If you are filing your return electronically then you are either required to send ITR-V to Income Tax Deparment CPC within 120 days from the date of filing or e-Verify your return. The utility of checking ITR-V receipt status is very useful if you have send signed ITR-V to Income Tax Department and want to track the current status as your return will be considered filed only if it is received by Income Tax Department within 120 days from the date of filing.

Step 1 – Go to https://incometaxindiaefiling.gov.in/

Step – 2 – Select ITR status option under Services from left side menu.

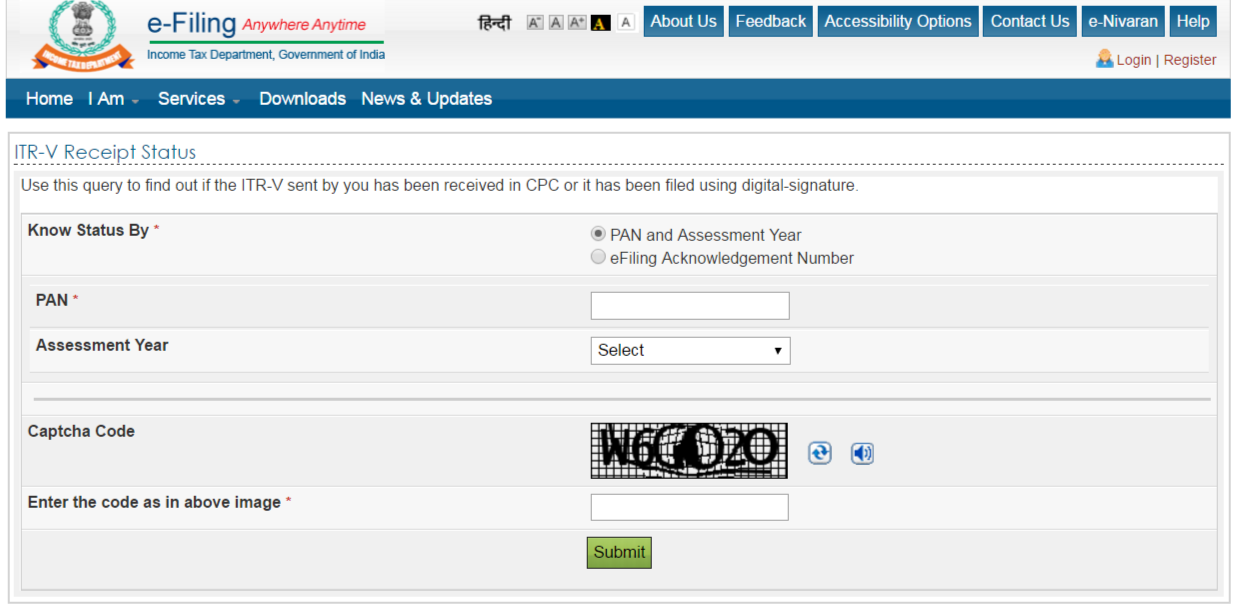

Step 3 – You can track ITR-V receipt status either using your PAN Number & Assessment Year or using eFiling Acknowledgment Number.

Step 4 – Enter your 10 digits PAN Number and select the Assessment Year for which you want to track your ITR-V receipt status or enter eFiling acknowledgment number. You can find your 15 digit eFiling acknowledgment number on ITR-V.

Step 5 – Enter Captcha code and click on Submit button.

Step 6 – You will get your ITR-V receipt status on the next page which are as follows:-

a) No e-Return has been filed for this PAN/Acknowledgement number – It means no return has been filed or the inputs which you have entered are incorrect.

b) e-Return for this Assessment Year or Acknowledgment Number has been Digitally Signed – It mean ITR-V has already been verified using Digital signature. No requirement to send the hard signed copy of ITR-V to Income Tax Department.

c) ITR-V Received – It mean ITR-V has been successfully received by Department.

d) ITR-V not received – It means ITR-V is not yet received by Department.

e) Successfully e-Verified – It means ITR-V has been electronically verified. No requirement to send the hard signed copy of ITR-V to Income Tax Department.