The provisions of TDS and TCS is applicable from 1st October 2018. Notification No. 50/2018 – Central Tax

When TDS needs to be deducted

The central or state government may mandate the following enterprises to deduct TDS at the rate of 2% (1% SGST +1% CGST) from the payment made or credited to a supplier for the taxable supplies of value greater than Rs. 2.5 lakh. The limit of Rs. 2.5 lakh is for a single contract and not for aggregate value in a month or year.

Thus, individual supplies may be less than Rs. 2,50,000/-, but if contract value is more than Rs. 2,50,000/-, TDS will have to be deducted.

The value of supplies will be taken as amount excluding GST and cess.

- Department or establishment of the Central or State Government

- Local authority

- Governmental agencies

- Such persons or category of persons as may be notified, by the Central or a State Government on the recommendations of the Council.

The following entities are notified via Notification no. 33/017.

(a) An authority or a board or any other body

(i) set up by an Act of Parliament or a State Legislature; or

(ii) established by any Government,

with fifty-one percent or more participation by way of equity or control, to carry out any function;

(b) Society established by the Central Government or the State Government or a Local Authority under the Societies Registration Act, 1860 (21 of 1860).

(c) Public sector undertakings

Tax Deduction and Collection Account Number (TAN) issued under Income Tax Act is required by the persons who are required to deduct TDS under GST. Such deductor needs to get compulsorily registered regardless of their turnover. Although such person has a privilege of obtaining registration under GST without PAN.

TDS (Tax Deducted at Source) is not required to be deducted if the location of supplier and place of supply is in different state from the state in which the recipient is registered. This can be understood in detail by following example:

| Particulars | Case – I | Case – II | Case – III |

| Supplier’s State | A | A | A |

| Recipient State | A | B | B |

| Place of Supply | A | B | A |

| Type of GST to be charged | CGST + SGST(A) | IGST | CGST + SGST(A) |

| TDS Applicable | Yes | Yes | No |

Payment and Interest on Late Payment

Payment is to be made within 10 days from the end of the month in which such tax is deducted. If deductor doesn’t pay the amount of TDS before due date then he is liable to pay interest at the rate of 18%.

Penalty on non-deduction or short deduction

Non-deduction / short deduction / non-payment or short payment of TDS is an offence under the act for which a minimum penalty of Rs 10,000/- is prescribed under the Act.

Return to be filed

Return for the month in which tax is deducted is to filed on or before 10th of the succeeding month. Only online return can be filed through Form GSTR-7, no paper return is allowed.

If the supplier is unregistered, name of the supplier rather than GSTIN shall be mentioned in the return.

Late fee of Rs. 100 for every day during which such failure continues, subject to a maximum amount of Rs. 5,000 is leviable in case of delay in filing of such return.

How can deductee claim such TDS amount?

Such amount as filed by the deductor in his return will be available to deductee in Part C of Form GSTR-2A, so that the deductee can take input tax credit by including it in his GSTR-2.

This input tax credit is credit to electronic cash ledger and thus can be used for payment of tax, penalty, fee or any other amount.

Refund of wrong or excess deduction

If wrong deduction is made by deductor or the amount deducted is excess of the amount required to be deducted then a refund can be made to the deductor.

If the amount wrongly or excessively deducted is credited to electronic cash ledger of the deductee then no such refund will be made.

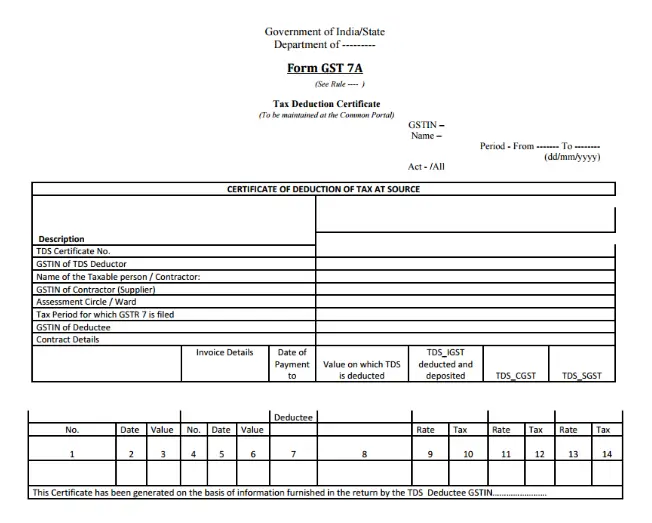

TDS Certificate

The deductor shall, in the manner prescribed, furnish to the deductee a certificate in Form GSTR-7A mentioning therein the contract value, rate of deduction, amount deducted, amount paid to the appropriate Government and other particulars.

The deductor has to furnish such certificate to deductee within five days of payment of such amount to the Government. Failure to furnishing such certificate will make deductor liable for a penalty of Rs. 100 per day, maximum to Rs. 5,000.

Source: CBEC Guide