Insurance, PPF, Repayment of Loan and other Deductions – Section 80C

Eligible Assessee – Individual and HUF Maximum amount of Deduction – A maximum of Rs. 1,50,000 is allowed as deduction under sections 80C, 80CCC, 80CCD(1) aggregately. Deduction is allowed whether the payment is made out of income chargeable to tax or not. Deductions allowed – Life insurance premium Contribution by an employee to approved superannuation […]

Taxability in case of Shares & Derivatives Trading

If a person is engaged in shares dealing then it can result either in Business Income/Loss (chargeable under section 28 as Profits & Gains of Business or Profession) or Capital Gain/Loss (chargeable under section 45 as Capital Gain). Classification of Income It depends on facts and circumstances of each case as no standard guideline is […]

Cost Inflation Index (CII) 2020-21 and Previous Years

Cost Inflation Index (CII) Applicable from Financial Year 2017-18 Financial Year Cost Inflation Index (CII) 2020-21 301 2019-20 289 2018-19 280 2017-18 272 2016-17 264 2015-16 254 2014-15 240 2013-14 220 2012-13 200 2011-12 184 2010-11 167 2009-10 148 2008-09 137 2007-08 129 2006-07 122 2005-06 117 2004-05 113 2003-04 109 2002-03 105 2001-02 100 […]

GST Practitioner

CGST Act contains the provisions regarding appointment of GST Tax Practitioner (GSTP). GSTP is a person who is authorized by the GST Department for performing certain functions on behalf of the registered persons under GST. Although any person can perform GST functions whether authorized or not. Such registration will increase the sense of responsibility in […]

Partnership Act, 1932 – Important Points

Applicability This act applies to the whole of India except the state of Jammu and Kashmir. Formation The relationship of partnership arises from contract and not from status. The members of a Hindu Undivided Family carrying on a family business as such are not partners in such business. Where no provision is made by contract […]

Section 139(A)(5)(c) and Rule 114B – 18 Transactions in which Quoting PAN is Compulsory

Section 139A(5)(c) of Income tax act states that PAN is required to be quoted on transactions prescribed by CBDT. In such case, the seller of goods/services has to collect PAN from the buyer. Rule 114B of Income Tax Rules states the transactions in which quoting of PAN is compulsory. A table showing requirement under Rule […]

Depreciation is allowed @ 60% on Printers, Scanner etc

From financial year 2017-18 and onwards, maximum rate of depreciation is 40%. So depreciation on printers, scanner etc is also applicable at the rate of 40%. CASE LAW DETAILS Decided by: ITAT, DELHI BENCH `B’: NEW DELHI In The case of: ACIT v Container Corporation of India Ltd. Appeal No. : ITA Nos. 2851 & […]

Points to be considered while taking a Medical Insurance

Emergencies never happen with a warning. At such times, a good medical insurance can be a boon for the sufferer and family members. Medical costs and treatment prices are skyrocketing every day. If your medical insurance is in place, it lifts a major weight off your shoulders. You can concentrate on taking care of your […]

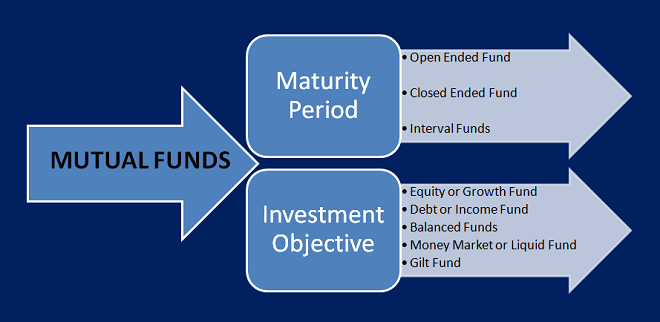

Types or Classification of Mutual Funds

Mutual funds is a trust that is managed by the professionals, whose main task is to gather funds from different investors & further invest them in various securities such as bonds, stocks, precious metals, etc. The funds are invested in such a way that the losses can be easily compensated with the profits. If you […]

TDS on Rent – Section 194I

Persons required to deduct Tax – Any person (other than an individual or HUF who is not liable for audit under section 44AB) who is responsible for paying rent to a resident is required to deduct tax under this section. Individual and HUF who are not covered in this section are required to deduct TDS […]