RCM on Commission Charges to Ebay

Ebay Commission Charges For each fulfilled order Ebay charges commission from sellers. Now question arises whether GST under RCM is payable on such a commission as Import of service ? As per Section 2(11) of IGST Act, Import of service means supply of service where: – Now, we need to find out whether all the […]

7 Steps to File Your Income Tax Return Online In India

An Income Tax Return (ITR) is a form that enables the taxpayer to declare his income, expenses, tax deductions, investment, and taxes. There are a number of reasons why filing an income tax return becomes crucial for a taxpayer, such as carrying forward losses, claiming an income tax refund, or availing the VISA, etc. However, […]

Changes in UAE Tax Law: New Corporate Tax Rules for 2024

In 2024, the UAE made significant changes to its corporate tax landscape, ushering in a new era of taxation for businesses operating in the region. Known for its business-friendly environment, the UAE has long offered attractive incentives to local and international companies. However, with the introduction of a corporate tax in 2024, the business environment […]

6 Best Accounting Softwares in India (Updated 2024 List)

A number of business accounting software are available in market these days but quite few of them satisfies the customer’s needs in an easy way. A number of software has emerged in the past few years which makes the competition tough for market leaders like Tally. Businesses starts preferring online application due to several benefits […]

What is a Proforma Invoice? Format and Status under GST

What is a Proforma Invoice? A Proforma Invoice is a document similar to an invoice regarding the particulars of the goods/services yet to be delivered to the customer. It states the prices and quantity of the goods/services, taxes applicable, and details of other charges like delivery charges. “Pro forma” is a Latin term that means […]

Everything about PPF and its Tax Benefits

What is PPF (Public Provident Fund)? PPF stands for Public Provident Fund which is backed by Indian Government. It is the most common investment for a number of decades. Its features like guaranteed return, tax exemption under section 80C as well as tax free interest under section 10(11) makes it the most popular investment among […]

NSC – National Saving Certificate

National Saving Certificate, commonly known as NSC, is saving bonds issued by Indian Government to individuals only. It is primarily focused on small savings. Also, the amount invested in NSC, can be claimed as tax deduction investment u/s 80C of Income Tax Act, 1961 subject to limit specified. Features of NSC VIII Issue Interest on […]

How to Use Fundamental Analysis in Forex Trading

Traders in the foreign exchange market implement the same two types of analysis as stock market investors do: fundamental and technical analysis. The applications of technical analysis in Forex are similar: the price is considered to reflect all news, and the charts are the focus of the study. But, unlike corporations, governments do not have […]

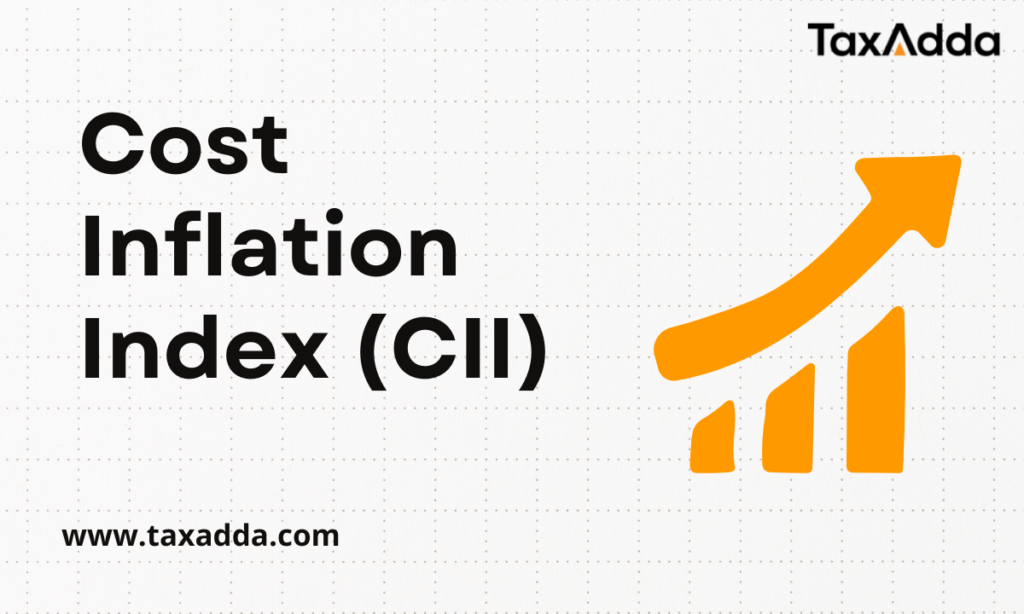

Cost Inflation Index (CII) for FY 2024-25 and Previous Years

Cost Inflation Index (CII) Applicable from Financial Year 2017-18 Financial Year (01 Apr to 31 Mar) Cost Inflation Index (CII) 2024-25 363 2023-24 348 2022-23 331 2021-22 317 2020-21 301 2019-20 289 2018-19 280 2017-18 272 2016-17 264 2015-16 254 2014-15 240 2013-14 220 2012-13 200 2011-12 184 2010-11 167 2009-10 148 2008-09 137 2007-08 […]

Top 11 Online Accounting Software in India

Managing finances, taxes, and cash flow has become significantly easier due to the rise of online accounting software. Here, we’ll delve into the top ten online accounting software solutions for Indian small businesses in 2023, taking into account your feedback. 1. Zoho Books Zoho is one of the famous names in the CRM software globally. […]