Demand is partially correct’.

Demand is not correct but agree for adjustment

Assessess is mandatorily require selecting one or more reasons for the disagreement along with the reason. Reason are similar as available under ‘Demand is partially correct’.

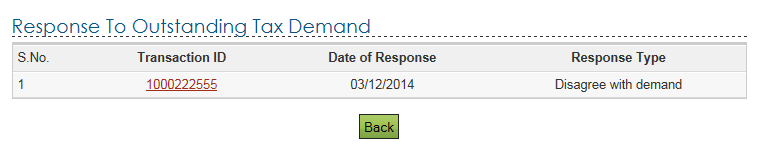

Step 5 – Once you click on Submit button after selecting the relevant reason, a confirmation message shall be displayed along with the unique Transaction ID.

Other Points

- Assessees can click on “View” link under Response column to view the response submitted. The following details are displayed:

- S. No.

- Transaction ID

- Date of Response

- Response Type

- For the demand against which there is “No Submit response option” available such demand is already confirmed by the Assessing Officer and you are required to contact your Jurisdictional Assessing officer.

- In case the demand is raised by the Assessing Officer, for viewing the tax and computations sheet, click on the download button next to the outstanding tax amount. The tax and computation sheet for demand available in database will be displayed. However, if the demand was raised by way of manual order outside the system, the details will have to obtained only from the Assessing Officer.