What is a Proforma Invoice?

A Proforma Invoice is a document similar to an invoice regarding the particulars of the goods/services yet to be delivered to the customer.

It states the prices and quantity of the goods/services, taxes applicable, and details of other charges like delivery charges.

“Pro forma” is a Latin term that means “for the sake of form” or “as a matter of form”?

Why Pro forma invoices are issued?

It is issued before the issue of a final invoice so that buyers gets aware of the price, quantity, additional charges along terms/conditions. If he has any objection, he can tell before issue of invoice and thus invoice need not be revised.

Some businesses also has the practice that invoice is only issued after receiving payment. So they first issue pro forma invoice, buyer makes payment on its basis and then they issue the invoice. Normally such practice is adopted in vehicle showrooms.

Status under GST and other laws

Pro forma invoice is not an actual invoice and therefore is not a legal document. GST act does not contain any term such as pro forma invoice. It is not required to be reported under any GST returns, either by buyer or seller. And seller is not required to pay GST on pro forma invoices issued.

Proforma invoice should contain heading like “Pro Forma Invoice”. If it has heading Sales invoice then it becomes a legal document under GST. So take care for this.

Since, it is not a sales bill, it is not recorded in accounting by seller or buyer. Although billing software like TaxAdda’s own billing software has functionality to create Pro forma invoices/quotations/sales-order/purchase-order. Although they are not considered in party’s ledger.

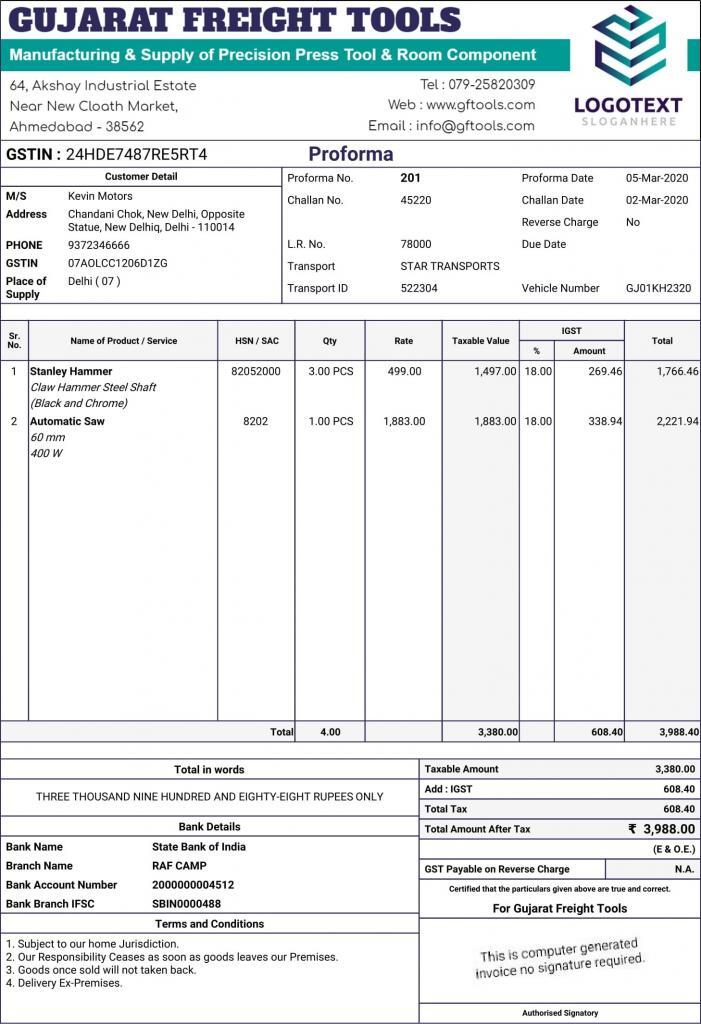

Format of Pro Forma Bill

There is no prescribed format for pro forma invoice. You can use your sales bill format for issuing pro forma bills but change heading.

Normally, it should have the following information

- Unique number.

- Date of issue

- Address of the supplier.

- Address of the prospective buyer.

- Description of good and/or services including their unit costs and line-item totals.

- Validity of the pro forma invoice

- Proposed terms of sale.

- Proposed terms of payment, if any.

- Bank Details of supplier.

- Certifications required by “Customs Authorities” if any.

- Signature by an authorized person from supplier’s company.

Also Read – Invoicing under GST

Sample Pro forma invoice Format

Download Sample Proforma Invoice Format

- Business dealing in Goods (with GST)

- Download in Excel format

Download in Word format

- Download in Excel format

- Business dealing in Goods (without GST)

- Download in Excel format

Download in Word format

- Download in Excel format

- Business providing services (with GST)

- Download in Excel format

Download in Word format

- Download in Excel format

- Business providing services (without GST)

- Download in Excel format

Download in Word format

- Download in Excel format

What is difference between Invoice and Proforma Invoice?

Invoice is issued when sales is made. Pro forma Invoice is a document similar to invoice regarding the particulars of the goods/services yet to be delivered to the customer. It is issued before the issue of a final invoice, so that buyers get aware of the price, quantity, additional charges and terms/conditions. If he has any objection, he can tell before issue of invoice and thus invoice need not be revised.

Both the documents are important but invoice is a legal document. Proforma invoice will not create any binding upon the client as it is not a legal document. Let’s discuss the point of differences between the two in detail:

- Definition:

Invoice is a legal commercial document that is sent to the purchaser of the product or service confirming that the sale occurred and the payment is due. Proforma Invoice on the other hand is an estimate or quote which is sent before the delivery but it mentions the particulars of goods and services along with the costing.

- Issue time:

Invoice is generally issued after the payment or after confirming the order or at the time of delivering the goods while Proforma Invoice is issued before the delivery of goods/service or you can say before the order placement.

- Purpose:

The purpose of issuing an invoice is to inform the purchaser that the amount is due against the goods or services provided through the sale. Invoice is legally binding while Proforma invoice is not as it informs the purchaser as what is expected from him.

- Format:

The format of the invoice includes full information such as logo, billing addresses, contact information, other billing details, and terms and conditions. A proforma invoice also includes the same information but it will be mentioned on the top “Proforma Invoice”.

- Accounting:

Proforma Invoices are not necessarily required for accounting purposes as it is just an intimation for the client to give him the idea of the amount due and the date of the payment. The invoice should be kept for reference and should be properly filed. It can be used as accounting information and also for audit purposes. Moreover, it is recorded to know about amount receivable or payable from the client

Also Read – What is POS software and how it is different from billing software

How Proforma Invoice is different from Quotation?

Pro forma invoice is generally given at final stage of sales while quotation is given at time of starting of sales.

Quotation may not contain quantity of goods, bank details and most time rather than giving exact details of extra expenses such as tax and shipping cost, in quotation it is written in end that tax and shipping extra.

What’s the Difference between a Proforma Invoice and a Purchase Order?

A proforma invoice sounds the same as a purchase order. Both types of documents contain descriptions, quantities, prices, discounts, payment terms and other terms of the sale. However, the difference is, the origin: the seller prepares and sends a proforma invoice to the buyer. When it comes to a purchase order, it’s the buyer who issues and sends it to the seller and uses the document for matching it with the invoice he has received when disbursing payment.

What are general terms and conditions that can be included in pro forma invoices?

You can include terms and conditions in pro forma invoices similar to invoices. You should include the payment terms, warranty terms, installation or delivery terms, information about after-sales services. If warranty is not provided by seller but by third party then it is better to include that also. For example, in case of electronic items like mobile, after-sales service is not provided by seller but by the company service center.

FAQs

What is Pro forma invoices?

Pro forma invoice is issued before the issue of final invoice, so that buyer gets aware of the price, quanity, additional charges and terms/conditions. So that if buyer has any objection then he can tell before issue of invoice and invoice need not be revised or cancelled.

What is the difference between a pro forma invoice and an invoice?

Invoice is issued when sales is made. Pro forma invoice is issued prior to sales, to made buyer aware of the price and quantity of goods/services, additional charges and terms of sales.

What is the format of pro forma invoice under GST?

Pro forma invoice outside the scope of GST as GST is not payable on issuing a pro forma invoice. Also, no format is prescribed in GST laws.