A complete guide to file form no. 61, 61B and 15CC. The use of these forms are

Form 61 – Filing of details regarding form 60

Form 61B – Statement of Reportable Account under sub-section (1) section 285BA of the Income–tax Act, 1961

Form 15CC – Quarterly statement to be furnished by an authorised dealer in respect of remittances under rule 37BB of Income Tax Rules, 1962

Users who have already registered in e-Filing portal can use this functionality to generate ITDREIN (Income Tax Department Reporting Entity Identification Number) and upload certain forms in e-Filing portal using the generated ITDREIN.

ITDREIN is the Unique ID issued by ITD which will be communicated by ITD after the registration of the reporting entity with ITD. The ITDREIN is a 16-character identification number in the format XXXXXXXXXX.YZNNN where

XXXXXXXXXX – PAN or TAN of the reporting entity

Y – Code of Form Code

Z – Code of Reporting Entity Category for the Form Code

NNN – Code of sequence number.

ITDREIN Services

The below list provides the services available for ITDREIN Users.

- Upload and View Form 61

- Upload and View Form 61B

- Upload and View Form 15CC

Step 1 – Login to e-Filing portal using User ID, e-Filing Password and DOB/DOI.

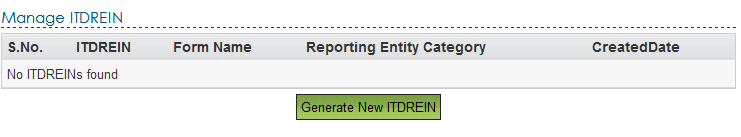

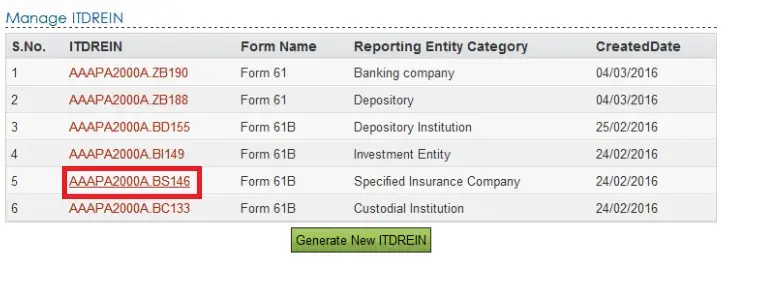

Step 2 – Go to My Account >>> Manage ITDREIN.

Step 3 – To generate new ITDREIN click on the button “Generate New ITDREIN”.

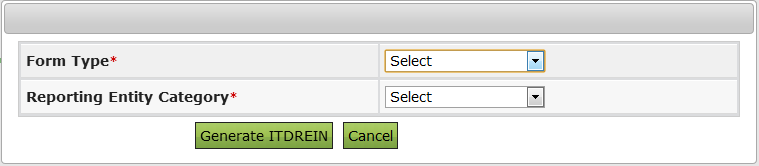

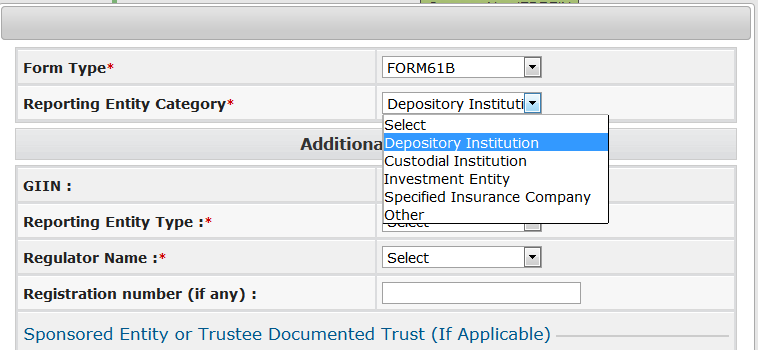

Step 4 – A Pop up with Form Type and Reporting Entity Category is displayed. Select the Form Type and Reporting Entity Category from the dropdown.

Step 5 – Based on the Form Type and Reporting Entity Category selected, the ITDREIN will be generated and the user will be able to upload and view the corresponding Form.

Step 6 – Click Generate ITDREIN button

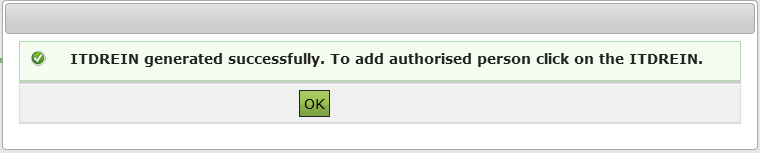

Step 7 – Success Message is displayed as shown below. User receives a confirmation e- mail on successful generation of ITDREIN to the registered Email ID. An SMS is also sent to the registered Mobile number.

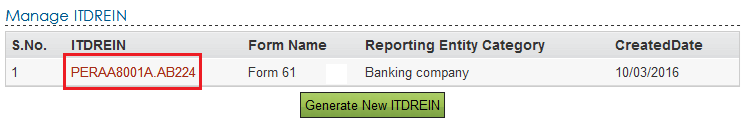

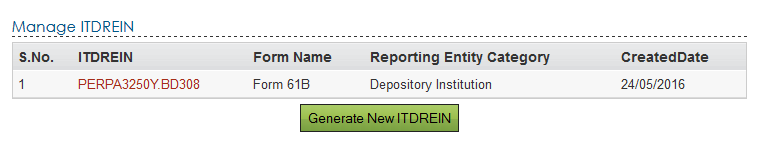

Step 8 – On Successful Generation of ITDREIN, the screen is displayed as shown.

Note – If the Form Type is FORM61B, than the below drop downs shall appear in Reporting entity category.

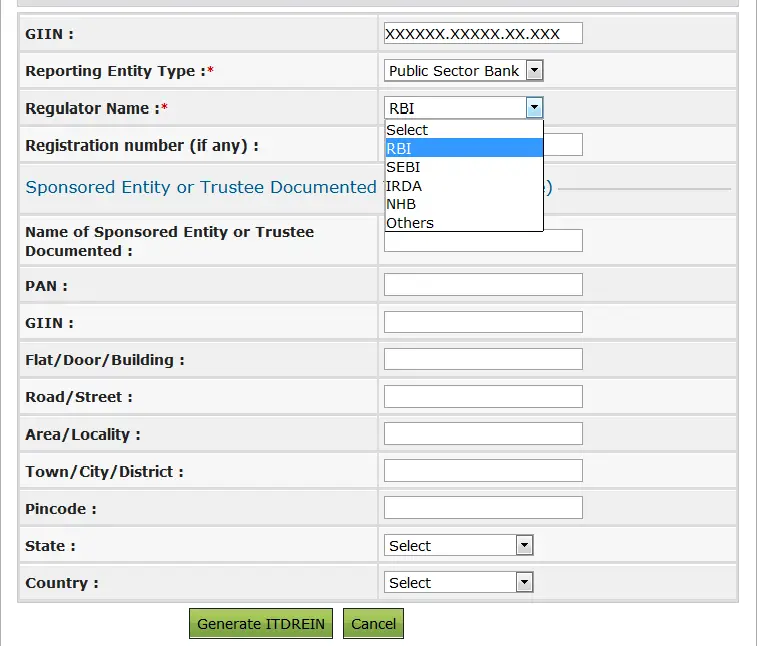

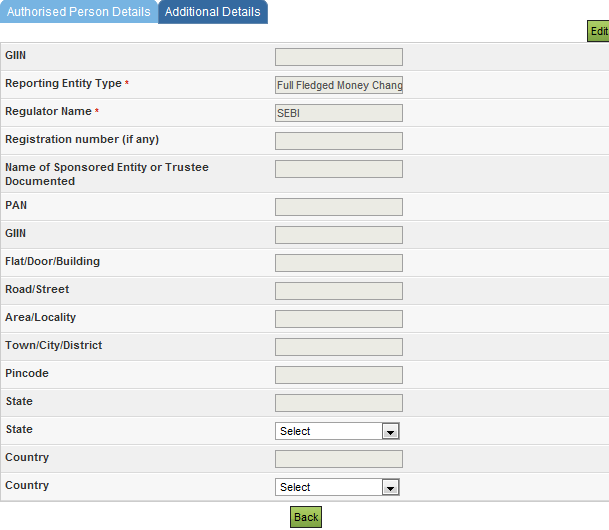

Also, fill additional details like GIIN, Reporting Entity Type, Regulator Name, Registration Number and the details of Sponsored Entity or Trustee Documented Trust if applicable and Click on Generate ITDREIN.

The drop down list for Reporting entity type is available in Annexure 1.

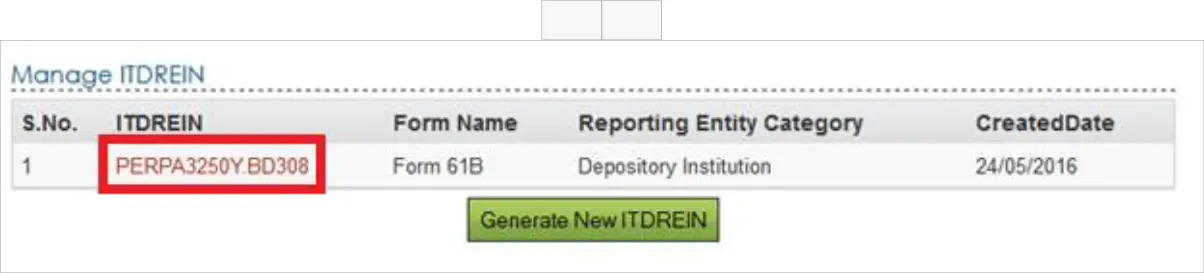

On click of Generate ITDREIN, below table shall be displayed.

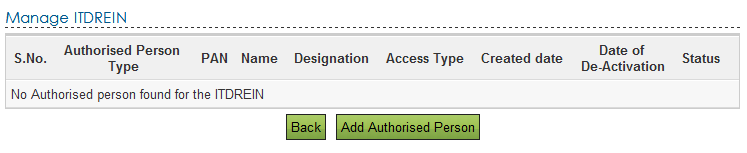

Steps to Add Authorised Person

Step 1 – Login to e-Filing portal using User ID, e-Filing Password and DOB.

Step 2 – Go to My Account >>> Manage ITDREIN.

Step 3 – To add Authorised Person for the generated ITDREIN, click on the link provided in the ITDREIN Column.

Step 4 – Click on the button Add Authorised Person.

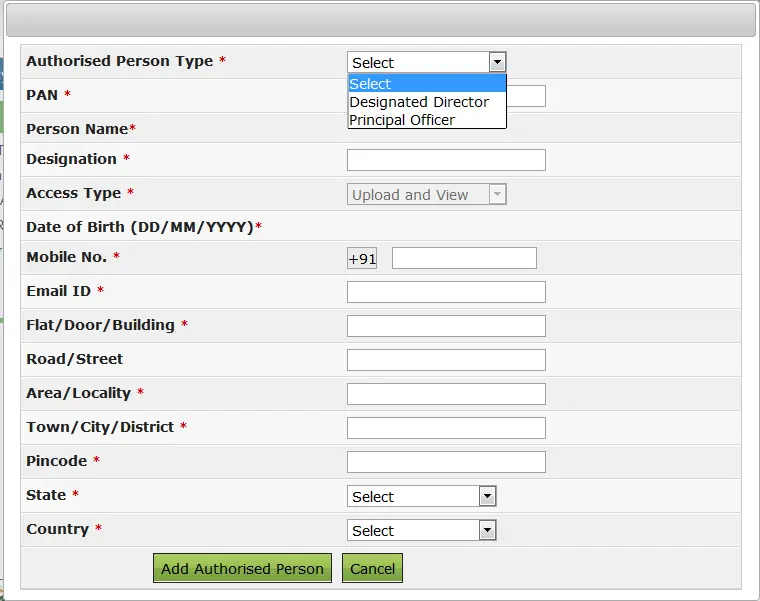

Step 5 – A Pop up with Authorised Person details appears as shown below.

Notes:

- If the Form Type is FORM61B, user needs to select “Authorised Person Type” from the drop down. This field is not available for “Form 61” and “Form15CC”.

- The details of Authorised Person cannot be edited further.

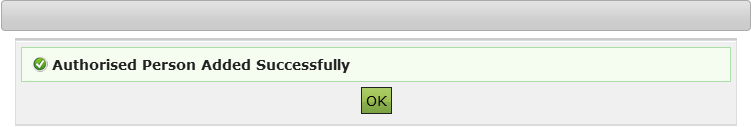

Step 6 – Enter all the details and Click on Add Authorised Person button. Success Message is displayed as shown below

Step 7 – User receives a confirmation e-mail on successful Addition of Authorised Person to the registered Email ID. An SMS is also sent to the registered Mobile number

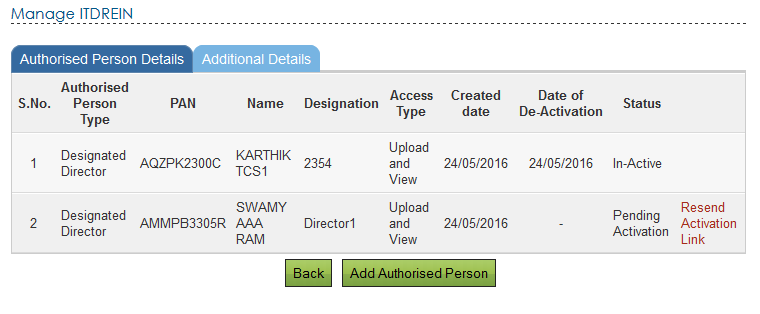

Step 8 – Authorised Person receives a confirmation e-mail with an activation link to the Authorised Person’s Email ID. An SMS along with OTP (One time Password) is sent to the Authorised Person’s Mobile Number.

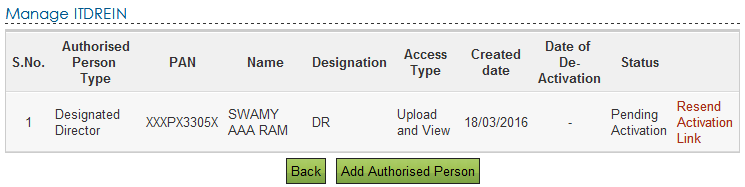

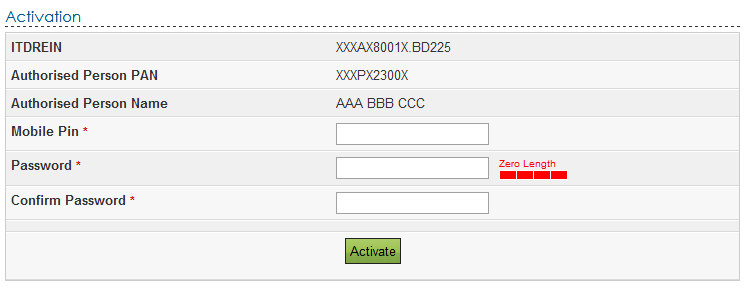

In order to activate the account, the user should click on the Activation link, enter the Mobile PIN, Password and Confirm Password and click on Activate Button. On success, the user account is activated and the database is updated.

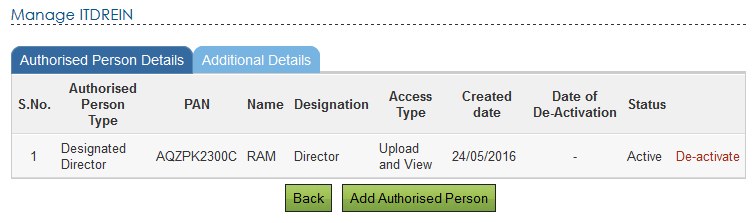

Step 9: After the Authorised person is activated, Authorised person can view the details as below.

Note – If the Form Type is FORM61B, the Additional details tab will also be displayed along with Authorised Person Details. User can also edit the Additional Details.

Steps to Upload Forms

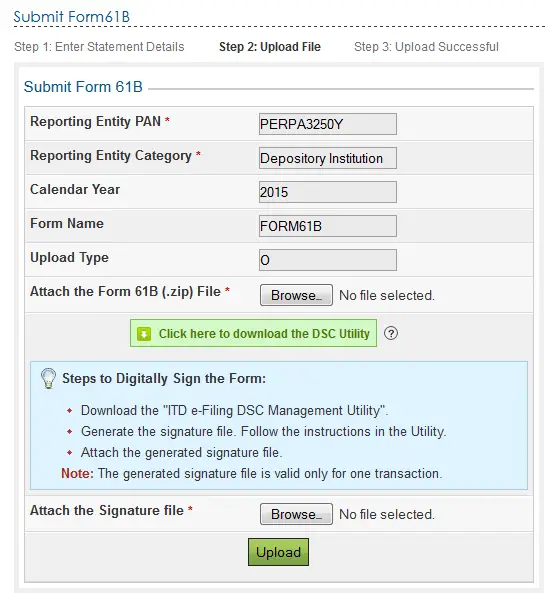

Step 1 – Login to e-Filing portal using ITDREIN, Authorised Person PAN and Password.

Step 2 – Based on the Form Type and Reporting Entity Category selected during registration, the ITDREIN user will be able to upload and view the corresponding Form.

Step 3 – Go to e-File àUpload Form ZZZ where ZZZ refers to the Form Name for which ITDREIN is generated.

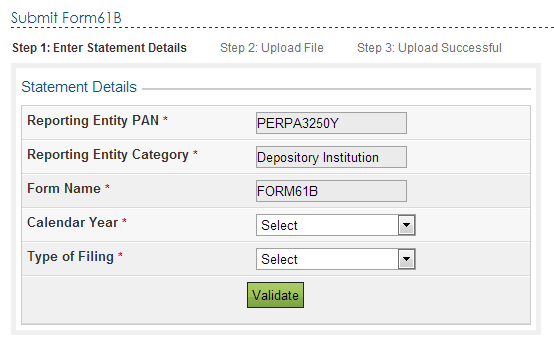

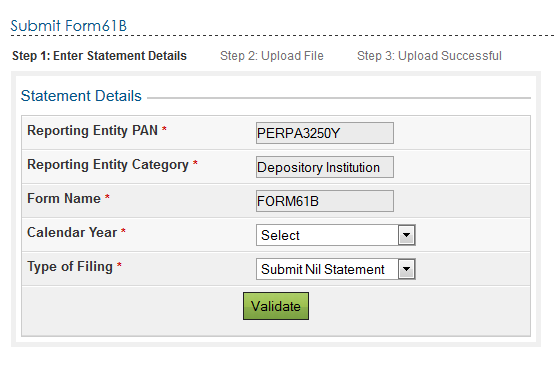

Step 4 – Enter the following details and click on Validate.

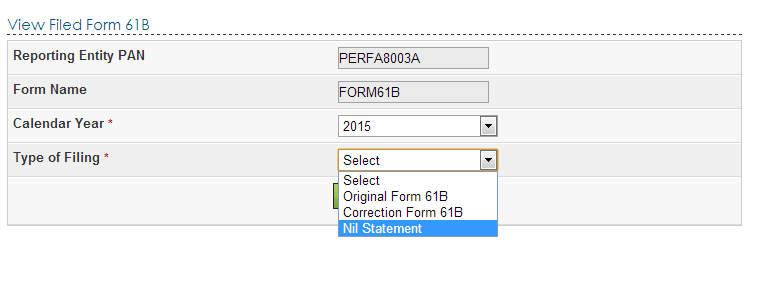

In Type of filing 3 drop downs shall be provided – a) Original Form 61B b) Correction Form 61B & c) Nil Statement

Step 5 – On successful validation upload the corresponding ZIP file, generate the Signature file using DSC Management Utility and Click on Upload.

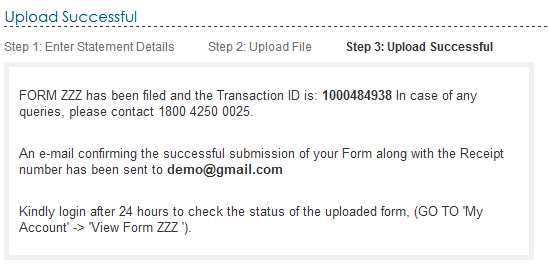

Step 6 – On successful upload user records are captured in the e-Filing system and the below success message must be displayed along with the Transaction ID.

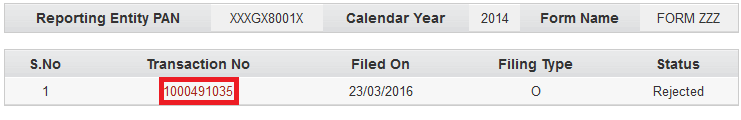

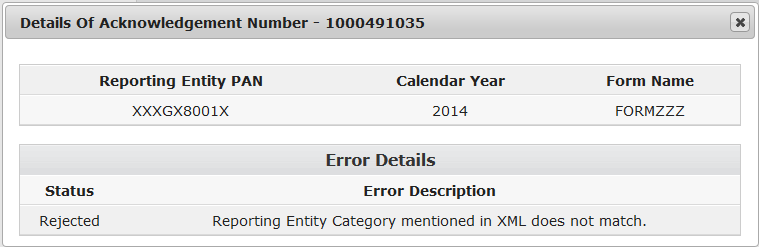

Step 7 – Once uploaded the status of the statement shall be “Uploaded”. The uploaded file shall be processed and validated. Upon validation the status shall be either “Accepted” or “Rejected which will reflect within 24 hours from the time of upload. In case if “Rejected”, the rejection reason shall be available and the corrected statement can be uploaded.

Step 8 – User can view the rejected reason by clicking on the Transaction Number against the rejected record.

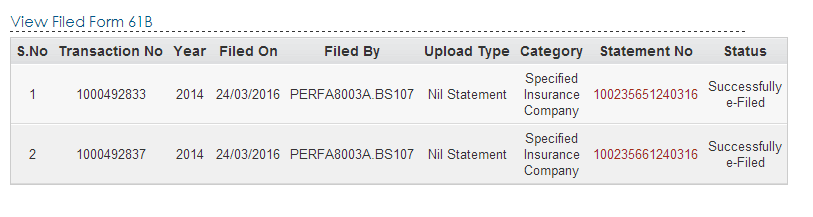

Steps to Upload Nil Statement

Step 1 – Login to e-Filing portal using ITDREIN, Authorised Person PAN and Password.

Step 2 – Based on the Form Type and Reporting Entity Category selected during registration, the ITDREIN user will be able to upload and view the corresponding Form.

Step 3 – Go to e-File >>> Upload Form 61B

Step 4 – Enter the following details and click on Validate.

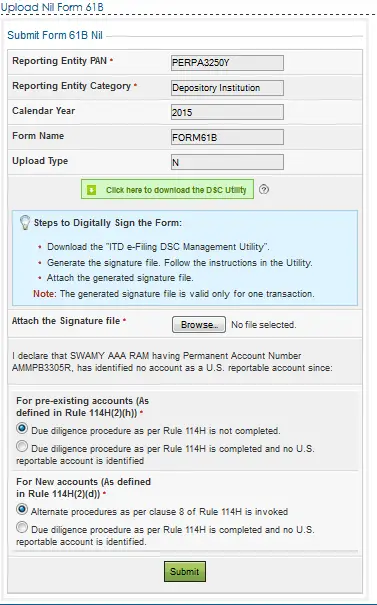

Step 5 – On successful validation generate the Signature file using DSC Management Utility, select radio button for respective accounts and Click on Submit.

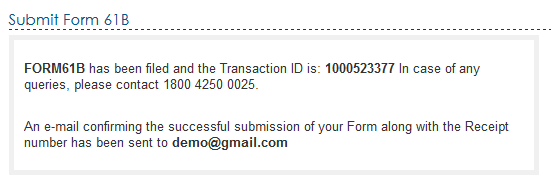

Step 6 – On successful submit user records are captured in the e-Filing system and the below success message must be displayed along with the Transaction ID.

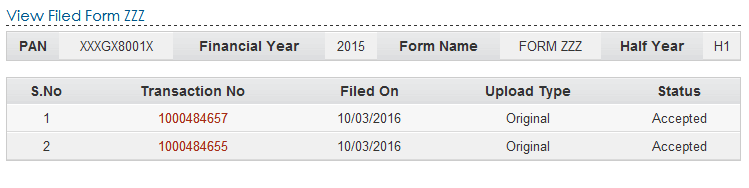

Steps to View Forms

Step 1 – Login to e-Filing portal using ITDREIN, Authorised Person PAN and Password.

Step 2 – Based on the Form Type and Reporting Entity Category selected during registration, the ITDREIN user will be able to upload and view the corresponding Form. Step 3 – Go to My Account >>> View Form ZZZ where ZZZ refers to the Form Name for which ITDREIN is generated.

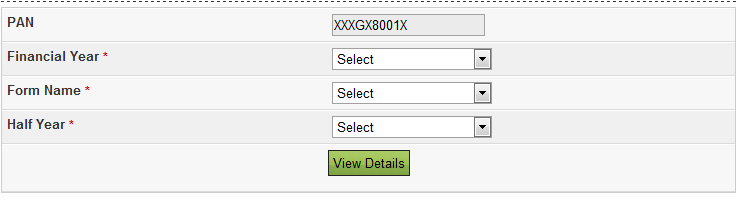

Step 4 – Enter the following details and click on View Details.

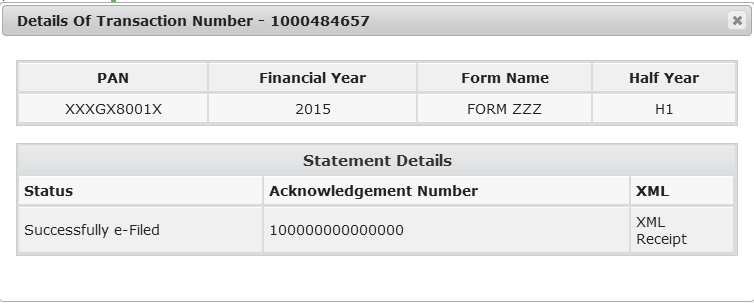

Step 6 – Click on the Transaction No. Filer can see the below details by clicking on “Transaction No”

- PAN

- Financial Year

- Form Name

- Half Year/Quarter

- Status (Accepted / Rejected)

- XML (In case of Acceptance)

- Acknowledgement Number (In case of Acceptance)

- Receipt

- Rejection Reason (In case of rejection)

Step 5: If the Form Type is FORM61B, Nil Statement can be viewed as below.

Step 6: Enter the following details and click on Validate.

Click on the hyperlink provided on the statement no to view complete details .

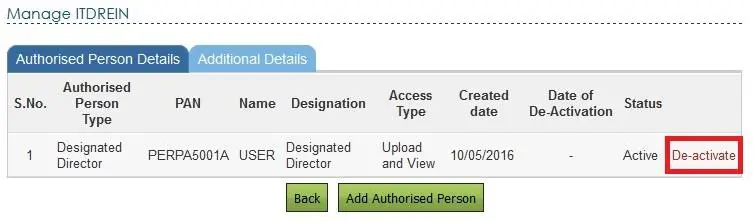

Steps to De-activate Authorised Person

Step 1 – Login to e-Filing portal using User ID, e-Filing Password and DOB.

Step 2 – Go to My Account >>> Manage ITDREIN.

Step 3 – Click on the ITDREIN under which the “Authorised Person” to be De-activated.

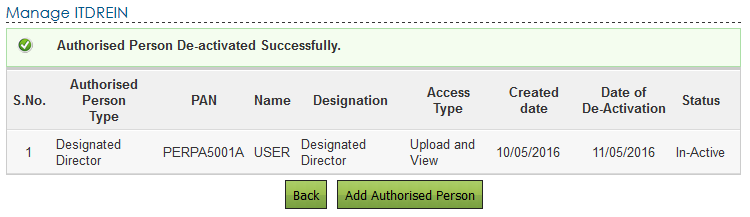

Step 4 – Click on the De-activate link to de-activate the Authorised Person.

Step 5 –After clicking on the de-activate link, a Success Message for De-activating will be displayed and the Date of De-activation will be recorded.

Step 6: To add another Authorised Person for the generated ITDREIN, click on Add Authorised person as appearing below the table and follow the process as mentioned in “Steps to add Authorized person” section above

Source – incometaxindia.gov.in