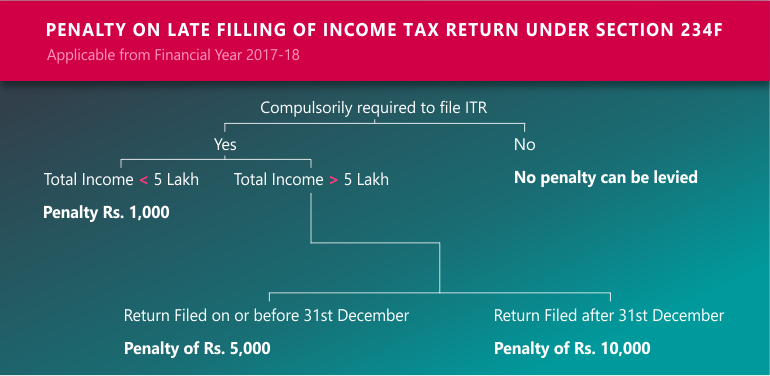

New penalty for late filing of Income Tax Return under section 234F is introduced in Budget 2017. Although this penalty is applicable only for income tax return of Financial Year 2017-18 and onwards. If a person who is compulsorily required to file Income Tax Return (ITR) doesn’t file return on time then he is liable to a penalty as follows

Amount of Penalty

For person with Total Income of more than Rs. 5,00,000

- If ITR is filed on or before 31st December following the last date – Rs. 5,000

- If ITR is filed after 31st December – Rs. 10,000

For person with Total Income of less than Rs. 5,00,000 – Rs. 1,000

Penalty is not applicable if ITR is filed before due date but verification is done after the due date.

In addition to the penalty interest under Section 234A is also levied on late filing of Income Tax Return.

Due Dates for filing ITR

Due date for filing return for person required to gets accounts audited under Section 44AB – 30th September

For all other persons – 31st July

Due dates in other cases see here.

Persons for whom it is mandatory to file Income Tax Return

The following persons are mandatorily required to file income tax return

- Company

- Firm (In Income Tax Act Firm means a Partnership Firm, Sole proprietor firms are considered as an individual)

- Any other person whose total income exceeds the maximum amount which is not chargeable to income tax.

- A person is required to file ITR if total income of any other person in respect of which he is assessable under this Act during the previous year exceeded the maximum amount which is not chargeable to income-tax.

Also Read – Benefits of Filling Income Tax Return (ITR) on time