Legal representative/heir of the deceased person is require to file the income tax return on his/her behalf. In most cases, spouse or eldest son/daughter assumes the status of legal representative or heir unless will mention another person to be executor or administrator of the estate.

As per Section 159 of the income tax act:-

- Legal representative of the deceased person is require to file the return of income earned from the beginning of the financial year till the date of the death as representative assesses of the deceased person.

- Income earned after the date of the death of the person shall be taxable in the hands of the legal heir or executor of the deceased estate and shall not be reported in the return of the deceased person.

- The tax liability of the deceased person legal representative shall be limited to the estate of the deceased person. The amount of tax does not go require to be paid from personal pocket of the legal representative.

Registering yourself as a Legal Heir of the deceased person

- Go to https://www.incometaxindiaefiling.gov.in/ and Login in to legal representative account.

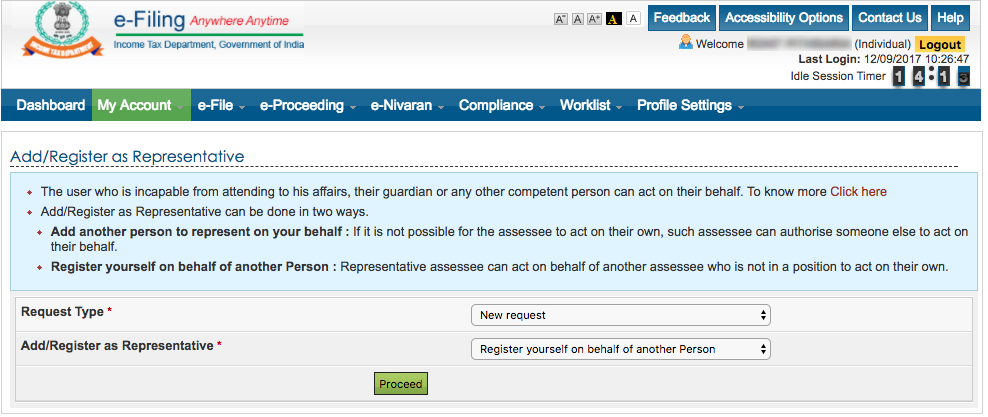

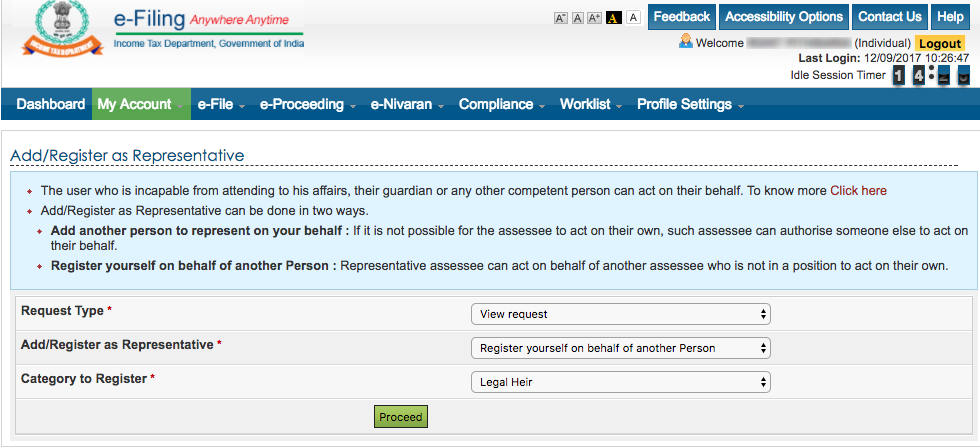

- Select option of Add/Register as Representative available under My Account.

- In Request Type, select New Request

- In Add/Register as Representative, select Register yourself on behalf of another Person and click Proceed.

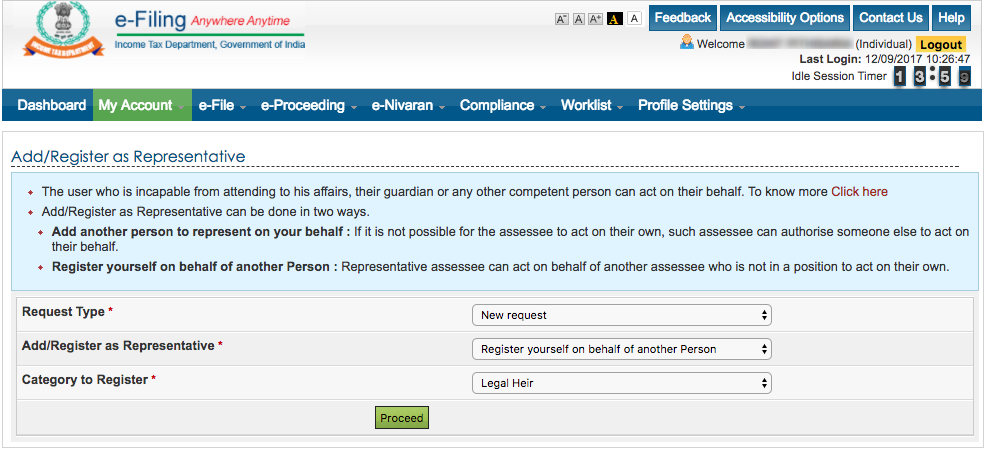

- In Category to Register, select Legal Heir and click Proceed.

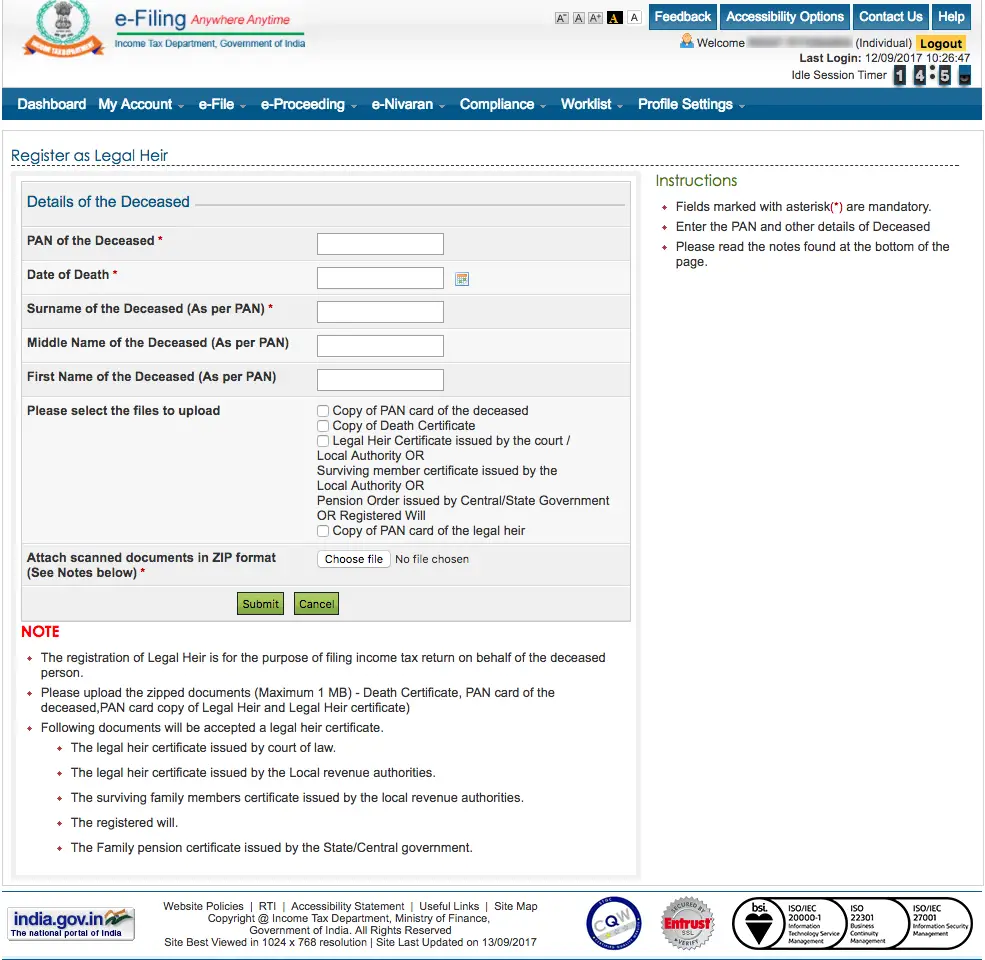

- Enter the below details of the deceased person

- PAN

- Date of Death

- Surname

- Middle Name

- First Name

- You are also required to upload the below documents

- Copy of PAN Card of the deceased person

- Copy of death certificate

- Copy of PAN Card of the legal heir

- Legal Heir Certificate – You can upload any one of the below documents as the proof of legal heir

– Certificate of legal heir issue by the court of law

– Certificate of legal heir issue by the Local Revenue Authorities

– Surviving family member certificate issued by the Local Revenue Authorities

– Registered Will

– Family pension certificate issue by the State/Central Government

Note:- Document in the regional language is required to be translated in to English or Hindi language. Such translated document is required to be notarized and both original and translated document are require to be uploaded.

- Click on Submit once you fill the above details.

- You will get a confirmation message on the successful submission of the request.

Approval Process

- Legal heir request will be sent to e-Filing Administrator.

- The e-Filing administrator will review and approve or decline your request as required.

- E-filing Administrator may approve request as temporary legal heir if the person is not able to present any legal heir certificate. If the person upload any one of the five legal heir certificate then the request will be approved as permanent legal heir.

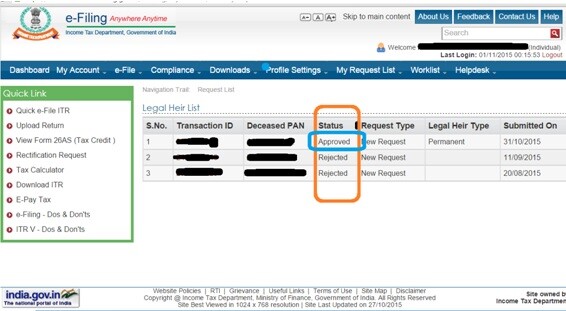

Check the status of your legal heir request

- Go to https://www.incometaxindiaefiling.gov.in/

- Login in to legal representative account.

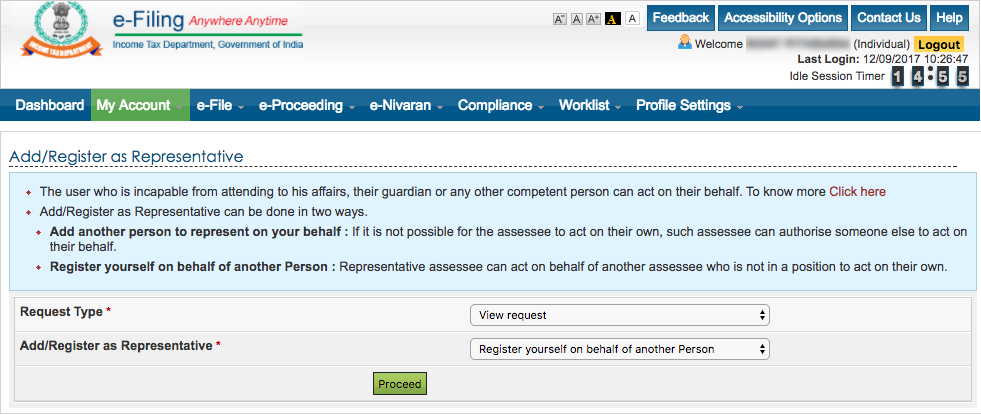

- Select option of Add/Register as Representative available under My Account.

- In Request Type, select View Request

- In Add/Register as Representative, select Register yourself on behalf of another Person and click Proceed.

- In Category to Register, select Legal Heir and click Proceed.

- This will show all of your pending, rejected or approved request.

- Also the reason for the rejection can be check by clicking on the link.

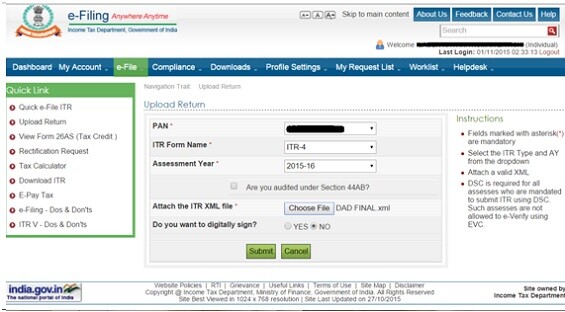

Once the request is approved, you will get an option to select the PAN Card of the deceased person at the time of filing Income Tax Return.

Services available to the Legal Heir

Following services will be available to the legal heir according to their status (temporary or permanent):-

| S.N | Services available on behalf of deceased person | Temporary LH | Permanent LH |

| 1 | Upload Return | Yes | Yes |

| 2 | Submit ITR online | Yes | Yes |

| 3 | Defective Returns | Yes | Yes |

| 4 | Submit Form online (self/LH) | Yes | Yes |

| 5 | My Returns/Forms | Yes | Yes |

| 6 | Rectification request/status | No | Yes |

| 7 | Refund Re-issue | No | Yes |

| 8 | Request for Intimation | No | Yes |

| 9 | Response to Outstanding Tax Demand | No | Yes |

| 10 | Tax Credit Mismatch | No | Yes |

| 11 | Add CA | Yes | Yes |

| 12 | List CA | Yes | Yes |

| 13 | Dis-engage CA | No | Yes |

| 14 | Dis-engage ERI | No | Yes |

| 15 | Helpdesk Request | No | Yes |

| 16 | Work list | No | Yes |

| 17 | Compliance | Yes | Yes |

| 18 | View Form 26AS (Tax Credit) | Yes | Yes |