Form 15G or Form 15H are the declaration forms by the assessee stating that no tax is payable by them and thus no TDS should be deducted from payments to them. The form can also be submitted through electronic process and it is mandatory for the payer to accept the electronic generated form.

The payer has then to verify the details of the declarant and he is responsible for to establish the identity and credentials of the declarant in any dispute.

Unique Identification Number (UIN)

Before doing these two processes the payer has to allot a Unique Identification Number (UIN) to each of the declaration received whether received in paper format or electronic mode. The method of allocating UIN is as given below-

UIN contains three fields –

- Sequence number of 10 digits as given below

For form 15G – G followed by 9 digits – G000000001 , G000000002 and so on

For form 15H – H followed by 9 digits – H000000001 , H000000002 and so on

Sequence number shall be reset to 1 at start of each financial year. - Financial year for which such form is furnished

- TAN of payer

And also the forms received in paper format is to be ditized and such ditized copy is to be uploaded to portal.

Due Dates for Filing Statement of Form 15G or Form15H

| Quarter Ending | Due Date |

| 30th June | 15th July |

| 30th September | 15th October |

| 31st December | 15th January |

| 31st March | 30th April |

The payer i.e the person who receives form 15G/15H, has to do these two processing each quarter

- Uploading these forms on incometaxindiaefiling.gov.in

- Furnishing particulars of declaration in TDS return of such quarter.

Process to e-file Statement of Form 15G/15H

Registration process

To file the “Statement of Form 15G/15H”, user should hold valid TAN and should be registered as “Tax Deductor & Collector”. If not already registered, he should Go to Register yourself- >Tax Deductor & Collector and complete the registration process.

Filing process

1) Download FORM 15G/15H utility from Downloads page > Forms (Other than ITR) >FORM 15G/FORM 15H (Consolidated) and prepare the xml zip file.

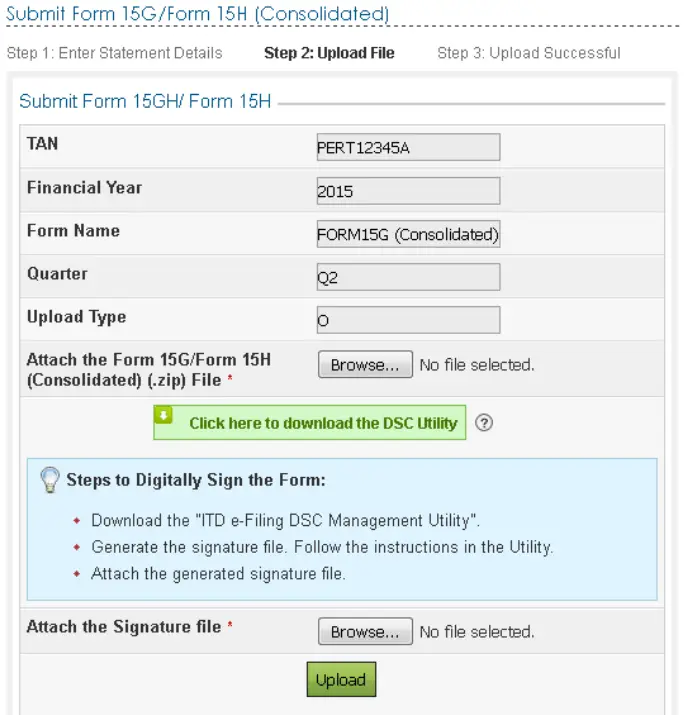

2) DSC is Mandatory to file FORM 15G/15H.

3) Generate signature for the zip file using DSC Management Utility (available under Downloads)

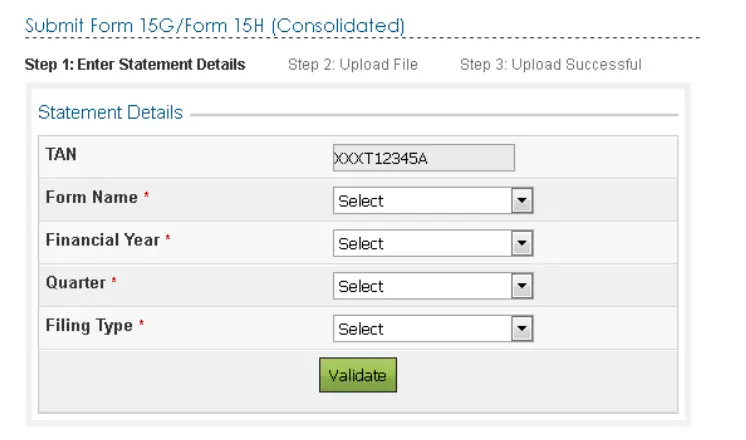

4) Login through TAN, Go to e-File -> Upload Form 15G/15H. Enter the details Form Name, Financial year, Quarter and the Filing type.

5) Upload the “Zip” file along with the signature file. Zip file and signature file can be generated from the DSC Management Utility.

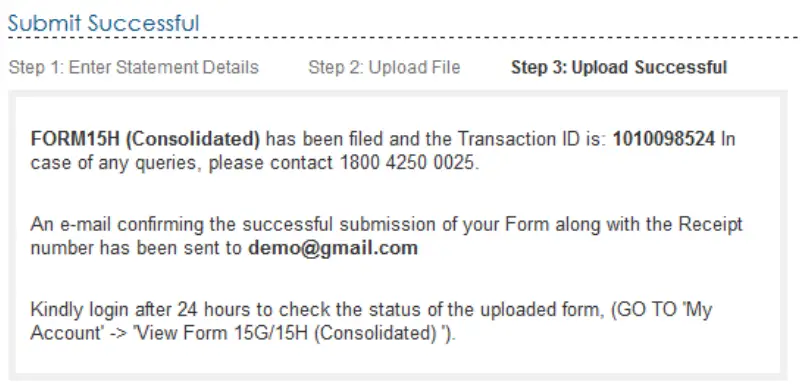

6) On successful upload, the following screen is displayed.

Filing Status

To view the status of uploaded file, Go to My account >> View Form 15G/15H.

Once uploaded the status of the statement shall be “Uploaded”. The uploaded file shall be processed and validated.

Upon validation the status shall be either “Accepted” or “Rejected” which will reflect within 24 hours from the time of upload.

Accepted statements shall be sent to CPC-TDS for further processing.

In case if “Rejected”, the rejection reason shall be available and the corrected statement can be uploaded.

List of validations

Below are the list of validations carried out on the uploaded statements.

>Schema validations – uploaded xml should comply with the published schema

> Other Business Validations

- Only one original will be accepted for combination of TAN, Financial Year, Form and quarter.

- TAN, Filing Type, Quarter and Financial Year entered in XML should match with the TAN, Quarter, Financial Year and Filing Type in upload screen.

- UIN should be unique for the TAN and financial year

- Financial year and TAN in the UIN should match with the TAN and Financial Year for which the statement is being uploaded

2. Furnishing particulars of declaration in TDS return of such quarter.

The person shall furnish the particulars of declarations received by him during the quarter along with the unique identification number alloted by him in TDS return of such quarter. TDS return is to be filed along with required information, even if there is no tax deducted in the said quarter.

The UIN shall be same which is used for uploading the forms.

UIN is not required to be submitted in TDS return for the quarter ending 31st Dec 2015 and 31st March 2016. Circular no. 18/2016

Other points-

The payer shall file exceptional report for the UINs not reported in TDS return or not uploaded on Income Tax Department website.

The payer is required to keep Forms 15G/15H with him for a period of 7 years from the end of the financial year in which such forms are received. Income tax authority may ask for these forms for verification.

Sources-