Sometimes we are required to make the changes in the TDS challan paid. Department has provided various ways in which you can make the changes in the challan paid which are as follows: –

- Online (For OLTAS challans)

- By Bank (For Physical Challans)

- By Assessing Officer (For Physical and Online Both)

Online (OLTAS) Challan Correction

TDSCPC provide OLTAS challan correction functionality to the deductor for correction of the unclaimed and matched challans. No approval from Assessing Officer’s is required for making following changes : –

- A financial year can be corrected up to the financial year relating to the date of deposit of challan. For example, if the date of deposit of challan is 10th January 2018 then the Financial year should be equal to or smaller than the financial year 2017-18.

- Correction in minor head 200 (TDS/TCS payable by the taxpayer) and 400 (TDS/TCS regular assessment)

- Correction in major Heads – 20 (Company) and 21 (Non-Company) deductee.

- Correction in nature of payment (section code) except code – 195 (other sums payable to non-resident)

Step by step guide for filing challan correction request

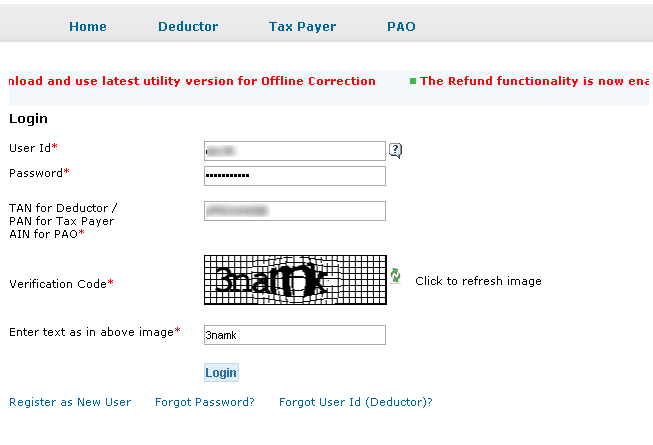

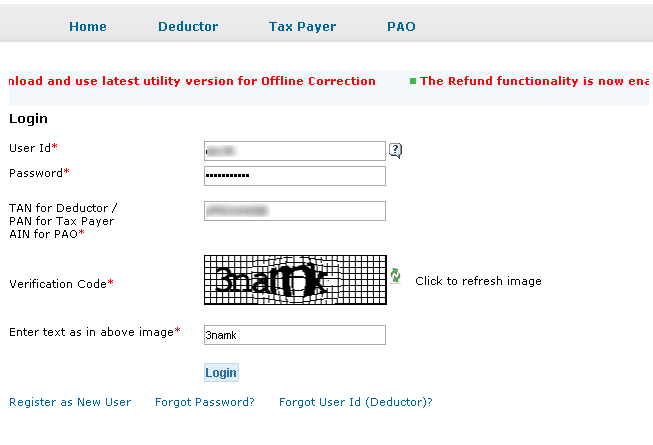

Step 1 – Login into Traces

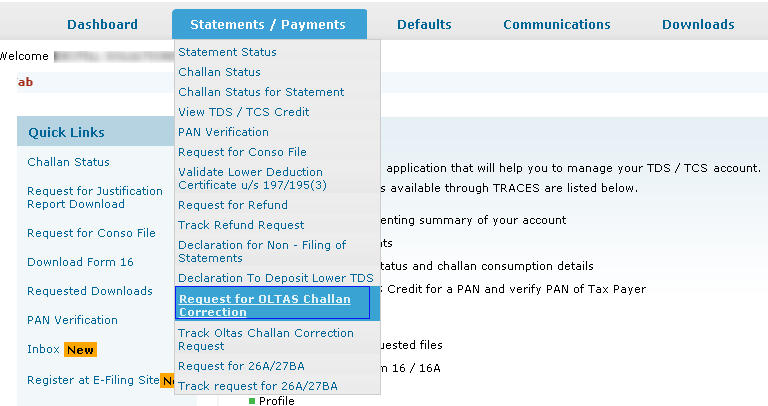

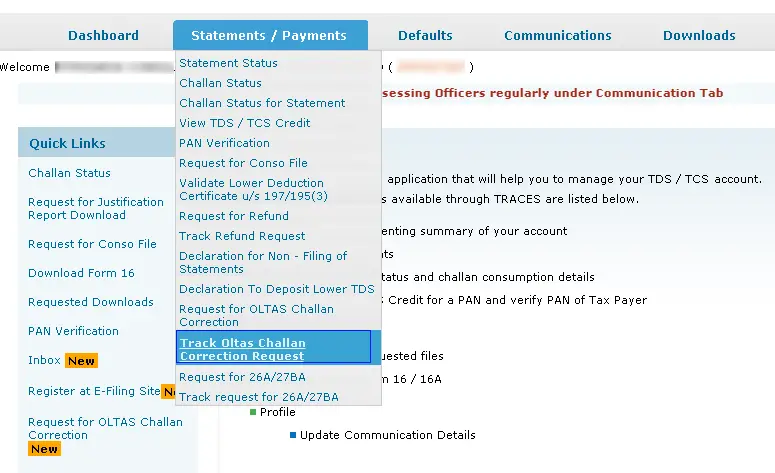

Step 2 – Select the option of Request for OLTAS Challan Correction under Statements/Payments

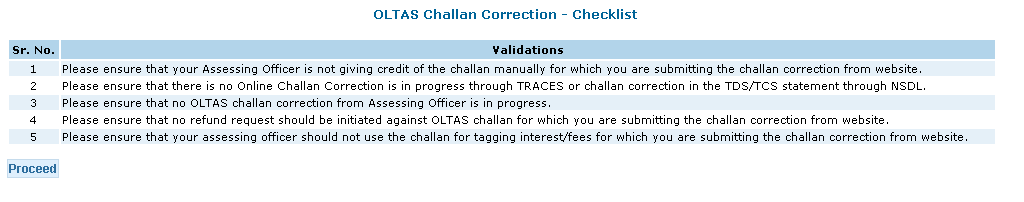

Step 3 – Click Proceed on the checklist page or the OTLAS challan. You are required to submit correction request only for those challans which matches the following conditions

- Ensure that your assessing officer is not giving credit of the challan manually for which you are submitting the challan correction from the website

- No Online Challan Correction is in progress through TRACES or challan correction in the TDS/TCS statement through NSDL.

- No OLTAS challan correction from Assessing Officer is in progress.

- No refund request should be initiated against OLTAS challan for which you are submitting the challan correction from the website.

- Ensure that your assessing officer should not use the challan for tagging interest/fees for which you are submitting the challan correction from the website.

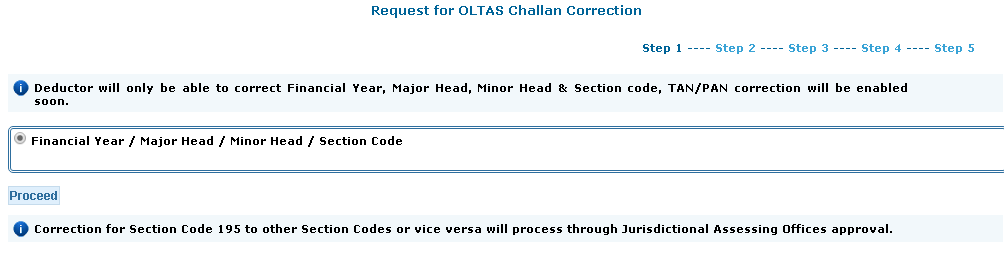

Step 4 – Select the option Financial year, major head, minor head and section code and click Proceed. TAN/PAN correction facility will be introduced soon.

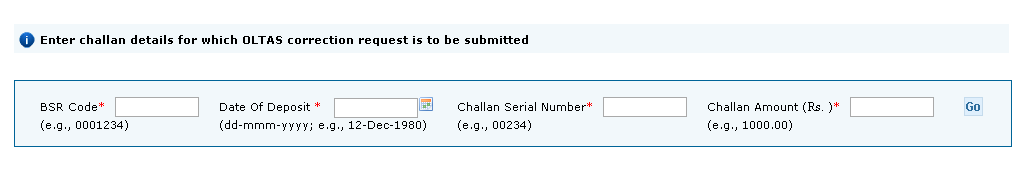

Step 5 – Enter the following challan details and click on Go button

- BSR code

- Date of deposit

- Challan serial

- Challan amount

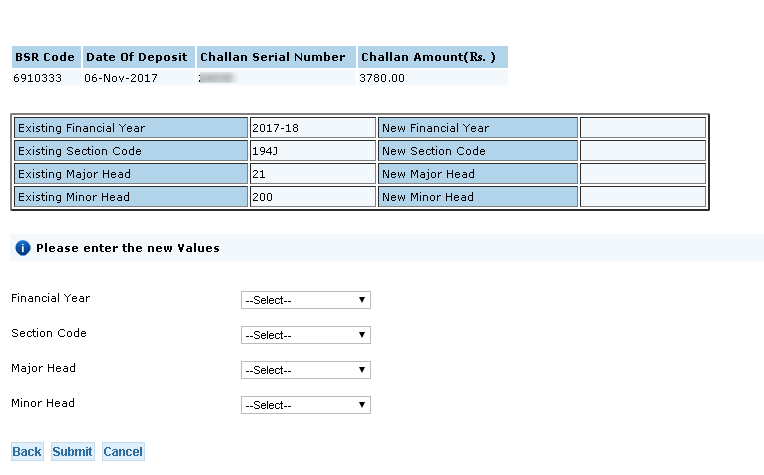

Step 6 – If the details entered for the challan are correct then the system will populate the challan details. Also, make sure the challan for which correction is required should be unclaimed and matched.

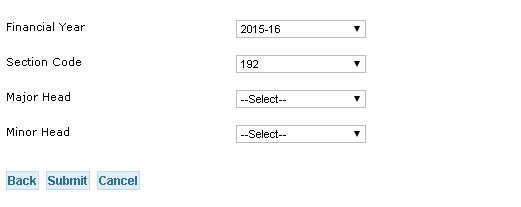

Step 7 – Enter new values for those fields and click on Submit. You can make changes in single or multiple fields simultaneously as required

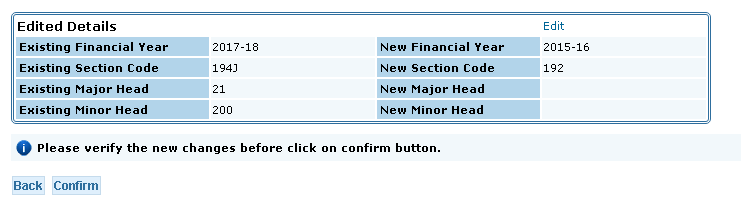

Step 8 – Review the new details and click on Confirm.

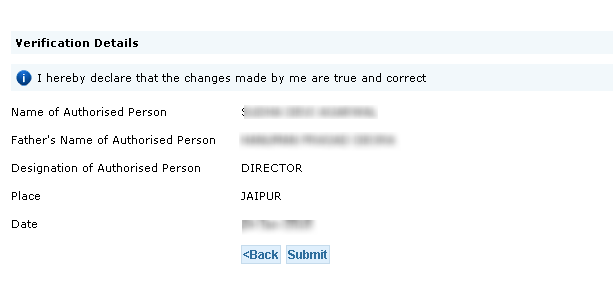

Step 9 –Verification details will be displayed of the user along with Proceed button for final submission. Click on Proceed for submission or Back to cancel or make any changes in the declaration.

Step 10 – Confirmation message will be displayed after successful filing.

Step by step guide to track OTLAS challan correction request

Step 1 – Login into Traces

Step 2 – Select the option of Track OLTAS Challan Correction request under Statements/Payments

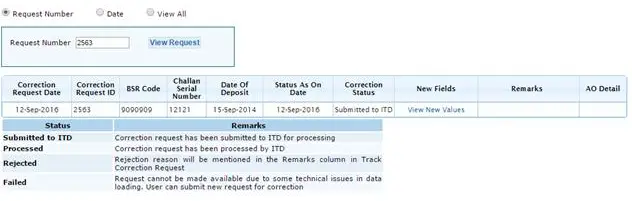

Step 3 – You can do a search either on the basis of request number or date or view all the request for correction.

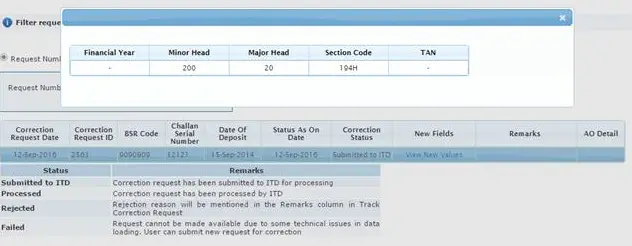

Step 4 –Now the system will display the relevant correction along with their status which is as follows: –

- Submitted to ITD

- Processed

- Rejected

- Failed

Note: – View New Fields option is also available to review the changes in the fields applied for.

Challan Correction by Banks (for physical challans)

The mechanism for correction in challan is also available for those tax payments which are directly deposited by the taxpayer in banks. The taxpayer has to visit the same branch where such physical challan has been deposited and have the below time window for the correct request

| Type of Correction | Period for Correction request (In days) from date of deposit of challan |

| PAN/TAN | Within 7 days |

| Assessment Year | Within 7 days |

| Total Amount | Within 7 days |

| Major Head | Within 3 months |

| Minor Head | Within 3 months |

| Nature of Payment | Within 3 months |

Other limitation in the correction of challan

The bank is having a correction window of 7 days from the date of receipt of correction request from the taxpayer. The changes can be made by the banks, subject to following conditions:

- Correction in Name is not permitted.

- Correction of Minor Head and Assessment Year together are not allowed.

- PAN/TAN correction will be allowed only when the name in the challan matches with the name as per the new PAN/TAN.

- The change of amount will be permitted only when the amount so corrected is not different from the amount actually received by the bank and credited to Govt. Account.

- For a single challan, correction is allowed only once. However, where 1st correction request is made only for amount, a 2nd correction request will be allowed for correction in other fields.

There will be no partial acceptance of change correction request, i.e. either all the requested changes will be allowed, if they pass the validation, or no change will be allowed if any one of the requested changes fails the validation test.

Procedure for submitting correction request to the bank

- The taxpayer has to submit the request form for correction (in duplicate) to the concerned bank branch.

- The taxpayer has to attach a copy of original challan counterfoil.

- In case of correction desired for challans in Form 280, 282, 283, the copy of PAN card is required to be attached.

- In case of correction desired for payments made by a taxpayer (other than an individual), the original authorization with a seal of the non-individual taxpayer is required to be attached with the request form.

- A separate request form is to be submitted for each challan.

Challan correction by Assessing Officers in case of physical and e-Payment challans

Assessee can get the correction made in challan by making a request for correction to his assessing officer (if above option is not workable or available anymore). The jurisdictional officer or officer authorized under the departmental for OLTAS after receiving such application can make the correction in challan data in genuine cases.

The Format of Correction request in Challan data Field by the assessee

To

The Branch Manager/ Jurisdictional Officer Address:

Taxpayer Details:

Taxpayer Name :

Taxpayer Address

Taxpayer TAN/PAN :

Name of Authorized Signatory

(in case of assessee other than Individual)

Sub: Request for Correction in Challan No: 280/281/282/283

Sir/Madam,

I request you to make corrections in the challan data of the Tax Payer as detailed:

The Correction required in Data/ fields of the following challan

| BSR Code | Challan Tender Date(cash/cheque deposit date) | Challan Sl. No. |

Fields for correction required

| Name of Fields | Please Tick | Original Details | Modified Details |

| TAN / PAN | |||

| Assessment Year | |||

| Major Head | |||

| Minor Head | |||

| Nature of Payment | |||

| Amount Paid |

Signature

Taxpayer/Authorized Signatory Date:

Also Read: