What is Input Tax Credit under GST?

Input Tax Credit (ITC) means claiming the credit of the GST paid on the purchase of goods and services which are used for the furtherance of the business. ITC is a mechanism to avoid the cascading effect of taxes. Previously, no credit of taxes paid to Central Government is available for set-off at the time of payment of taxes levied by State Governments and vice-versa. ITC is one of the key features of Goods and Service Tax Act as the tax charged by the Central or the State Government is the part of same tax regime and the credit of tax paid at every stage shall be available as a set-off for payment of tax at every subsequent stage.

What are Zero-Rated Supplies?

As per Section 16 of Integrated Goods and Service Tax Act, zero-rated supplies mean: –

- Export of goods or services or both; or

- Supply of goods or services or both to a Special Economic Zone developer or a Special Economic Zone unit.

Also Read:

Zero Rated Supplies – The detailed guide

Difference between Zero Rated, Nil Rated, Non-GST and Exempt Supplies

Refund on Account of Zero-Rated Supplies

By zero rating it is meant that the entire supply chain of a particular zero-rated supply is tax-free i.e. there is no burden of tax either on the input tax side or on the output side. This is in contract with exempted supplies, where only output is exempted from tax but tax is levied on the input side. The essence of zero rating is to make Indian goods and services competitive in the international market by ensuring that taxes do not get added to the cost of exports.

As per subsection (3) of Section 16 of Integrated Goods and Service Tax Act, a registered person making zero-rated supply shall be eligible to claim a refund under either of the following option, namely: –

- he may supply goods or services or both under bond or Letter of Undertaking, subject to such conditions, safeguards and procedure as may be prescribed, without payment of integrated tax (IGST) and claim refund of unutilised input tax credit of Central tax (CGST), State tax (SGST) / Union territory tax (UTGST) and integrated tax (IGST); or

- he may supply goods or services or both, subject to such conditions, safeguards and procedure as may be prescribed, on payment of integrated tax and claim a refund of such tax paid on goods or services or both supplied.

GST law allows the flexibility to the exporter (which will include the supplier making supplies to SEZ) to claim refund upfront as integrated tax (by making supplies on payment of tax using ITC) or export without payment of tax by executing a Bond/LUT and claim refund of related ITC of taxes paid on inputs and input services used in making zero-rated supplies.

Note: – As per sub-section (2) of Section 16 of Integrated Goods and Service Tax Act, a registered person shall be eligible to claim a refund for zero-rated supplies even such supply is non-taxable or even exempt supply.

Conditions for Claiming Refund of Unutilised Input Tax Credit

Refunds for unutilised input tax credit is governed by Section 54 of Central Goods and Service Tax Act, 2017.

Time Period

Application for refund has to be made before the expiry of 2 years from the relevant date.

The relevant date means—

- in the case of goods exported out of India where a refund of tax paid is available in respect of goods themselves or, as the case may be, the inputs or input services used in such goods,––

- if the goods are exported by sea or air, the date on which the ship or the aircraft in which such goods are loaded, leaves India; or

- if the goods are exported by land, the date on which such goods pass the frontier; or

- if the goods are exported by post, the date of despatch of goods by the Post Office concerned to a place outside India;

- in the case of supply of goods regarded as deemed exports where a refund of tax paid is available in respect of the goods, the date on which the return relating to such deemed exports is furnished;

- in the case of services exported out of India where a refund of tax paid is available in respect of services themselves or, as the case may be, the inputs or input services used in such services, the date of––

- receipt of payment in convertible foreign exchange, where the supply of services had been completed prior to the receipt of such payment; or

- the issue of invoice, where payment for the services had been received in advance prior to the date of issue of the invoice;

Exception for Refund

No refund of unutilised ITC shall be made under the following mentioned circumstances –

- where the goods exported out of India are subject to export duty; or

- if the supplier of goods or services or both avails of a drawback in respect of central tax or claims refund of the integrated tax paid on such supplies

Documentary Evidence

The application shall be accompanied by—

- such documentary evidence as may be prescribed to establish that a refund is due to the applicant; and

- such documentary or other evidence (including the documents referred to in section 33) as the applicant may furnish to establish that the amount of tax and interest, if any, paid on such tax or any other amount paid in relation to which such refund is claimed was collected from, or paid by, him and the incidence of such tax and interest had not been passed on to any other person:

Note: – However, Section 54(4) of the CGST Act, 2017, provides that where the amount claimed as the refund is less than two lakh rupees, no documentary evidence needs to be filed. Only a declaration to that effect from the applicant based on the documents available with her shall suffice.

Detailed List of documentary evidence

(a) the reference number of the order and a copy of the order passed by the proper officer or an appellate authority or Appellate Tribunal or court resulting in such refund or reference number of the payment of the amount claimed as a refund;

(b) a statement containing the number and date of shipping bills or bills of export and the number and the date of the relevant export invoices, in a case where the refund is on account of export of goods;

(c) a statement containing the number and date of invoices and the relevant Bank Realisation Certificates or Foreign Inward Remittance Certificates, as the case may be, in a case where the refund is on account of the export of services;

(d) a statement containing the number and date of invoices along with the evidence regarding the endorsement in the case of the supply of goods made to a Special Economic Zone unit or a Special Economic Zone developer;

(e) a statement containing the number and date of invoices, the evidence regarding the endorsement specified and the details of payment, along with the proof thereof, made by the recipient to the supplier for authorised operations as defined under the Special Economic Zone Act,2005, in a case where the refund is on account of supply of services made to a Special Economic Zone unit or a Special Economic Zone developer;

(f) a declaration to the effect that the Special Economic Zone unit or the Special Economic Zone developer has not availed the input tax credit of the tax paid by the supplier of goods or services or both, in a case where the refund is on account of supply of goods or services made to a Special Economic Zone unit or a Special Economic Zone developer;

(g) a statement containing the number and date of invoices along with such other evidence as may be notified in this behalf, in a case where the refund is on account of deemed exports;

(h) a statement containing the number and the date of the invoices received and issued during a tax period in a case where the claim pertains to refund of any unutilised input tax credit where the credit has accumulated on account of the rate of tax on the inputs being higher than the rate of tax on output supplies, other than nil-rated or fully exempt supplies;

(i) the reference number of the final assessment order and a copy of the said order in a case where the refund arises on account of the finalisation of provisional assessment;

(j) a statement showing the details of transactions considered as intra-State supply but which is subsequently held to be inter-State supply;

(k) a statement showing the details of the amount of claim on account of excess payment of tax;

(l) a declaration to the effect that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person, in a case where the amount of refund claimed does not exceed two lakh rupees:

(m) a Certificate in Annexure 2 of FORM GST RFD-01 issued by a chartered accountant or a cost accountant to the effect that the incidence of tax, interest or any other amount claimed as refund has not been passed on to any other person, in a case where the amount of refund claimed exceeds two lakh rupees:

Refund on Provisional Basis

As per Section 54(6) of the CGST Act, 2017, that in cases where the claim for refund on account of zero-rated supply of goods and/or services made by registered persons, other than such category of registered persons as may be notified by the Government on the recommendations of the Council, refund on a provisional basis, ninety per cent of the total amount so claimed, excluding the amount of input tax credit provisionally accepted and the final order shall be issued within sixty days from the date of receipt of application complete in all respects as per Section 54(7) of the CGST Act, 2017. If the refund is not issued within 60 days, interest at the rate of 6% p.a. under Section 56 shall be payable.

Rule 91 of CGST Rules, 2017 provides that the provisional refund is to be granted within 7 days from the date of acknowledgment of the refund claim. An order for provisional refund is to be issued in Form GST RFD04 along with payment advice in the name of the claimant in Form GST RFD 05. The amount will be electronically credited to the claimant’s bank account.

Note: – The rules also prescribe the provisional refund will not be granted to if the person claiming refund has, during any period of five years immediately preceding the tax period to which the claim for refund relates, been prosecuted for any offence under the Act or under an earlier law where the amount of tax evaded exceeds two hundred and fifty lakh rupees.

Calculation of Amount of Refund

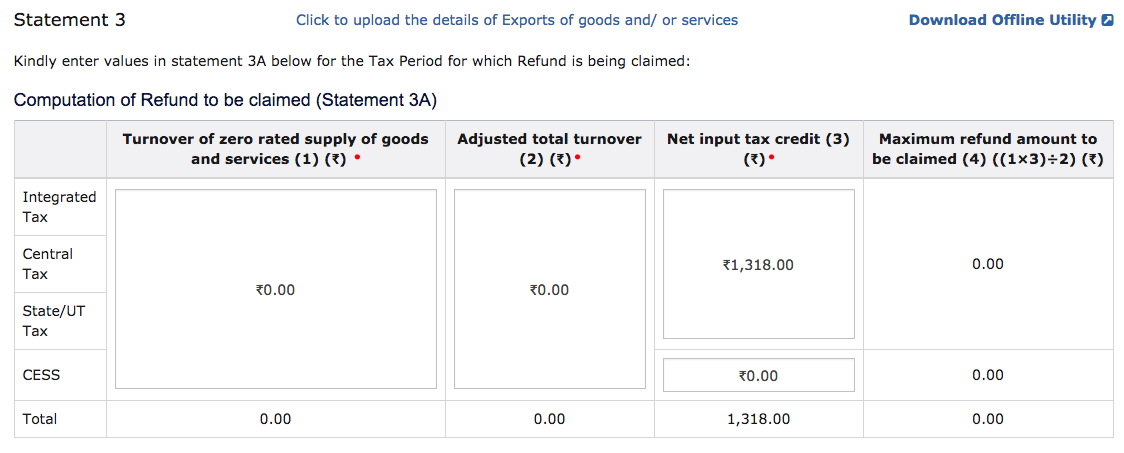

The formula for grant of refund in cases where the refund of accumulated Input Tax Credit is on account of zero-rated supply is based on the following:

Refund Amount = (Turnover of zero-rated supply of goods + Turnover of zero-rated supply of services) x Net ITC ÷ Adjusted Total Turnover

Where, –

(A) Refund amount means the maximum refund that is admissible;

(B) Net ITC means input tax credit availed on inputs and input services during the relevant period other than the input tax credit availed for which refund is claimed under rule 89(4A) (for deemed export)or 89(4B) (intra-State supply of taxable goods by a registered supplier to a registered recipient for export at a rate of 0.05%) or both;

(C) Turnover of zero-rated supply of goods means the value of zero-rated supply of goods made during the relevant period without payment of tax under bond or letter of undertaking, other than the turnover of supplies in respect of which refund is claimed under rule 89(4A) or rule89(4B) or both;

(D) Turnover of zero-rated supply of services means the value of zero-rated supply of services made without payment of tax under bond or letter of undertaking, calculated in the following manner, namely:-

Zero-rated supply of services is the aggregate of the payments received during the relevant period for zero-rated supply of services and zero-rated supply of services where supply has been completed for which payment had been received in advance in any period prior to the relevant period reduced by advances received for zero-rated supply of services for which the supply of services has not been completed during the relevant period;

(E) Adjusted Total turnover means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on a reverse charge basis) and exempt supplies made within a State or Union territory by a taxable person, exports of goods or services or both and inter-State supplies of goods or services or both made from the State or Union territory by the said taxable person but excludes central tax, State tax, Union territory tax, integrated tax and cess, excluding –

- the value of exempt supplies other than zero-rated supplies and

- the turnover of supplies in respect of which refund is claimed under rule 89(4A) or 89(4B) or both, if any,

during the relevant period;

(F) Relevant period means the period for which the claim has been filed.

Other Points

- As per Section 54(14) of the CGST Act, 2017, no refund shall be issued if the amount of refund is less than Rs. 1,000.

- As per Rule 89(3) of CGST Rules, 2017, where the application relates to refund of input tax credit, the electronic credit ledger shall be debited by the applicant by an amount equal to the refund so claimed.

- As per Rule 93 of CGST Rules 2017, where any deficiencies have been communicated or any claim has been rejected, either fully or partly, the amount so debited shall be re-credited to the electronic credit ledger.

- Applicant must ensure that proper return has been filed for the relevant tax period for which refund application is made. Normal taxpayers having a turnover of more than Rs.1.5 crores can file for GST refund every month after filing the relevant GSTR 1 and GSTR 3B return. In case of taxpayers opting to file quarterly GST returns, GST refund application can be filed every quarter after filing of GSTR 1 and GSTR 3B return. Since GSTR 2 and GSTR 3 return have been temporarily suspended, there is no requirement for filing such returns to claim GST refund.

Process for filing Refund

The application for refund for unutilised input tax shall be made online using GST Portal.

Step 1– Login into your GST account on GST Portal

Step 2 – Navigate to Services -> Refunds ->Application for Refund

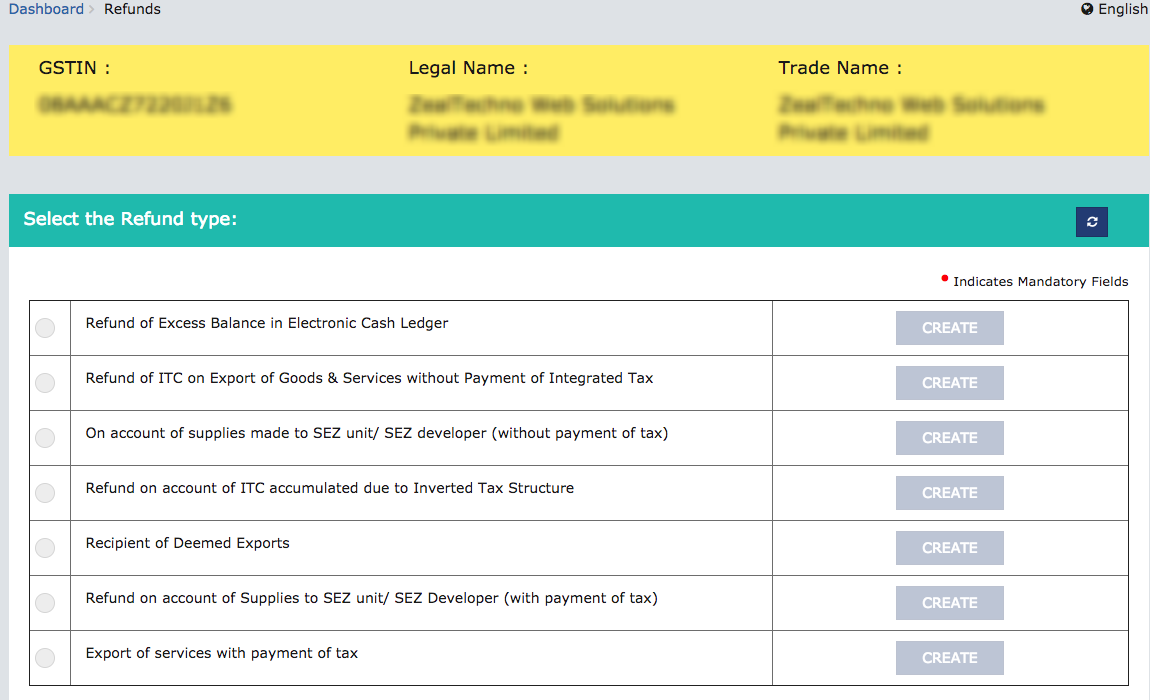

Step 3 –Select the option of Refund of ITC on Export of Goods & Services without Payment of Integrated Tax or On account of supplies made to SEZ unit/SEZ developer (without payment of tax) as required.

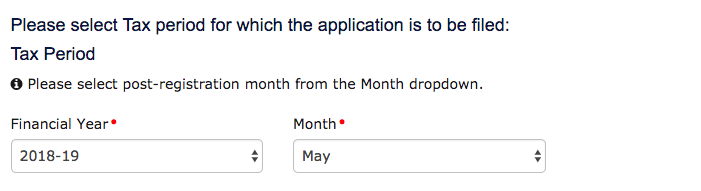

Step 4 – Select the relevant financial year and the month for which refund is requested and then click on Create button. Refund application can only be made once proper GST return has been filed for that period.

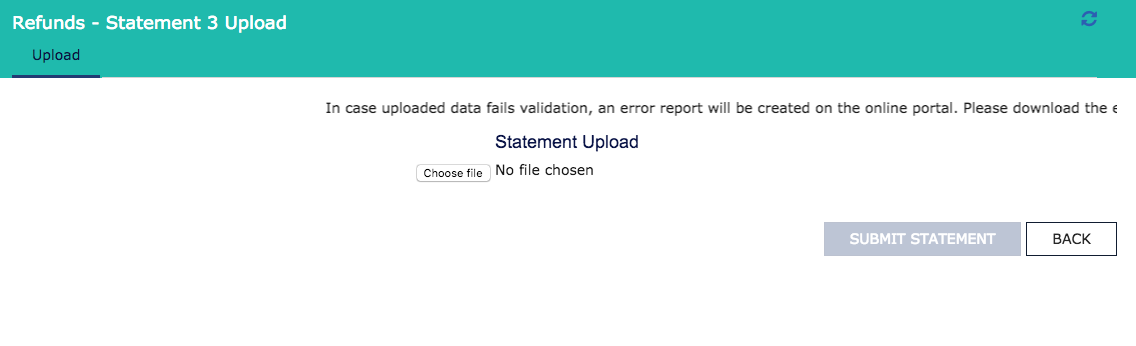

Step 5 – Enter the details relevant to the Export of goods and/or services as required under Statement 3. You can use the offline utility provided by the department or can upload the JSON file generated by your software.

Step 6–Enter the following amounts: –

- Turnover of zero-rated supply of goods and services

- Adjusted total turnover

- Net input tax credit available for Cess.

The system will auto calculate the maximum amount of refund on the basis of the figures entered and the net ITC available in the account.

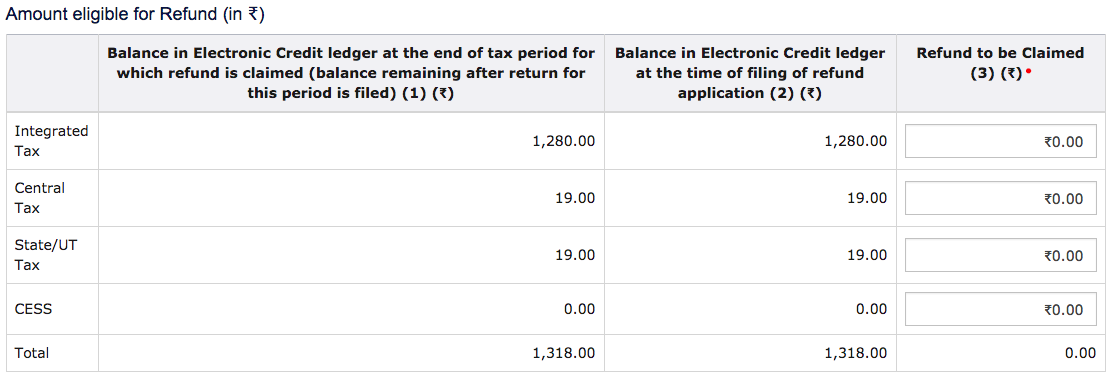

Step 7–Enter the breakup for refund requested under Integrated Tax, Central Tax, State/UT Tax & Cess.

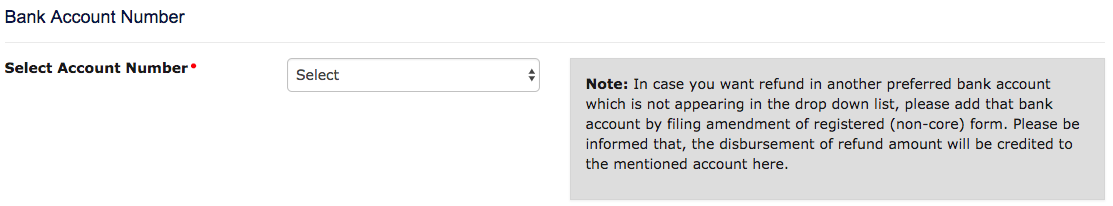

Step 8–Select the bank account in which the refund is requested.

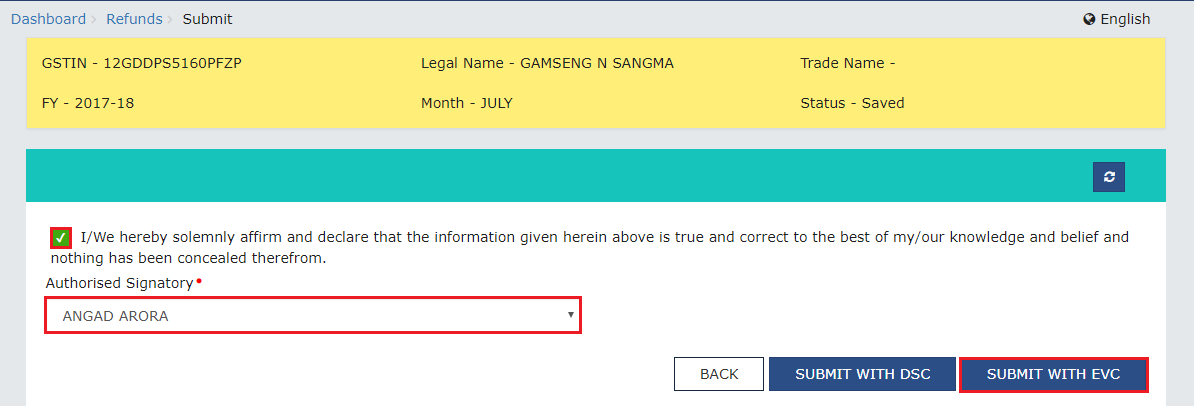

Step 9 –Click on Proceed and Submit the application using DSC or EVC.