A registered taxpayer may change its constitution vide sale/ amalgamation/merger/demerger/transfer of business. In such condition registered taxpayer has available matched Input Tax Credit (ITC) in electronic credit ledger which will need to be passed to the transferee. In this article, we will discuss about in which conditions ITC can be transferred and how it will be transferred to transferee using GST portal in detail.

CONDITIONS IN WHICH ITC CAN BE TRANSFERRED

As per Section 18(3) of CGST Act, when there is a change in constitution of a registered taxpayer on account of sale, merger, demerger, amalgamation, lease or transfer of business with specific provision for transfer of liabilities, the said taxpayer are allowed to transfer the matched ITC as per electronic credit ledger to such transferee sold, merged, demerged, amalgamated, leased or transferred business.

In other words, if a registered taxpayer transfer his business he is allowed to transfer the matched unutilized ITC to the transferee. In the case of the demerger of a company, the ITC shall be apportioned in new assets sharing ratio.

Also, ITC can be transferred in case of death of sole proprietor to the transferee or successor.

For Example:

Krishna Private Limited has demerged and separated into two units A & B. The Asset sharing ratio between the units us 6:4. The ITC available would be apportioned in the ratio of 6:4 between units A & B.

MANNER OF TRANSFER OF CREDIT

As per rule 41(1) of the CGST Rules, a registered person shall file FORM GST ITC-02 electronically on the common portal with a request for transfer of unutilized input tax credit lying in his electronic credit ledger to the transferee, in the event of sale, merger, de-merger, amalgamation, lease or transfer or change in the ownership of business for any reason. Followings are the pre-requisite to filing Form GST ITC-02:

- The transferee and transferor should have GST registration.

- It is mandatory for the transferor to file all GST returns of past periods.

- The transferor should have matched ITC available in the electronic credit ledger on the date of transfer of business.

- All liability of the returns filed by transferor must be paid.

- The inputs and capital goods so transferred shall be duly accounted for by the transferee in his books of account.

- The transferre shall accept the details furnished by the transferor and upon such acceptance ITC shall be credited to transferre electronic credit ledger.

- The transfer of business has to be with an accurate provision of transfer of liabilities which will be the stayed demands of tax, or with any litigation/recovery cases. It has to be accompanied by the certificate that is issued by the Chartered Accountant or Cost Accountant.

STEPS TO FILE FORM GST ITC-02

Followings are the steps to file form GST ITC-02 to transfer matched ITC on GST common portal:

Step 1: Log in to the GST Common portal i.e. gst.gov.in using credentials.

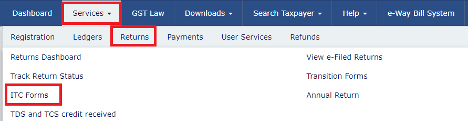

Step 2: Click on “Services” tab under that “Returns” Tab under that “ITC Forms”.

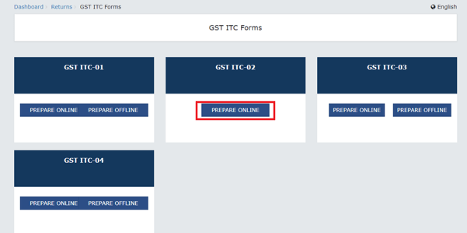

Step 3: Click of “Prepare Online” Tab under Form GST ITC – 02.

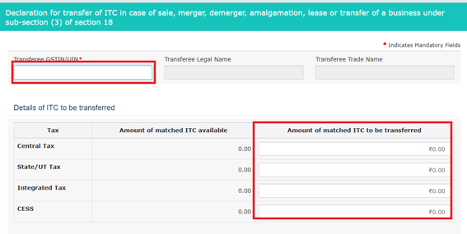

Step 4: Enter the GSTN of the transferee. After that, the amount of matched ITC to be transferred for each major head under the Details of ITC to be transferred section. The amount entered has to be less than or equal to the amount of ITC that is available in the Electronic Credit Ledger.

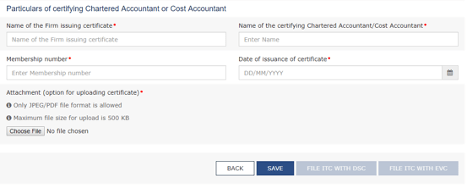

Step 5: Under section particulars of certifying Chartered Accountant or Cost Accountant following details have to enter.

- Name of the certifying accounting firm

- Name of the certifying Chartered Accountant / Cost Accountant in the certifying firm

- Membership number of the certifying firm

- Date of the certificate issued by the certifying accounting firm

After that, attach the certificate by clicking on choose file.

Step 5: After entering all the details Click on “Save” and the File the form with the Electronic Verification Code (EVC) or Digital Signature Certificate (DSC) of the authorized signatory.

ACCEPTANCE OR REJECTION OF ITC BY TRANSFEREE

After ITC-02 has been filed by the transferor, the transferee has to either accept or reject the ITC transfer. Following steps should be followed to accept or reject the ITC transferred.

Step 1: Transferee has to login to the GST portal i.e. gst.gov.in using credentials.

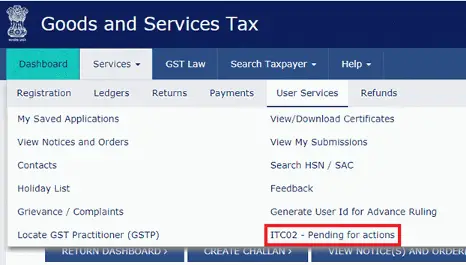

Step 2: Click on “Services” tab under that “User Services” tab under that “ITC-02 – Pending for actions” as shown on screenshot.

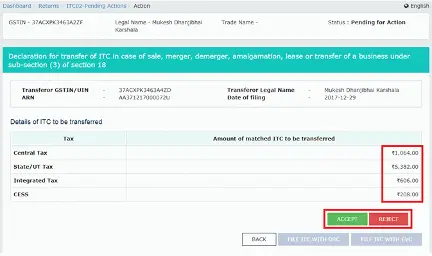

Step 3: The transferee will be directed to a new page from which the user has to click on the ARN link.

Step 4: After clicking on the ARN Link, details of all the matched ITC transferred by the transferor will be displayed. The transferee has to either accept or reject the request.

Step 5: After Accepting the transfer, the system displays a confirmation message and then prompts the user to proceed with filing the response.

Step 6: Transferee has to file the response with EVC or DSC of the authorized signatory. After successful accepting the ITC the status of transfer has been changed to accepted as shown in the screenshot.