- What is Leave Travel Allowance (LTA)?

- Conditions and Calculation for exemption of LTA

- Maximum amount of deduction

- Other Points to be kept in mind

- How to claim Leave travel allowance (LTA) in Income Tax Return

What is Leave Travel Allowance (LTA)?

Leave travel allowance is an allowance given by an employer to his employee for travelling in India with or without family. Such allowance is to be spend on travelling from public means of transport i.e by air, rail or bus and not for other expenses such as hotel room charges, food expenses etc. The amount received as LTA is exempt under Income Tax subject to certain conditions as per section 10(5) and rule 2B. Sometimes it is also termed as Leave Travel Concession (LTC).

Conditions and Calculation for exemption of LTA

- The amount which is paid as fare for travel via air, rail or bus is allowed as exemption subject to maximum limits. The amount which is paid for other expenses such as hotel room charges, food expenses etc are not allowed. Also travel made via private car or hired cab is not eligible.

- The maximum amount of deduction is the leave travel allowance actually received.

- LTA exemption can be claimed for two travels made in a block of 4 calendar years (Jan to Dec). Current block of 4 years is 2014 to 2017. If two exemptions are not claimed in a block of 4 years then one exemption can be carried forward to the first year of next block.

- Exemption is not allowed for expenses made on international travel.

- Exemption is allowed for expenses made on travel of himself or family members only. So if a person pays for travel of his/her friends or distant relative then exemption is not allowed.

Meaning of Family – Spouse(husband/wife), children and also dependent parents, brothers and sisters. - Exemption is allowed only when the person claiming deduction is also travelling. If only family is travelling then deduction is not allowed.

- The exemption is available only for two surviving children. However in the following two cases, exemption is available for more than two children.

- All surviving children born before October 1st , 1998

- There is a case of multiple birth after the 1st child

- If such allowance in received from former employer after retirement or termination of service then also LTA exemption can be taken.

- If an employee receives LTA on per year basis and he doesn’t utilize that amount in a year then the amount is carried forward to next year(s). For eg an employee receives rs. 10,000 per year he doesn’t utilize that amount in a year, now rs. 20,000 can be allowed as deduction in next year if he uses such amount as per above provisions.

- Exemption is allowed only for one travel within one calendar year.

Maximum amount of deduction

The amount of concession in this section will not exceed the amount actually incurred in any case.

- Journey by air

Economy fare of national carrier by shortest route. If the journey is taken in breaked manner then the fare for direct flight will be taken as maximum allowed allowance. - Journey by rail

1st Class AC rail fare by the shortest route to the place of destination. - By bus or other mode –

In a case place of origin of journey and destination are connected by rail and journey is performed by any other mode than air – 1st Class AC rail fare by the shortest route to the place of destination.

In a case place of origin of journey and destination(or part thereof) are not connected by rail and

- Recognised transport system exists – 1st Class or deluxe class fare of such transport by the shortest route to the place of destination.

- Recognised transport system exists – 1st Class AC rail fare by the shortest route (as if the journey had been performed by rail)

Other Points to be kept in mind

- Proof of travel expenses is not initially required but advised to be kept handy.

- Form 12BB is to be filed with employer if you want your employer to take deduction under this section into consideration and thus deduct lower TDS.

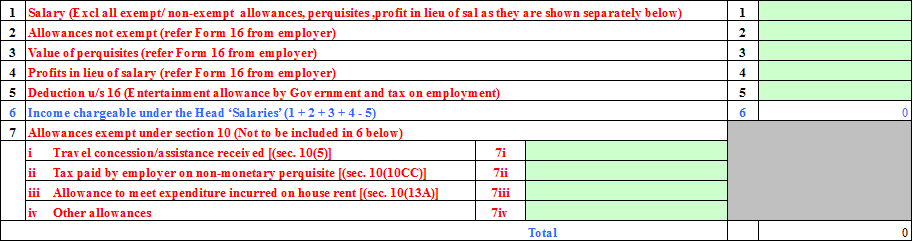

How to claim Leave travel allowance (LTA) in Income Tax Return

In ITR -1 the income from salary after all exempted allowances are to be filled in “Income from Salaries”. No separate details are to be filed. While in ITR – 2, 3, 4 the amount of allowance which is exempt is to be inserted in Point 2 of sheet “Salary” and the amount of LTA to be exempted is to be filed in point no. 7(i) of the same sheet.

Also Read: