Features of Practice Management Software for CA

Explore Features

Task Management

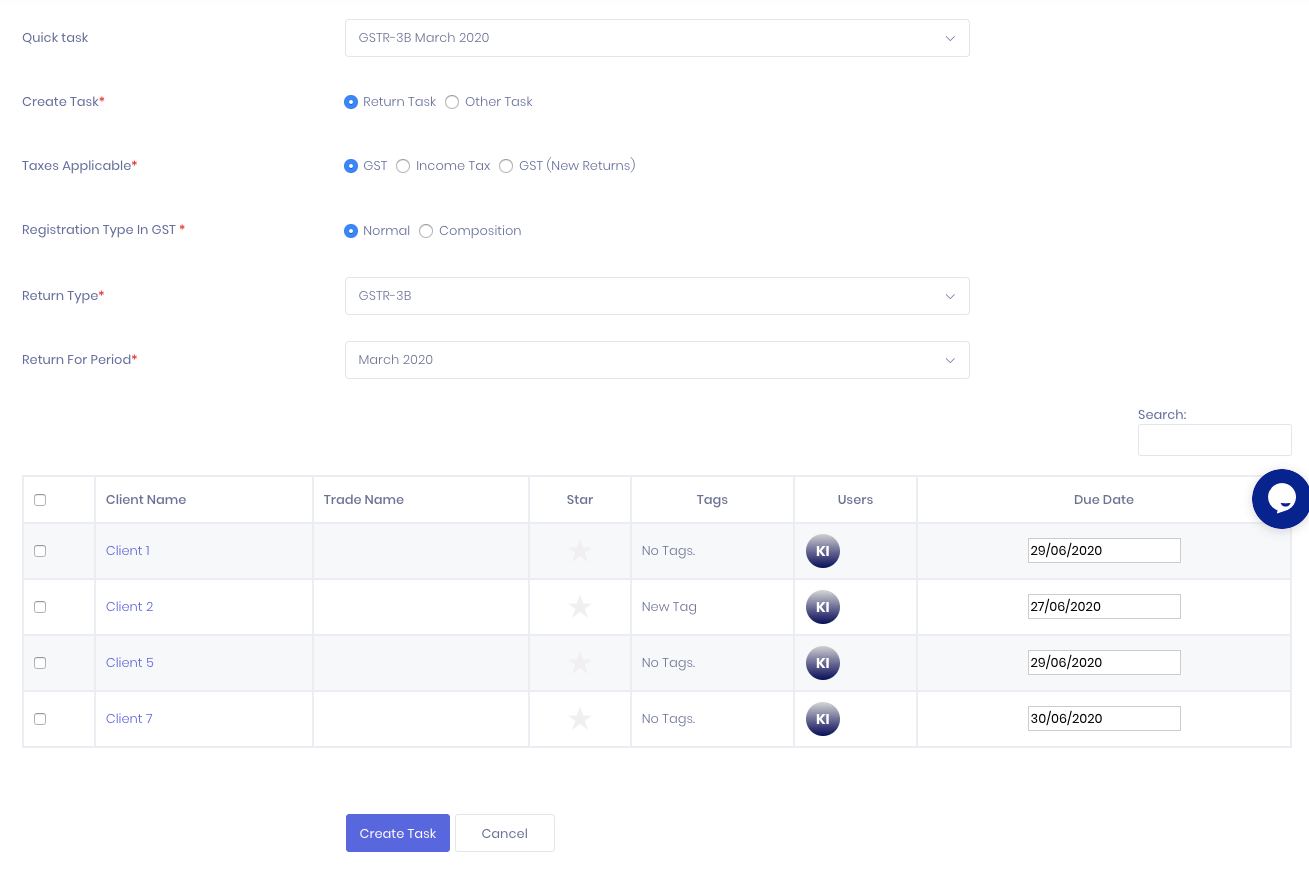

Smart Task Creator

Create return task for all clients in one go.

System also considers registration date and cancellation date while creating task. For example: if a GSTIN is registered on 5th July 2020 and you are creating GSTR-3B task for June 2020 then such client will be ignored automatically.

Due date for the task will also be shown automatically. In case of GSTR-3B, state and turnover will also be considered to show staggered due dates.

Although, you can change them manually.

Duplicate return task will not be created in any case.

You can also create any other task by selecting other task.

You can allot them to users, mark priority tasks with star. You can also do these actions at any point of time.

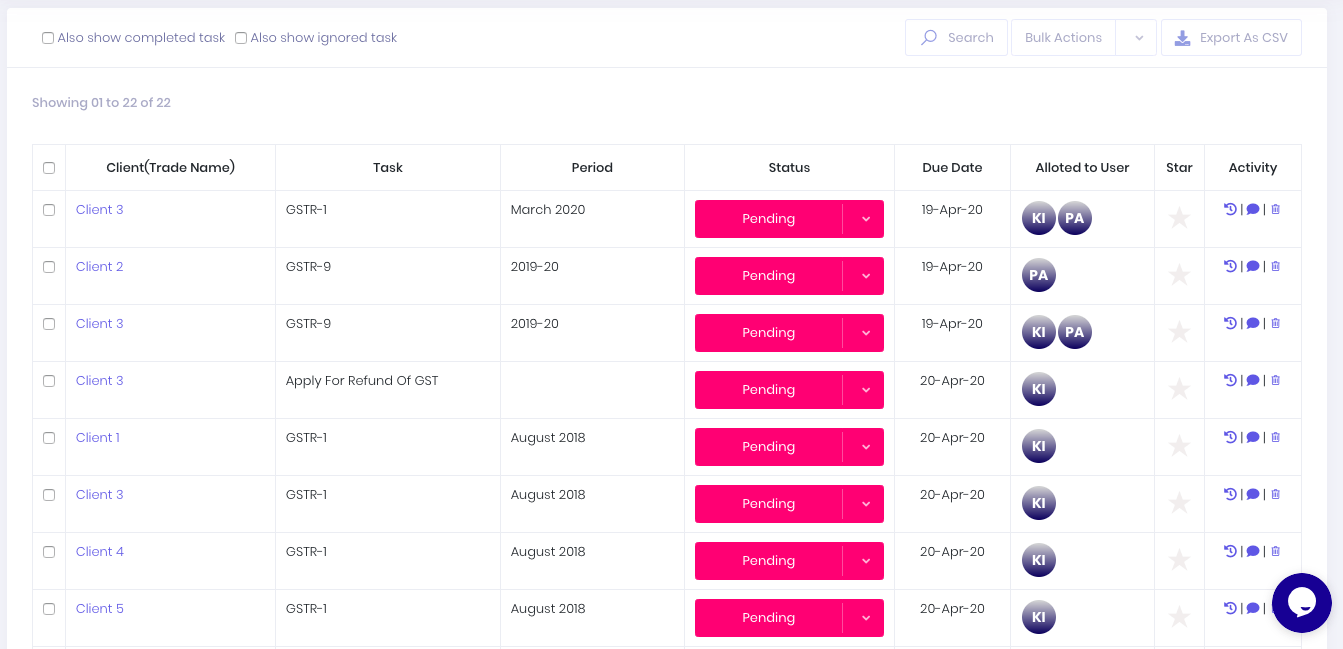

Task List

All the task listed, sorted with due date. You can mark a task as star or change status, due date, user. You can also add comments.

A task may be alloted to one or more users.

You can also search on basis of status, return type (GSTR-1, GSTR-3B etc.), due date, users, star, period, date of adding task etc.

Tags - For complete flexibility

TaxAdda PMS gives standard GST & Income Tax tasks. But there are many other returns, statements, certificates to be filed. For example: Letter of undertaking, ITC-04. For creating such tasks, we have Other tasks.

You can add one or more tags to a client. Then tag can be used for filtering clients for creating task. For example: You can add a tag LUT and then add this tag to all clients whose LUT is required to be filed. Then go to other task, filter task on basis of tag LUT and then select all clients and create tasks. This way you can create tasks for multiple clients in one go. For complete process see this guide.

Status of Tasks

New tasks added are given status of Pending by default. There are 7 status which are created automatically. You can create more status according to your requirements and given them the color you want.

Some functionalities are based on three status of Pending, Completed and Ignore tracking. They are not allowed to be edited or deleted.

You can know more about status from this page.

GST Return task will be marked as completed only after confirmation from GSTIN

TaxAdda PMS has a very special feature for GST returns. Often times it happens that a person marks wrong return as completed in excel sheet. For example: A person files return of Abhishek Singh of GSTR-3B for March 20 but it mistakenly completes GSTR-3B task of Abhishek Singhania, while GSTR-3B of Abhishek Singhania is still pending.

When a user tries to mark a GST return task as completed then system checks the status of such return from GSTN and marks it as completed only afterwards. We use GSTN authorized APIs, so data is always correct and up to date. You can even confirm it by filing a return and check its status after 2 seconds.

You can check the return filing date by taking mouse to the completed status.

Activity

Each change in a task is recorded as an activity. You can track the progress of the task and also set responsibility of your team by seeing activity. For example: A task is marked as Completed, but it is not completed in actual. You can see from activity, which member of your team had marked it as completed.

Comments

Comments can be added for a task by any user. It is useful to keep notes and information related to that task. Team members need not call or message each other for asking information related to a task.

Return Tasks Overview

Overview page is a page where you will find all return tasks listed with clients in rows and month/quarter/year in columns, just like you create an excel sheet for managing tasks.

But unlike excel, you can change status, allot users, check activity, filter and much more.

If a task is not created for a period, then you can create task by just clicking plus icon.

This page is great when you want to get overview of all client’s status of a particular return.

User Access Management

You can add a user as an admin, as a manager or as an employee.

Admin has all the rights including changing plan of PMS subscription, adding other users, change in setting etc..

You can select each right you want to give to a manager or employee. Although, Some rights are exclusively for admin and cannot be given to manager or employee, such as adding another user, change in plan. There are also some rights which cannot be taken away from any user, such as, status change, user allocation, view clients.

The difference between manager and employee is that manager can be given some rights such as view all tasks or view all task other than allotted to admin only, import of clients, delete task. When given this right, a manager can see all tasks other than tasks which are on one or more admins only. This right can be given to manager, so that he can see all tasks which are pending on other employees also.

Read more about User management here.

GST Return Status

Check GST return status of a client from 1st July 2017. The status are fetched from GSTN server directly. So no chance of mistake.

Time Tracking

You can either start and stop time for a task or you can enter time manually. Get reports for time worked by a user and also time worked for a client.

Client Page

There is a page for every client, where you will find all information and task for that client.

You can check GST return status from 1st July 2017, by clicking GST return status button.

Click on call icon after mobile number to call from your mobile (You must be login in google account with same email id in browser and in mobile). Click on email icon after email id to open gmail/outlook/apple mail etc with email id autofilled in “To”. Click on whatsapp icon to open web.whatsapp.com with the mobile number selected.

You can view and process tasks from here also.

To go to client page, there is a dropdown in top bar. You can select client from there. Also, at any place where name of client appears, it is linked to client page.

Dashboard

On dashboard, you will see tasks pending on you. Number of task status-wise, user-wise. GST and Income tax return task pending for each month/quarter/year. DSC which are expired or are going to be expired soon. Click on any row to view the tasks or more information.

SMS & Whatsapp

You can send sms from TaxAdda PMS. You can send sms to individual client or also in bulk.

Sending sms from TaxAdda PMS will give you two advantages. First is that you can use templates to save the common messages and you didn’t need to type or copy/paste message every time.

Second is that you can send reminder messages to only those clients which are required to file a particular return. For example: select GST, then select normal, then GSTR-3B then May 2020. Only those clients are listed which needs to file GSTR-3B for May 2020. Other clients such as who are registered in composition scheme, has cancelled registration before May 2020 are filtered out. And now you can send bulk SMS to remind about the pending return.

Know more about SMS & Whatsapp here.

Chrome & Firefox extensions

All browsers save your username and password for all websites in which you login. You can then easily select the username and login in one click without remembering usernames and password.

Taxadda PMS extensions gives exact this functionality to users to login in their client’s GST & Income tax accounts. A top bar will come on gst.gov.in and incometaxindiaefiling.gov.in login pages. And you just need to select client and username and password will be autofilled. You need to login in extension and can be installed on any number of computers. Also any additions and changes will be sync among all computers.

To maintain high security, we uses a system in which a unique 256 bit key is generated at time of sign up. This key is not stored in our server. All username and password is encrypted and decrypted using this key.

You need to enter this key when you login in PMS or in extension on a new computer for using or managing your client passwords. All the other work can be done without using the key.

You can download the chrome extension from here and firefox extension from here.

Receipts and Payments

This functionality can be used to record amount paid, payable, received or receivable. You can use it for entering transactions like fees receivable, amount paid on behalf of client (like company law fees, GST amount, Income tax amount) etc.

You can add source (bank name, cash etc.), category (fees, reimbursement etc), add notes, attach files. There is also option that admin can mark a transaction as verified.

You can also see reports on basis of client, source, category.

A balance button comes on client page. You can click on this button to get the amount receivable or payable.

Searching

A search comes in top bar, where you can search on basis of GSTIN, PAN, Mobile, Email, File No. and notes. Click on the result to go to client page.

Import of Clients

You can import all clients in one go. Download the sample csv file. Enter all your client’s data and upload the file.

To go to Import clients page, go to Client list and then click on Import client button.

Need help? Mail us at pms@taxadda.com