Rule 138 of CGST Rules define the provisions of the e-Way bill. A registered person needs to generate an e-way bill where the goods need to be moved from one place to another and the value of such goods is more than Rs. 50,000 in the following cases: –

- Sales of goods

- Movement of goods for reasons other than supply. For example- for transfer of goods from one branch to another branch/godown.

- Goods are purchased from an unregistered person by a registered person and goods need to be moved. In such case, the recipient registered person needs to generate the e-way bill.

E-way bill form (GST EWB-01) is divided into two parts – Part A and Part B.

- Part A – It contains invoice-level information relating to goods such as invoice number and date, GST registration number of supplier and recipient, HSN and value of goods etc. (These details cannot be edited once the e-way bill has been uploaded)

- Part B – It contains details relating to the transporter of goods such as vehicle number in case of road transport, transport document number. (These details can be modified once the e-way bill has been uploaded).

The e-Way bill once generated cannot be deleted. There is no option to delete or rectify or correct an incorrect e-way bill, however, there is an option to cancel such e-Way bill.

An e-Way bill may be required to be cancelled because of any of the following reasons : –

- Error in e-way bill generation

- Non-movement of goods

Also Read – Comprehensive guide on E-way Bill

Time period for cancellation of an e-way bill

An e-way bill can be cancelled by the generator only within 24 hours of generation. Cancellation of the e-way bill is not possible once it has been verified by any empowered officer during the transit.

After the expiry of the above mentioned time limit, the e-Way bill shall be deemed valid and cannot be cancelled by the generator. However, you can request the recipient to reject such incorrect e-way bill as the timeline for rejecting an e-way bill is 72 hours.

Steps for cancellation of the e-way bill

- Login: One must log on to the e-way bill system portal to access waybill https://ewaybill.nic.in/

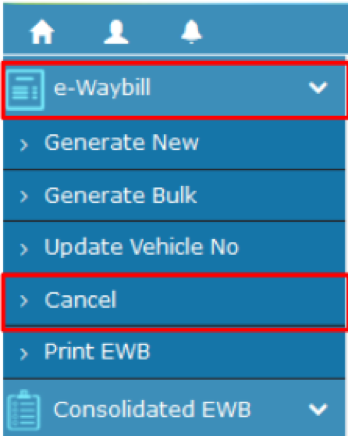

- Options for Cancellation: Click on ‘e-way bill’/‘Consolidated EWB’ and Select ‘Cancel’ from the drop down

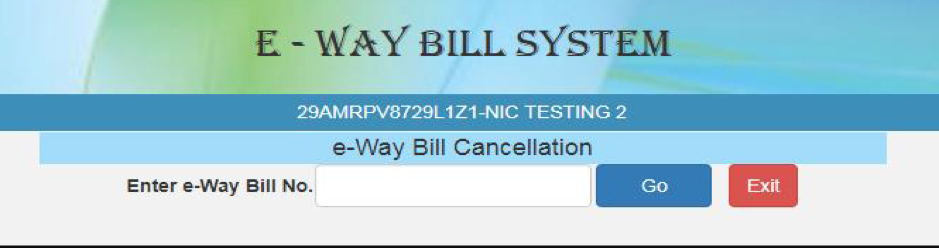

- E-way Bill No: Once the cancellation is selected, a new screen would be displayed prompting the user to enter the e-way bill number.

- Enter e-way bill no.: Enter the 12 digits e-way bill number and select Go.

- Reason: The particular e-way bill would be displayed as soon as the e-way bill number is entered. The reason to cancel the concerned e-way bill must be specified.

Once the e-waybill is cancelled, it is illegal to reuse it for any cause. A fresh e-way bill can be generated thereon.