Mutual funds is a trust that is managed by the professionals, whose main task is to gather funds from different investors & further invest them in various securities such as bonds, stocks, precious metals, etc. The funds are invested in such a way that the losses can be easily compensated with the profits.

If you are facing difficulty in finding the time to do research over various investments alternatives available in the market & make a choice, mutual funds is the best way to remove your hassle. Mutual funds are considered as the flexible & easy mode of investment which also provide liquidity to the investor.

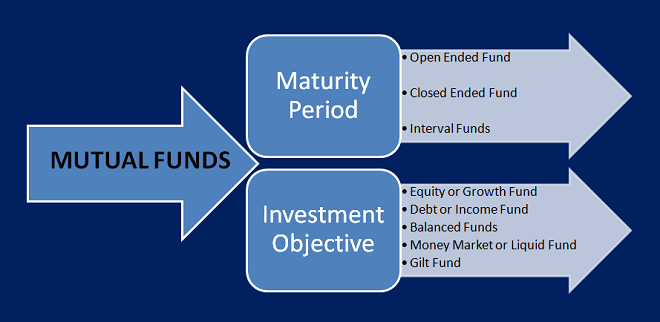

Mutual funds are classified on the basis of Investment objectives & maturity period

| On the Basis of maturity period | |

| Open-Ended Fund | Open-ended funds are the funds in which maturity date is not fixed. The investors have the opportunity to buy & sell units any time at NAV. These are the liquid funds & investors can invest at any time during the year & redemption can also be done on continuous basis. |

| Close-ended fund | Close-ended funds are the funds where maturity period is fixed. These funds are not available for subscription all the time like open-ended funds rather they are available for investment during specified period of time i.e. when they are launched initially. |

| Interval Funds | Interval funds are the combined version of Open-ended as well as close-ended funds. These funds are available for trading in stock exchange at predetermined intervals. |

| On the basis of Investment objectives | |

| Equity or Growth funds | Equity funds are the funds in which majority of the investment is made in the equity shares. Therefore it carries a high risk but also potential of high returns. The investment goal under such kind of funds is to achieve long term growth. There may be funds which focus mainly on a single market sector for eg Banking sector equity fund. |

| Debt or Income Funds | The investment under such kind of funds is made in securities such as bonds, debentures, government securities, etc. Since investment is made in debt instruments, risk factor is low & income is stable & regular. Debt or income funds are less volatile as compared to equity funds. The investment goal under such type of funds is safety and to achieve moderate growth of funds. |

| Balanced funds | Under balanced funds, the money is invested in both equity & debt instruments. The investment goal is to achieve both profits & moderate growth. They ensure stable returns & appreciation in capital to the individuals who have invested money in balanced funds. |

| Money Market or Liquid funds | Such kind of funds go for short term investments such as Treasury bills, commercial papers, etc. under which time period is less than 91 days. The investment objective under liquid funds is to attain liquidity, increase in capital & moderate return on funds. |

| Gilt funds | These are the government securities carry no credit risk & are considered as safest kind of funds. |

There is also an option to opt for the dividend option and growth option. In dividend option, the income earned is distributed among the unit holders whereas in the growth option the income is not distributed therefore the income gets reinvested in the same fund.