Earlier, for filing TDS/TCS statement, deductor/collector has to submit the signed statement physically at TIN facilitation centres.

To overcome this manual process of submitting statement physically, CBDT issued a Notification No. 6/2016 on 04 May 2016 which laid down the complete procedure for filing the TDS/TCS statement online from anywhere without visiting TIN facilitation centres.

Also Read – Online Correction Facility to Add/Modify Deductee in TDS Return

Step by Step Guide for Registering as Tax Deductor and Collector

Tax Deductor/Tax Collector should get themselves register on the Income Tax e-Filing portal as Tax Deductor and Collector.

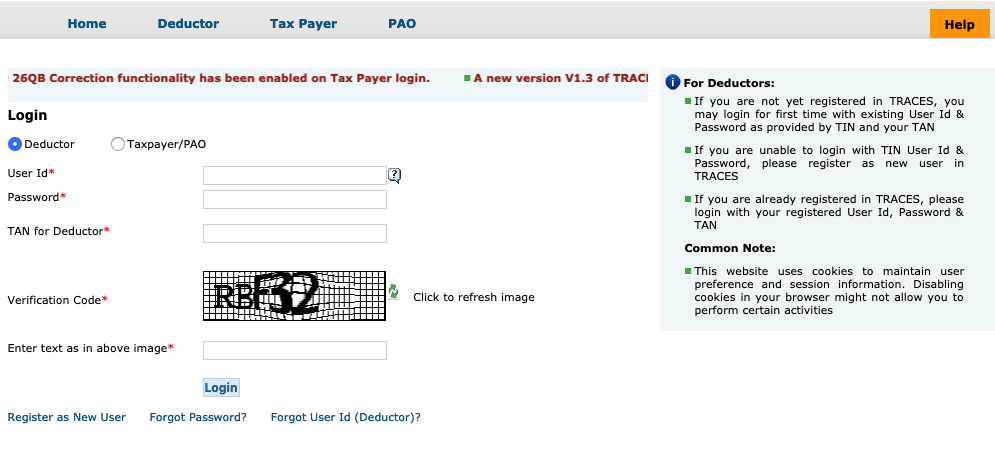

Step 1 – Login into TRACES website

Note – You have to first register yourself on Traces if you are not registered as a Deductor.

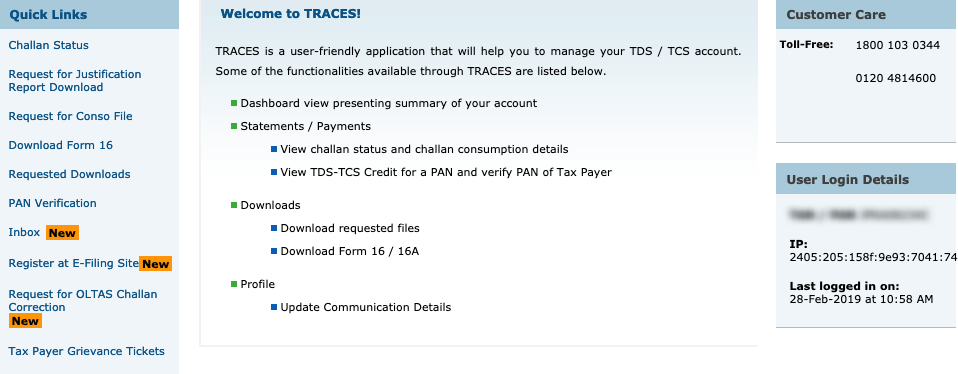

Step 2 – Select the option of Register at E-Filing Site from Quick Links

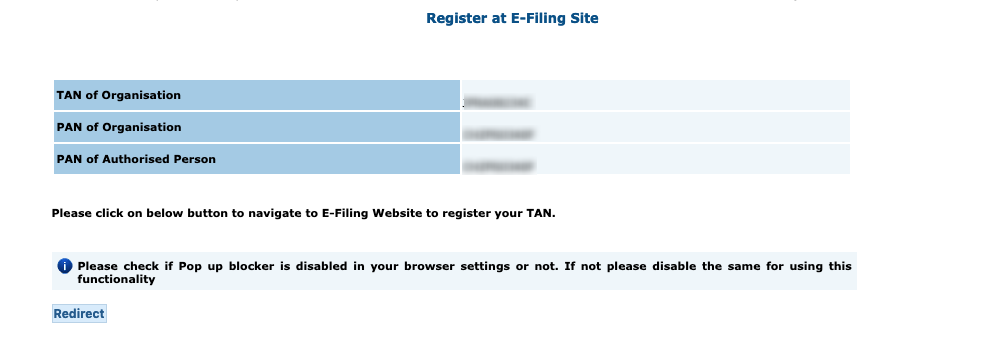

Step 3 – TRACES portal will display the TAN, PAN of the organisation along with the PAN of the Authorised Person. Please make sure all the details are correct and up to date. Once you verify all the details, click on Redirect

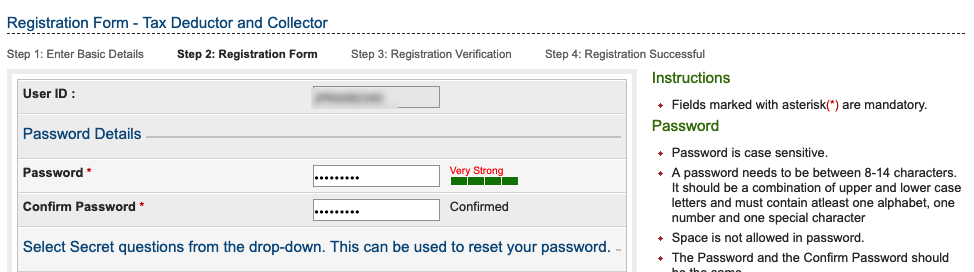

Step 4 – You are now redirected to e-Filing portal and various details will get auto-filled on the basis of the TRACES portal. Now you are required to set up your password and enter other details such as security questions, mobile number, email address, contact details etc.

Note – You may get some error of session time out at the time of redirecting to e-Filing portal. In such a case, you have to log out from TRACES and then log in again. The registration process is now very much similar to the normal taxpayer registration.

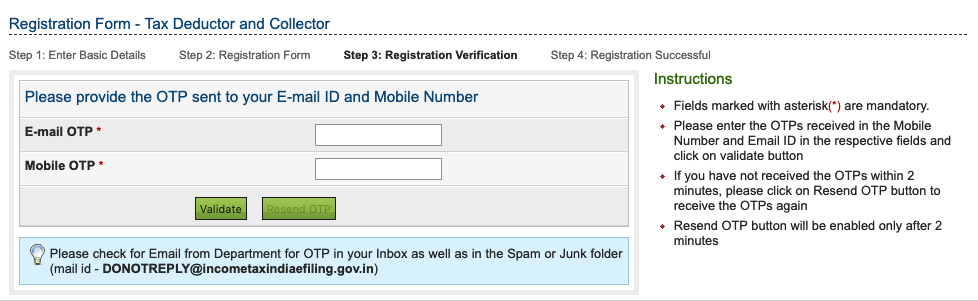

Step 5 – Enter the OTP’s received on email and mobile number and click on Validate

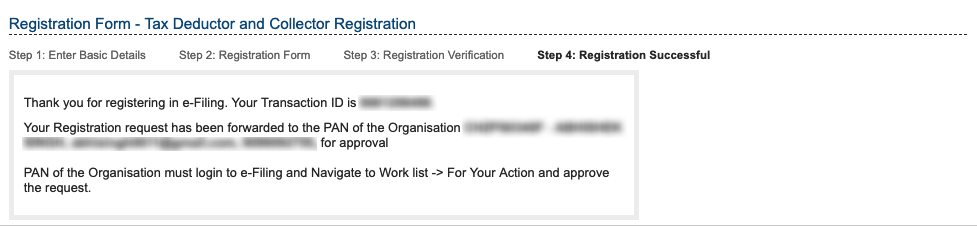

Step 6 – Once the OTP’s got validated you will receive a confirmation screen and now you have to login into Organisation e-Filing account to approve this request.

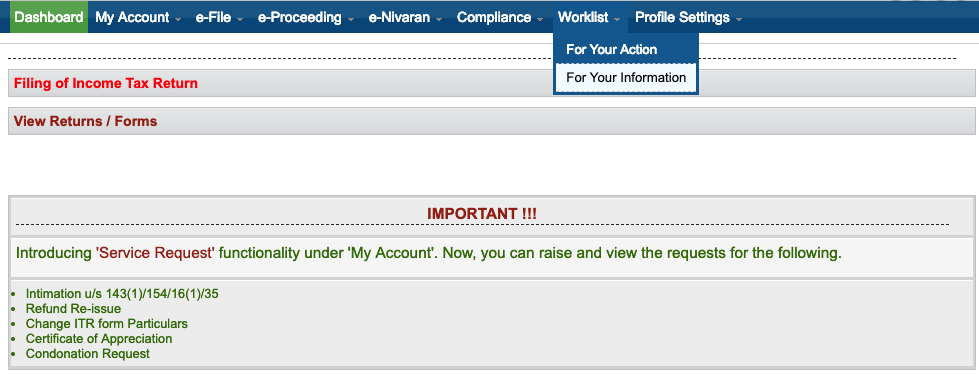

Step 7 – Select Worklist -> For Your Action, once you logged in to the Organisation e-Filing portal.

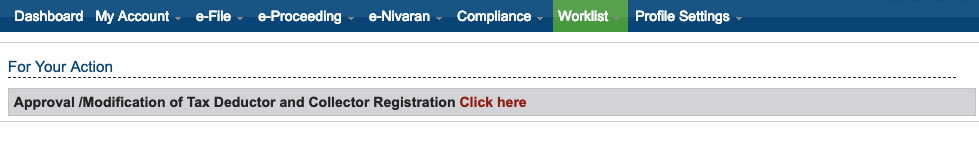

Step 8 – You are now required to click on Click here option for Approval/Modification of Tax Deductor and Collector Registration

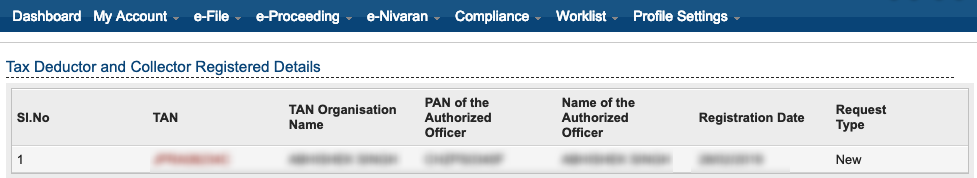

Step 9 – All the details for the new registration will be shown on this screen. Now you are required to click on the TAN number to approve this request.

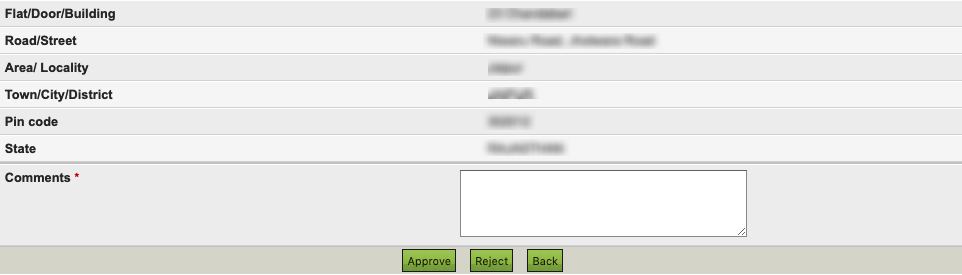

Step 10 – All the relevant details such as name, contact details etc. of the Authorised officer will be shown. Please enter the comment for your reference and click on Approve to complete the registration as Tax Deductor and Collector.

Step by Step Guide for Uploading TDS/TCS Statement

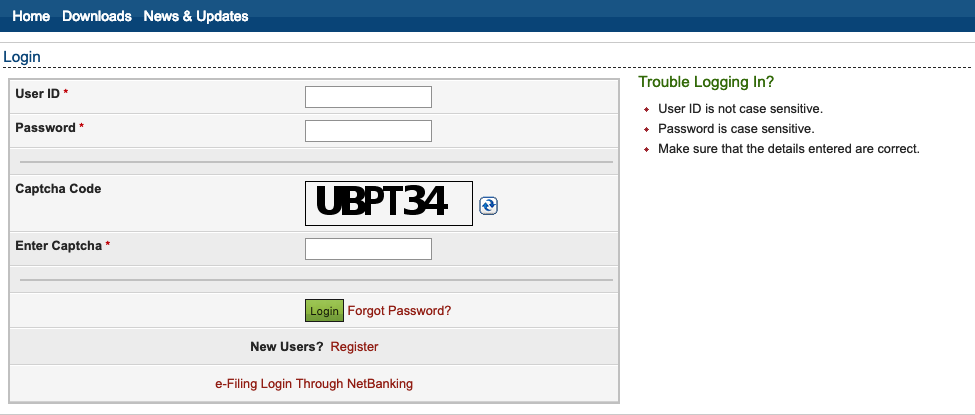

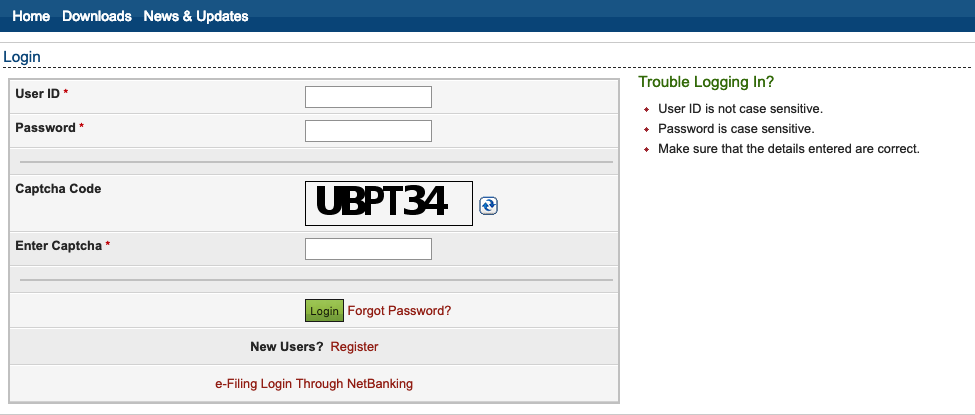

Step 1 – Login into e-Filing portal account using your credential as Tax Deductor and Collector.

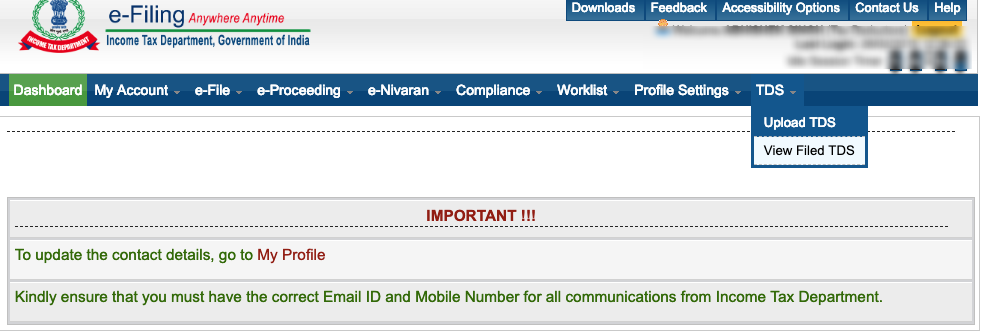

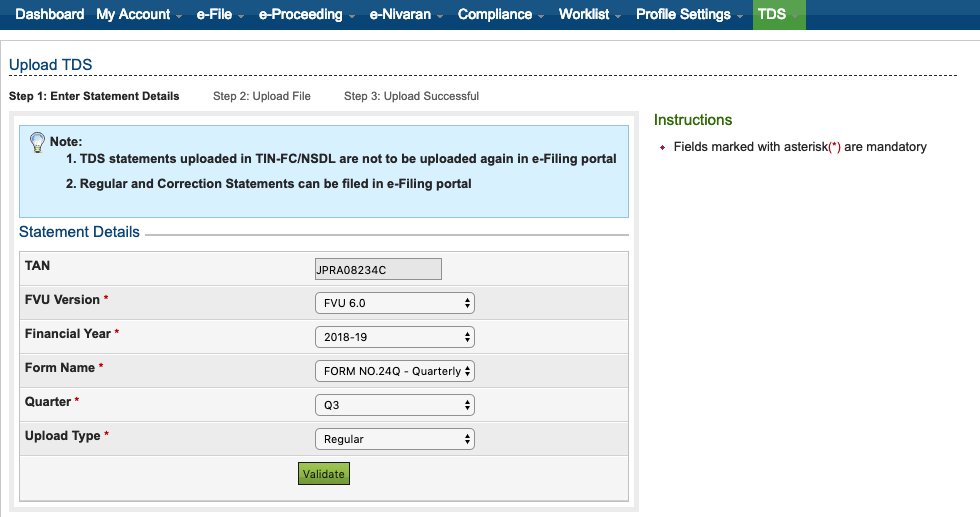

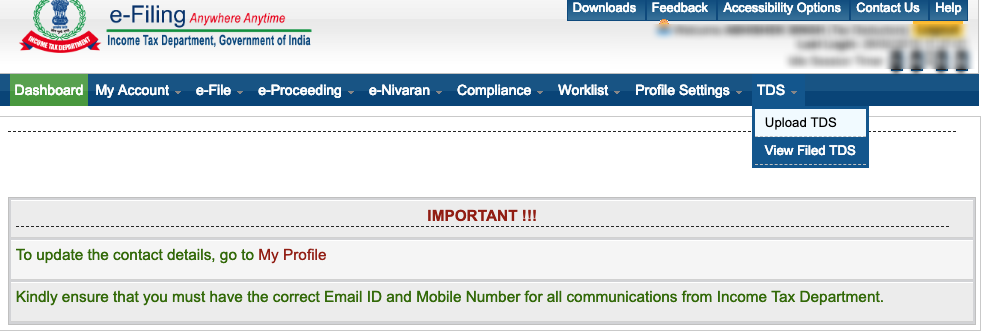

Step 2 – Select TDS -> Upload TDS from the top menu

Step 3 – Select the relevant details as applicable for the TDS/TCS statement you are going to upload and click on Validate.

Notes

- TDS/TCS statement can be submitted beginning from the financial year 2010-11

- Initially, a only regular statement can be uploaded from the e-Filing portal but now you can also upload correction statement.

- You can submit the following form through the e-Filing portal

- Form No. 24Q – Quarterly statement of TDS for Salary u/s 200(3)

- Form No. 26Q – Quarterly statement of TDS for Other than Salary u/s 200(3)

- Form No. 27Q – Quarterly statement of TDS for Non-Resident (Other than Salary) u/s 200(3)

- Form No. 27EQ – Quarterly statement of TCS u/s 206C

- The statement which has already been submitted via TIN-FC/NSDL shall not be uploaded again in e-Filing portal.

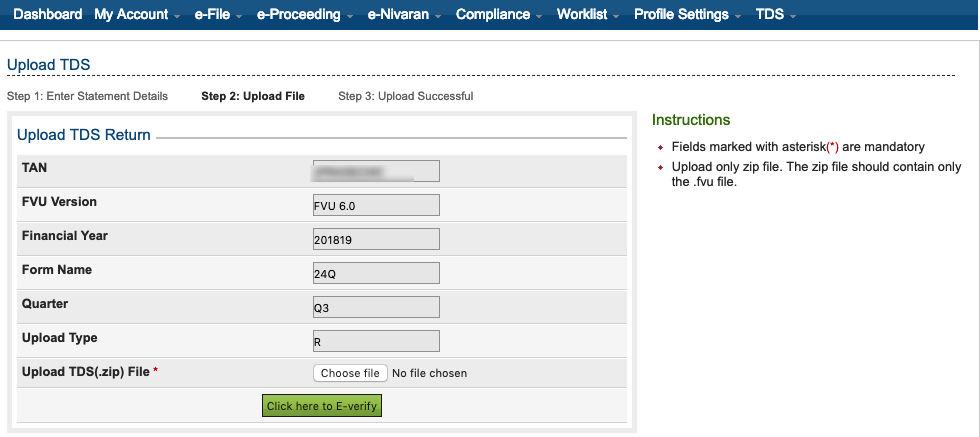

Step 4 – Once the details got validated, you are not required to upload the TDS(.zip) File and click on the E-verify button

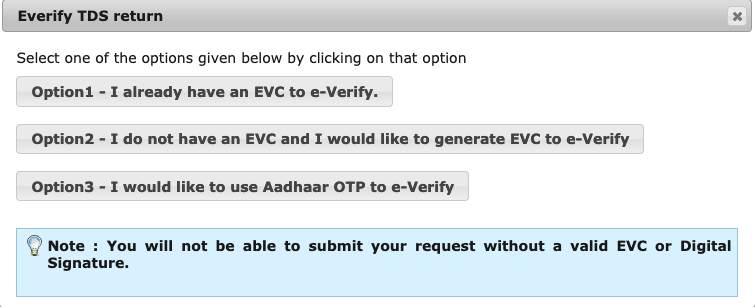

Step 5 – You will get the various option to E-verify TDS/TCS statement.

Step 6 – Select the relevant option to e-Verify your TDS/TCS statement and your TDS return will get filed.

Step by Step Guide for Tracking Status of Submitted TDS/TCS Statement

Step 1 – Login into e-Filing portal account using your credential as Tax Deductor and Collector.

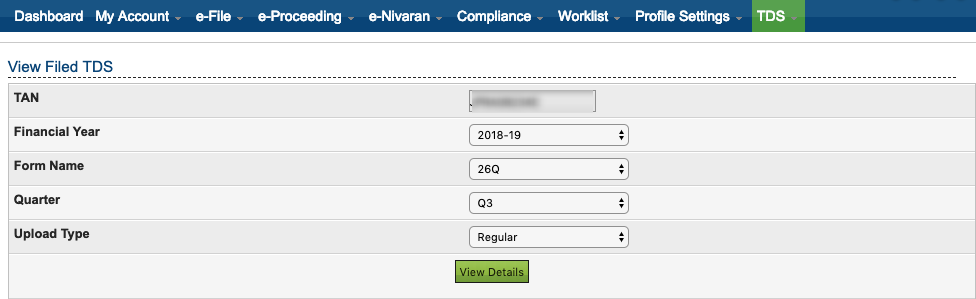

Step 2 – Select TDS -> View Filed TDS from the top menu

Step 3 – Select the relevant details to search for TDS/TCS statement status and click on View Details

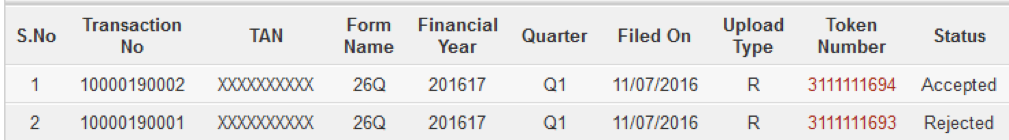

Step 4 – All the relevant TDS/TCS statement shall be shown along with their current Status.

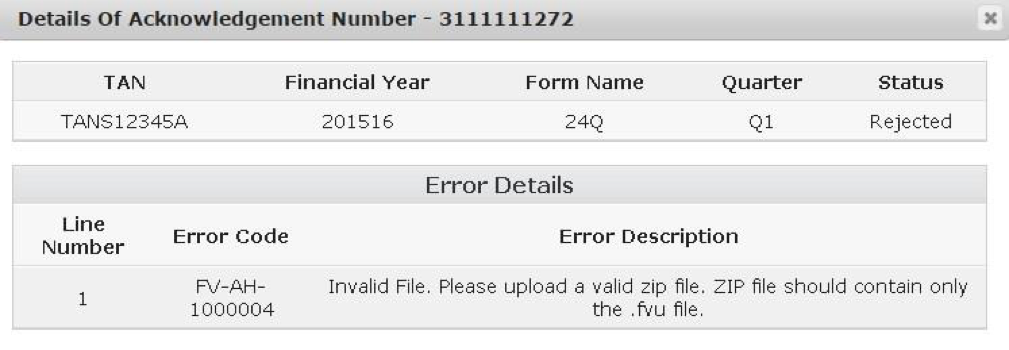

Step 5 – If the statement is having status as Rejected, click on Token Number to find out the reason for rejection.

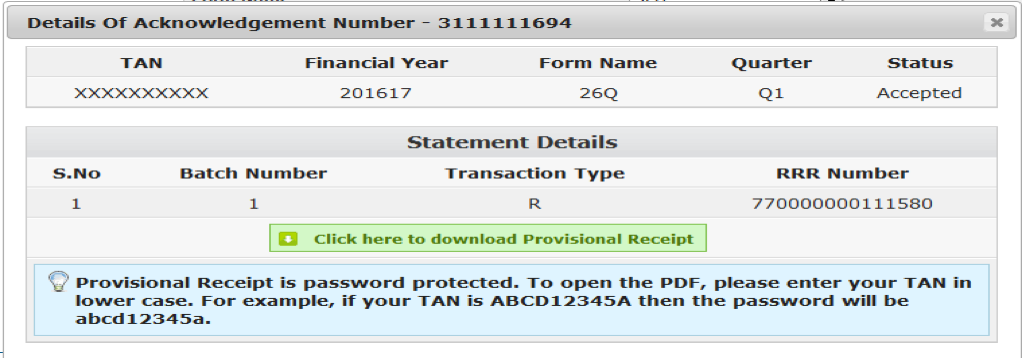

Step 6 – If the statement is having status as Accepted, click on Token Number to download the Provisional Receipt.

Also Read – Online Correction Facility to Add/Modify Deductee in TDS Return