Applicability

Section 194IA is inserted by Finance act 2013 and is applicable from 01st of June , 2013. A person who is purchasing any immovable property (other than agricultural land) from a resident is required to deduct TDS @ 1% from the amount payable in this behalf. TDS is not required to be deducted If the property value is less than Rs. 50 lakhs. Also, TDS is required to be deducted on all type of immovable property such residential property, commercial property or industry except agricultural land.

Exception

- The provisions of this section is not applicable where section 194LA regarding compulsory acquisition is applicable.

- If the seller is non-resident or NRI then TDS is to be deducted under section 195 on basis of capital gains and not under this section.

- When it comes to under construction properties, TDS will be deducted on installments paid on or after 1st June, 2013. No TDS is applicable on the installments paid before 1st June, 2013.

Rate of TDS, Threshold limit

TDS is required to be deducted @ 1% on the amount payable to the seller of property. If the PAN number of the seller is not available then the TDS is required to be deducted @ 20%.

No tax is required to be deducted where the total amount of consideration (selling price of property) is less than Rs. 50 lakhs. When amount of consideration is Rs 50 lakhs or more then the TDS is to be deducted on the whole amount not only on the amount exceeding Rs. 50 lakhs.

Also Read – Tax on buying/selling of immovable property below stamp duty value

Time of Deduction

Tax is required to be deducted at the time of credit of such sum to the account of the payee or at the time of payment whichever is earlier. The date of registration, agreement or contract is irrelevant for deciding the time of payment of TDS.

If the purchase value is greater than Rs. 50 lakhs then TDS is to be deducted from the first instalment itself and for each and every instalment. The purchaser should not wait for the aggregate instalment amounts to exceed Rs. 50 lakh. The view that TDS is to be deducted from final instalment or after exceeding Rs. 50 lakh is not right.

If the purchaser has availed loan from a bank and bank pays directly to the seller then its also considered as a payment and TDS needs to be deducted on date of such payment to seller. The date of payment of EMI by buyer to bank is irrelevant.

In this case, it should be considered that the amount paid by bank is after tds and tds to be paid accordingly. For eg:- A bank pays Rs. 3,50,000 to the seller, so we should consider this as payment after TDS and so the gross payment will be 3,50,000/.99 = 3,53,535. So the purchaser has to pay Rs. 3,535 as TDS.

Due date of TDS Payment and Form 26QB

The deductor i.e the purchaser of property has to file form 26QB which is a Challan cum declaration statement within 30 days from the end of the month in which payment is made. No separate TDS return is to be filed in respect of such deduction. Form 26QB has to be file online on https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp . Manual submission of form is not allowed.

Other Points

- TDS is to be deducted for each instalment and for each deduction a separate Form 26QB is required to be filed.

- Form 26QB is to be file for one buyer one seller combination. For eg if there are 1 buyer and 2 seller then 2 Form 26QB is to be filed similarly if there are 2 buyers and 2 sellers then 4 Form 26QB is to be filed (2 Forms by each buyer) for each deduction.

- There is no requirement of obtaining Tax deduction account number (TAN) of the person who is required to deduct tax in this section. Only PAN of the buyer i.e the deductor is required for filing form 26QB.

How to Pay TDS and file Form 26QB

Form 26QB is a challan cum declaration statement. Therefore it’s not possible to pay TDS without filing this form and not possible to file the form without payment of TDS.

- Go to https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

- Click on Form 26QB. If you have receive a demand notice from Income Tax Department then click on Demand Payment option for TDS on property.

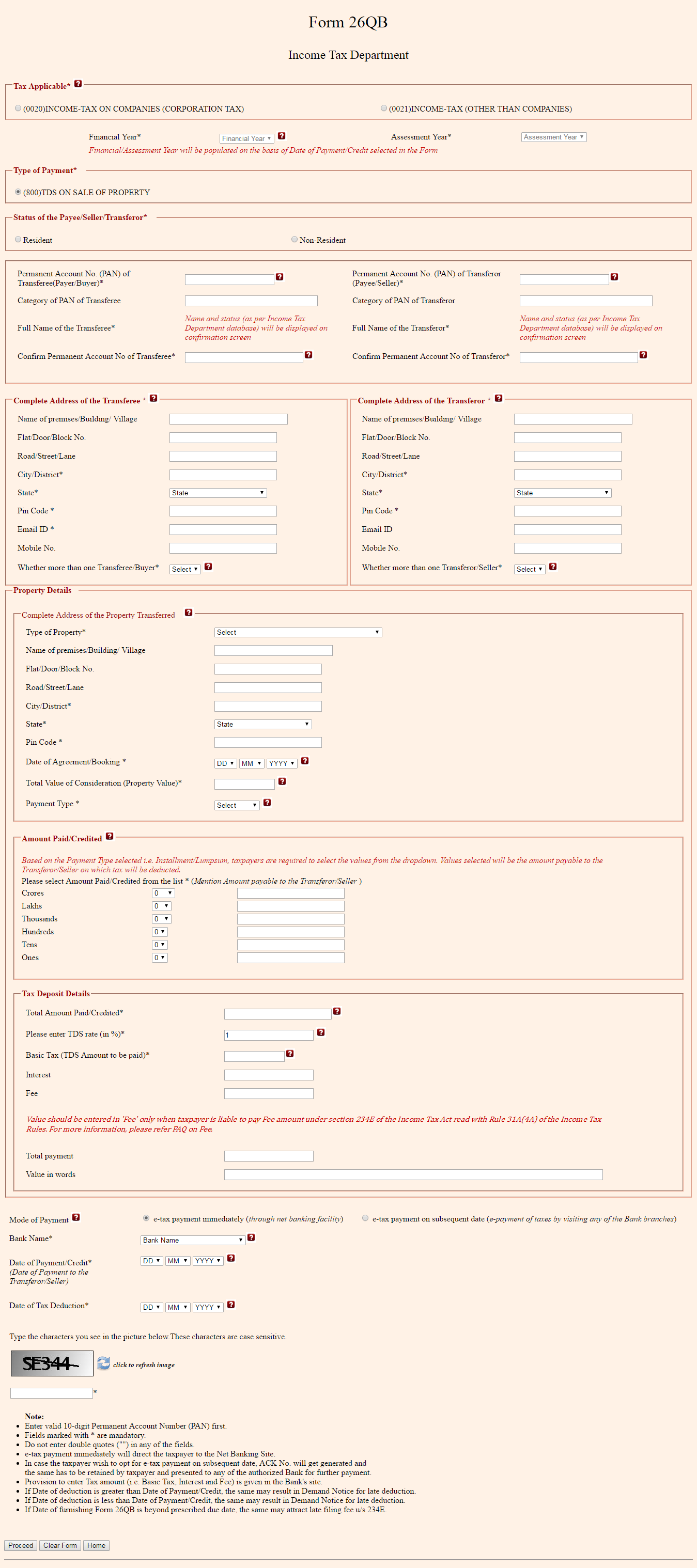

- Form is having various section as follows:-

a) Tax Applicable

Select Corporation tax if the purchaser is a Company otherwise Income Tax. The status of seller is irrelevant.

b) Type of Payment

By default TDS on sales of property will be selected.

c) Status of Payee/Seller/Transferor

Select option of Resident. If the seller is Non-Resident then Form 27Q is require to be filled.

d) Enter the PAN and address of the purchase and seller and the complete address of the property transferred.

e) Enter the amount paid/credited to the seller. If the payment is being made in instalment then enter the amount of the instalment to which this form 26QB is applicable.

f) Enter the amount paid or credited. TDS rate of 1% will get auto filled on the basis of the PAN number entered above. Enter the amount of the TDS and any interest or Fee which are being paid by using this Challan.

g) Select e-tax immediately in case the payment will be made using internet banking or debit cards. You can select e-tax payment on subsequent date when the payment will be made using authorised bank branches.

h) Enter the confirmation code and click on Proceed button.

i) On the next screen name of purchase and seller will be shown along with all the details filled on previous screen. Click Confirm after cross checking all the information.

4) An acknowledgement number will be generated and will be required in case if there are any changes in the challan filed.

5) If you have selected e-tax immediately then you will be redirected to the banking site otherwise a challan will be generated which can be deposited in any authorised branch. Return will be considered as submitted only when the TDS payment is completed as the form is TDS challan cum TDS statement.

See the complete procedure of filing form 26QB on Incometaxindia.com.

TDS Certificate in Form 16B to seller

The buyer has to provide TDS certificate in form 16B to the seller within 15 days from the day of filing Form 26QB. The form has to be downloaded form the website of traces. Form 16B is to be downloaded by the deductor from www.tdscpc.gov.in and given to the seller of the property within 15 days from the date of filing of form 26QB.

How to Download Form 16B

- Register & login on TRACES portal ( www.tdscpc.gov.in) as taxpayer using your PAN.At the time of registration use Option -2 Challan details of Tax deposited by Taxpayer for authentication. Redo registration if you have not received link for activating your account.

- Select “Form 16B (For Buyer)” under “Downloads” menu.

- Enter the details pertaining to the property transaction for which Form 16B is to be requested. Enter the Assessment Year, Acknowledgment Number, PAN of Seller and click on “Proceed”.

- A confirmation screen will appear. Click on “Submit Request” to proceed.

- A success message on submission of download request will appear. Please note the request number to search for the download request.

- Click on “Requested Downloads” to download the requested files.

- Search for the request with request number. Select the request row and click on “HTTP download” button.

Consequences of non deduction or non payment and non filing of Form 26QB

- Interest for TDS not deducted

Interest at the rate of 1% per month or part thereof, for the period from the date on which TDS is deductible/collectible to the date on which TDS/TCS is actually deducted/collected. - Interest for TDS deducted but not paid

Interest at the rate of 1.5% per month or part thereof, for the period from the date on which TDS is actually deducted/collected to the date on which such TDS/TCS is actually paid.

Calendar month is considered in calculating interest therefore if you delay payment by one day, you have to pay interest for two months. For example, if TDS is deducted in month of July and deposited on 8th of August then you have to pay interest for 2 month i.e. July and August. Total interest payable shall be 3%.

- Penalty for late filing of Form 26QB

Along with the interest penalty is also payable at the rate of Rs. 200 per day for which the default continues. The penalty amount cannot exceed the amount of TDS to be deducted. And if the default continues for a period of more than one year then additional penalty of Rs. 10,000 to 1,00,000 is to be paid under section 271H. Amount of such penalty is to be calculated by the Assessing officer.

You can calculate interest on late payment using our TDS Late Payment Interest Calculator.

Meaning of Agricultural Land

A land is not treated as agricultural land if:

- It is situated within jurisdiction of Municipality or Cantonment Board which has a population of not less than 10,000 or

- It is situated in any area within below given distance measured aerially:

| Population of the Municipality | Distance from Municipal limit or Cantonment Board |

| More than 10,000 but does not exceed 1,00,000 | Within 2 kms |

| More than 1,00,000 but does not exceed 10,00,000 | Within 6 kms |

| Exceeding 10,00,000 | Within 8 kms |

Meaning of Immovable Property

Immovable property means any land (other than agricultural land) or any building or part of building.

Traces helpline No. – 18001030344, 0120-4814600