Appeal under GST

GST tax laws primarily impose two types of obligation – tax-related and procedural related, which are required to be compiled by the tax-payers. The taxpayer’s compliances with this obligation are verified by the proper tax officers via return filing, audit, scrutiny, examination, search, seizure etc.

In certain cases, there is the difference an opinion such as perceived and actual non-compliance, given set of laws/facts which results in disputes between the tax-payers and the GST authority. That is the reason for providing appeals mechanism to resolve such differences.

Appeal Mechanism

The dispute is first resolved by passing an adjudication order. This adjudication order is passed by Adjudicating Authority under GST. As per Section 2(4) of the CGST Act, means any authority, appointed or authorized to pass any order or decisions under this act but does not include CBEC, the Revisional Authority and Authority/Appellate Authority for Advance ruling/Appellate Tribunal. In general, the adjudication order is passed by tax officer.

However, if a taxable person or even the department itself is not satisfied by the decision or order so passed by the Adjudicating Authority, then any party can appeal to the next available level. The appeal, as discussed above will be an application to a higher court which may reverse the decision of a lower court.

The following are the 4 levels of the appeal procedure in GST, as per the provisions for appeal and revision in GST:

| Appeal Level | Order Passed By | Can Appeal To |

| 1st | Adjudicating Authority | Appellate Authority* |

| 2nd | Appellate Authority* | Appellate Tribunal** |

| 3rd | Appellate Tribunal | High Court |

| 4th | High Court | Supreme Court |

*Appellate Authority means an authority appointed or authorised to hear appeals as referred to in Section 107 of CGST Act 2017.

**Appellate Tribunal means the Goods and Service Tax Appellate Tribunal constituted under Section 109 of CGST Act 2017.

Since India follows a dual GST structure, as per the provisions of GST appeals and revisions, both CGST, as well as SGST / UTGST officers, are empowered to pass orders, and an order passed under CGST will also be deemed to be applied to SGST / UTGST.

Time Period for Filing Appeal to Appellate Authority

As per Section 107(1) of CGST Act, any person (registered or unregistered) aggrieved by any decision or order passed against him by the Adjudicating Authority may appear to Appellate Authority within a period of three months from the date of which the said decision or order is communicated to such person.

As per Section 107(2) of the CGST act, an appeal can be filed to the Appellate Authority within a period of six months by the GST Department.

As per Section 107(4), the Appellate Authority may, if he is satisfied that the appellant was prevented by sufficient cause from presenting the appeal within the aforesaid period of three months or six months, as the case may be, allow it to be presented within a further period of one month.

Pre-Deposit and the Effects on Recovery

As per Section 107(6) of CGST Act, no appeal shall be filled, unless the appellant has paid: –

- In full, the admitted liability (including tax, interest, fee, and penalty) arising from the impugned order as it admitted by him and

- A sum equal of 10% of the remaining amount of tax in a dispute arising from the said order

For example, if a demand order has been raised by Department for Rs 50,000 and the appellant agrees to the demand up to Rs 20,000 only when the appellant has to make a pre-deposit of Rs 23,000 (Rs. 20,000 + 10% of Rs. 30,0000) for filing an appeal to Appellate Authority.

Note: – Once the appeal is made, the recovery proceeding against the tax-payer shall get stopped.

Non-Appealable Decisions and Order

As per Section 121 of CGST Act, no appeal shall lie against the decisions/order passed by the competent officer, it relates to any of the following: –

- Order by competent authority directing the transfer of proceedings from one office to another.

- Order pertaining to seizure or retention of books of accounts, register, and other documents.

- Order sanctioning prosecution under the GST

- The order passed under Section 80 of CGST Act for payment of tax/other amounts in installments.

Process of Filing Appeal at GST Portal

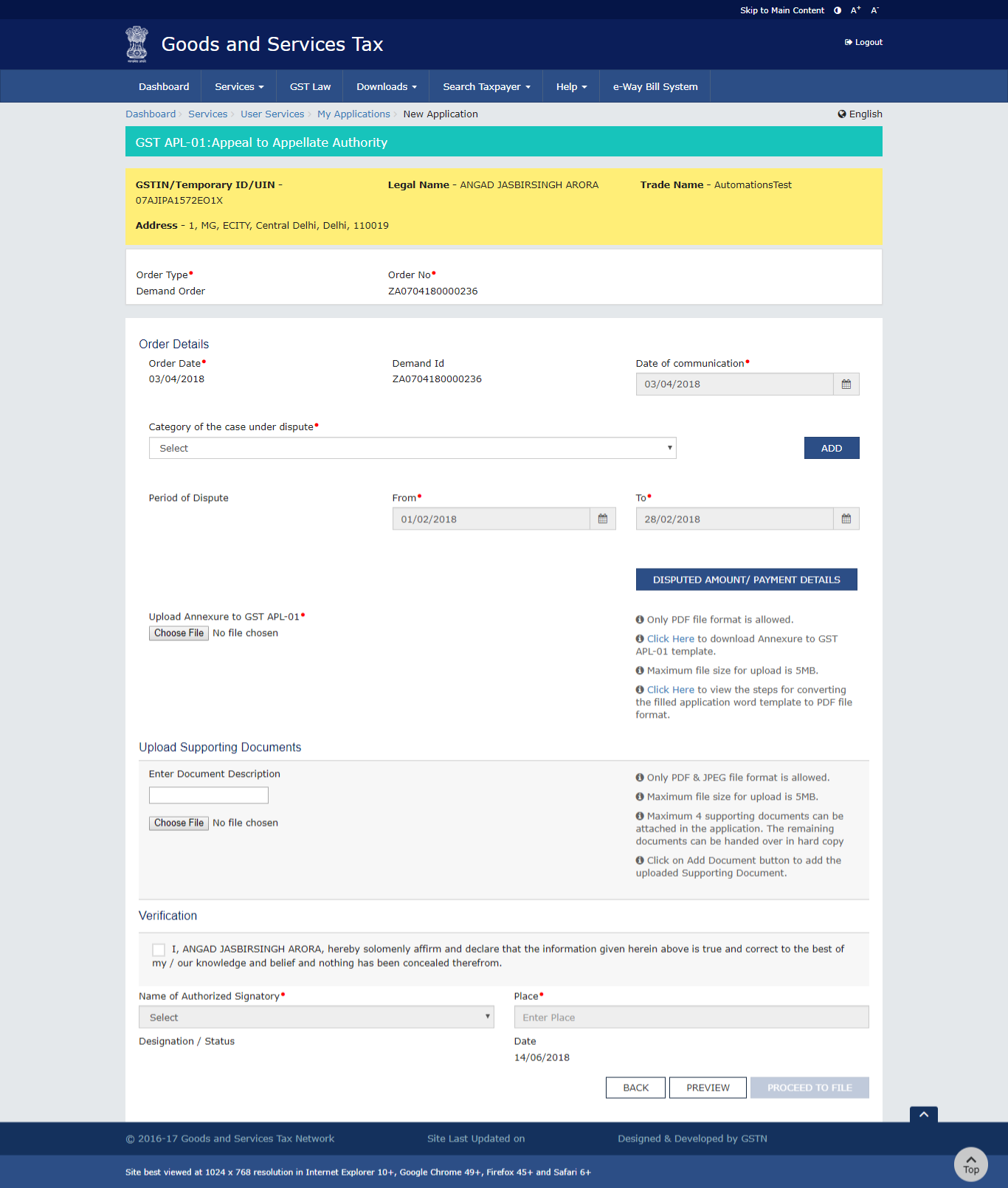

Appeal to the Appellate Authority shall be filed in GST APL-01 by the tax-payers. This functionality has been recently launched by the GSTN on GST portal.

Step 1 – Login into GST portal using your username and password.

Step 2 – Click on Services -> User Services -> My Application option.

Step 3 – My Application page is displayed. Select application type as Appeal to Appellate Authority from the dropdown list and click on New Application button.

Step 4 – This will open the form GST APL-01 in which appeal shall be filed to Appellate Authority.

Step 5 – Select Demand Order under Order Type from the dropdown and enter the Order No. issued by the Adjudicating Authority and click on Search button.

Step 6 – Basis of the Order Type and Order Number, details of that relevant order will get auto-populated.

Step 7 – Date of communication will get auto-populated but it can be modified by the user if he has a reasonable reason for the delay in receiving of communication. The date will be cross-checked by the department with the actual date of communication so it must be entered correctly.

Step 8 – Select the Category of the case under dispute from the available dropdown list and click on Add button. You can add multiple options for the category by the repeating this step again and again. Also, there is an option for Others if the category is not available in the Dropdown.

Step 9 – Period of dispute shall get auto-filed on the basis of the Order Number but it can be edited by the user.

Step 10 – The next step is to download the annexure from the link provided.

Step 11 – Enter the required details related to your case in the downloaded annexure in word format.

Step 12 – Save the file as PDF and select the button of Choose File to upload.

Note: – The maximum file size which is allowed for upload is 5 MB and only PDF files can be uploaded.

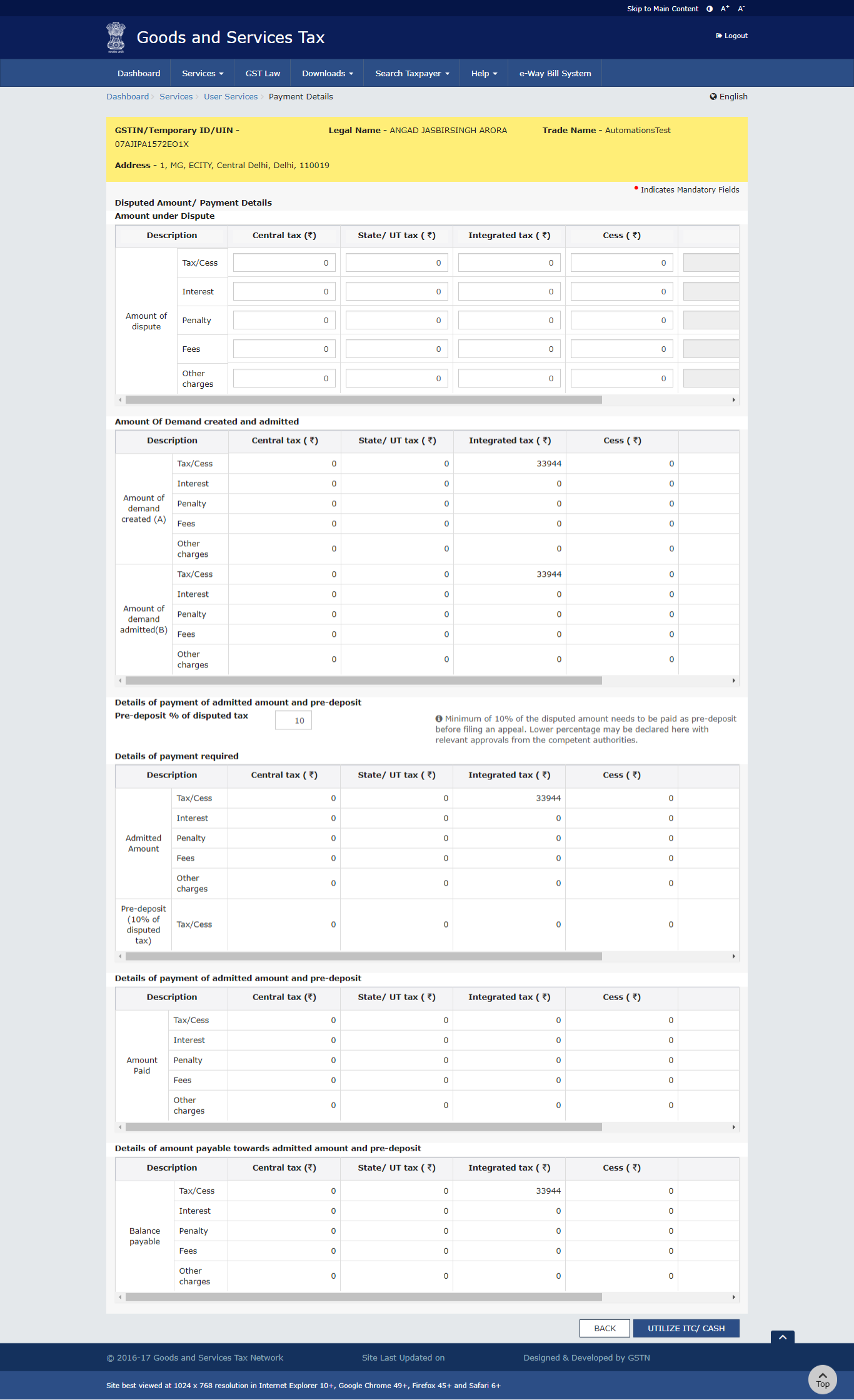

Step 13 – Click on the Dispute Amount/Payment Details button. This will open a new page where you are required to enter various details related to dispute amount and admitted amount.

Note: –

- The amount under Dispute cannot be more than the Amount of Demand Created.

- 10% of such disputed amount is required to be deposited before filing the appeal. The lower percentage may be declared here with relevant approvals from the competent authorities.

- 100% of the admitted amount is required to be deposited before filing the appeal.

Step 14 – Click on Utilize ITC/Cash button once you enter all the details regarding disputed and admitted amount.

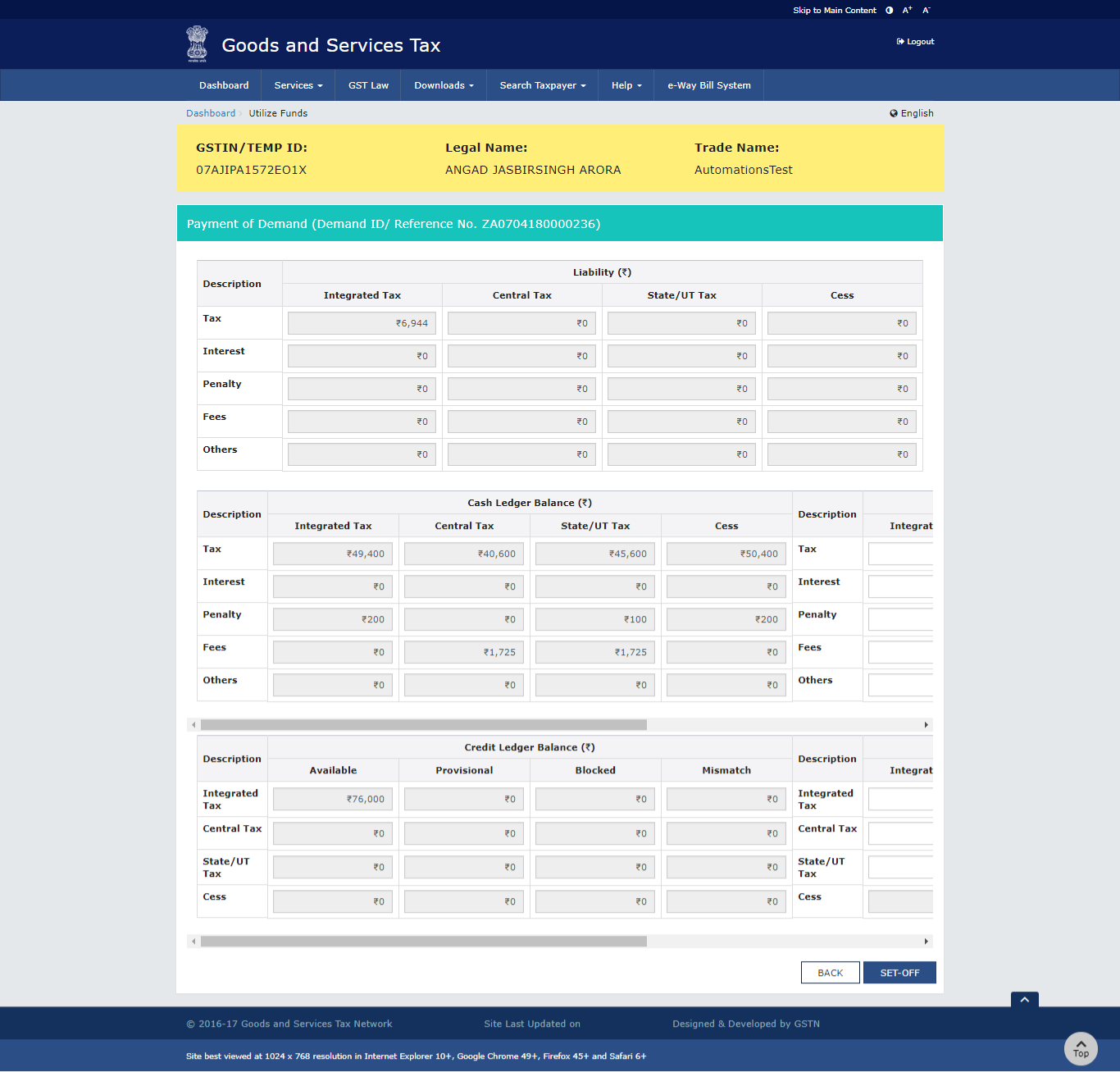

Step 15 – On the next screen, the total liability along with the balance in cash and credit ledger will get displayed. Enter the amount in the relevant boxes to set off the deposit liability from cash and credit ledger.

Note: – Make sure you have sufficient cash and credit balance already in the ledger to pay the deposit liability before filing the appeal.

Step 16 – Select OK in the confirmation message displayed for Set-off.

Step 17 – Once the set-off is successful, a payment reference number is displayed on the screen. Click on the Back button.

Step 18 – You can also upload other supporting documents for your case. Enter Document Description and click on Choose File button to upload the supporting documents.

Note: – Maximum 4 supporting documents can be attached in the application. Also, the maximum file size for upload is 5 MB and only PDF & JPEG format are allowed. If you are having more than 4 supporting docs then it is advised to hand over the hard copies of the remaining support to the office of the Appellant Authority.

Step 19 – Now click on Preview button shown at the end of the form to cross check all the detailed filed.

Step 20 – Once you are satisfied with the details, check the verification box, select the authorized signatory from the dropdown, enter your place and then click Proceed to File button.

Step 21 – Click on Proceed button shown in warning box and select the relevant option for submission.

Step 22 – A confirmation message is displayed that the provisional appeal has been submitted successfully. Also, a confirmation email shall be sent to the registered email address.

Step 23 – This is the only the provisional acknowledgment of the appeal. The taxpayer is required to submit the following certified true copies to the Appellate Authority within a period of 7 days from the filing of appeal online: –

- Appeal form

- Provisional acknowledgment

- Impugned order

- Annexure

- Pre-deposit particulars

- Supporting documents

Final acknowledge in the form GST APL-02 shall be issued after the submission of the hard copy of the above-mentioned documents. The appeal will be treated as filed only after issuing of Final acknowledgment.

Note: – If the above documents are submitted after the 7 days from the filing of appeal then the date of actual submission of the document shall be considered the date of filing an appeal, not the date on which appeal is filed online.