What is GSTIN ?

GSTIN stands for Goods and Services Tax Identification Number. It is a unique 15-digit alphanumeric number assigned to every registered taxpayer (business or individual) under the Goods and Services Tax (GST) regime in India. It has different formats (structure) based on various types of Registrations under GST.

Format of GST Number

We can understand the composition of GSTIN as explained below

- The first two digits of GSTIN represents the State Code according to Indian Census 2011. Each State has a unique two-digit code like “08” for Rajasthan and “27” for Maharashtra.

- The next ten digits of GSTIN will be the PAN/ TAN of the taxpayer which emphasizes the fact that a PAN is compulsory for any person who is required to take registration under GST. The only exception to this is registration in case of a non-resident taxable person (NRTP) wherein registration is granted even in the absence of PAN being allotted to such person. Registration to such person shall be granted based on the tax identification number or unique number on the basis of which the entity is identified by the foreign Government where the said entity is based.

- The 13th digit indicates the number of registrations entity/person has within a State for the same PAN. It is an alpha-numeric number, first 1 to 9 and then A to Z, which will be assigned on the basis of number of registrations an entity, with the same PAN, has within one State. For example, if an entity has one registration only within a State then “1” will be assigned as the 13th digit of the GSTIN. If the same entity obtains another registration for say a business vertical or an SEZ within the same State, then the 13th digit of GSTIN assigned to this entity will become “2” so on and so forth.

- The 14th digit is assigned based on the nature of the business of the Assessee. Eg.“Z” is used as a default 14th digit in case of a regular tax Payer, “D” is used for Tax deductors under GST, “C” is used for Tax Collectors under GST.

- The last digit (15th) is a check code which can be either be a number or an alphabet (1 to 9 or A to Z)

You can search & validate any GSTIN/UIN with our GSTIN Search and Validator tool

Format & Composition of GSTIN for Resident Taxpayers

Following Registration falls under Taxpayer category in GST

- Regular Registration ( including taxpayers who opted for QRMP)

- Registration under Composition Scheme

- Registration as SEZ Developer/SEZ unit

- Registration as Input Service Distributor (ISD)

we can understand the composition of various GSTIN with the help of below examples

Example 1 : GSTIN format for Regular Taxpayer

Structure of GSTIN 22AAAAA1234B1Z5 will be as follows

| Character | Description | Example |

| 1st to 2nd | State Code | 22 |

| 3rd to 12th | PAN (Permanent Account Number) of the taxpayer | AAAAA1234B |

| 13th | Entity Code (number of registrations within a state) | 1 |

| 14th | Based on type of registration (“Z” for all regular taxpayers) | Z |

| 15th | Check Digit (may be number/alphabet) | 5 |

Example 2 : GSTIN format for Tax Deductor (TDS) u/s 51 of CGST Act, 2017

Structure of GSTIN 22AAAAA1234B1D5 will be as follows

| Character | Description | Example |

| 1 to 2 | State Code | 22 |

| 3 to 12 | PAN (Permanent Account Number) of the taxpayer | AAAAA1234B |

| 13 | Entity Code (number of registrations within a state) | 1 |

| 14 | Based on type of registration (“D” denotes Tax Deductors) | D |

| 15 | Check Digit (may be number/alphabet) | 5 |

Example 3 : GSTIN format for Tax Collector (TCS) u/s 52 of CGST Act, 2017

Structure of GSTIN 22AAAAA1234B1C5 will be as follows

| Character | Description | Example |

| 1 to 2 | State Code | 22 |

| 3 to 12 | PAN (Permanent Account Number) of the taxpayer | AAAAA1234B |

| 13 | Entity Code (number of registrations within a state) | 1 |

| 14 | Based on type of registration (“C” denotes Tax Collectors) | C |

| 15 | Check Digit (may be number/alphabet) | 5 |

Format & Composition of GSTIN for Non- Resident Taxpayers

The structure of GSTIN of Non-Resident Taxpayers is different from Resident taxpayer, it is not PAN Based like Resident taxpayers. Composition of GSTIN for Non-Resident Taxpayer is as follows

- The first two digits of GSTIN will represent the Special Code which is “99” for Non Residents.

- The next 2 digits (3 to 4) represent the “year of Registration” under GST in India for “17 for 2017”.

- The next 3 digits (5 to 7) represent the “Country Code” of Non Resident Taxpayers like “USA” is the country code for the United States of America.

- The next 5 digits (8 to 12) represent the “Serial No. per year ” of registration granted to Non Resident Taxpayers.

- The next 2 digits (13 to 14) represent the “Code for goods/services ” provided by Non- resident Taxpayers.

For Example Structure of GSTIN 9917USA00013OS5 for Non Resident OIDAR service provider will be as follows

| Character | Description | Example |

| 1 to 2 | Special Code for foreign countries | 99 |

| 3 to 4 | Year of registration (“17” for the year 2017) | 17 |

| 5 to 7 | Country Code | USA |

| 8 to 12 | 5 digit serial no. per year | 00013 |

| 13 to 14 | Code for goods/services (OIDAR service provider in this example) | OS |

| 15 | Check Digit (may be number/alphabet) | 5 |

Examples of GSTIN of some Non -Resident OIDAR Service providers are as follows

- Upwork : 9923USA29044OSE

- Fiverr : 9924ISR29001OSH

- Godaddy : 9917USA29016OS6

You can validate any Non Resident Taxpayer’s GSTIN/UIN with our GSTIN Search and Validator tool

Format & Composition of other Registrations under GST

1. Unique Identification No. (UIN) : It is a special type of GST registration for foreign diplomatic missions and embassies & United Nation bodies, that are not required to pay taxes in India. Any tax (direct or indirect) collected from these bodies is refunded to them.

For Example structure of UIN of UNICEF (MP) 2317UNO00001UND for United Nation Body is as follows

| Character | Description | Example |

| 1 to 2 | State Code | 23 |

| 3 to 4 | Year of registration | 17 |

| 5 to 7 | Type of unique registration | UNO |

| 8 to 12 | 5 digit serial no. per year | 00001 |

| 13 to 14 | Code for United Nation Body & embassy of foreign country | UN |

| 15 | Check Digit (may be number/alphabet) | D |

Another Example of format of UIN is 2717USA00046UNV for Consulate of the United States, Mumbai, is as follows

| Character | Description | Example |

| 1 to 2 | State Code | 27 |

| 3 to 4 | Year of registration | 17 |

| 5 to 7 | Foreign Country code | USA |

| 8 to 12 | 5 digit serial no. per year | 00046 |

| 13 to 14 | Code for United Nation Body & embassy of foreign country | UN |

| 15 | Check Digit (may be number/alphabet) | V |

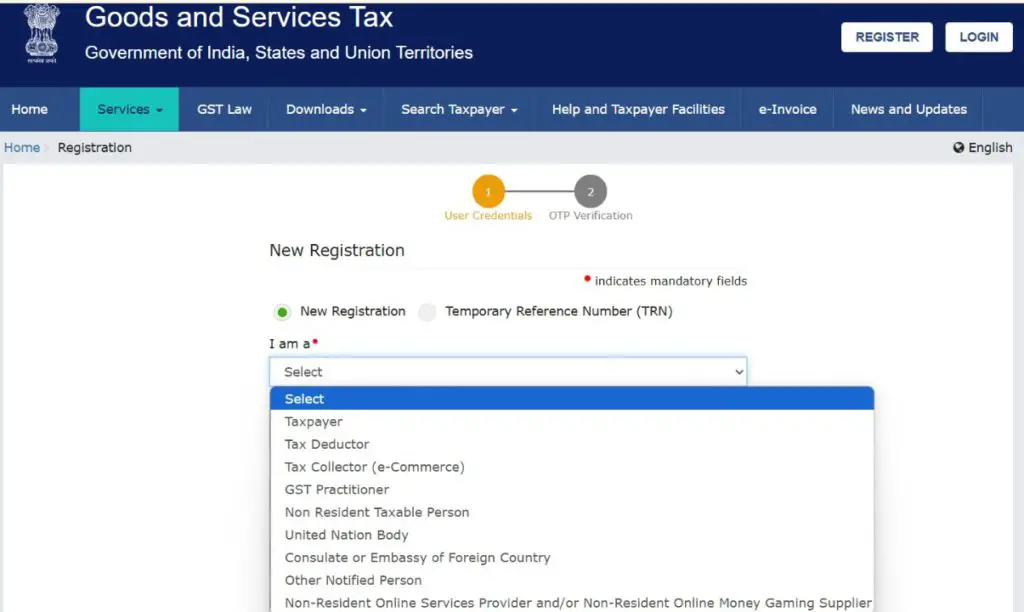

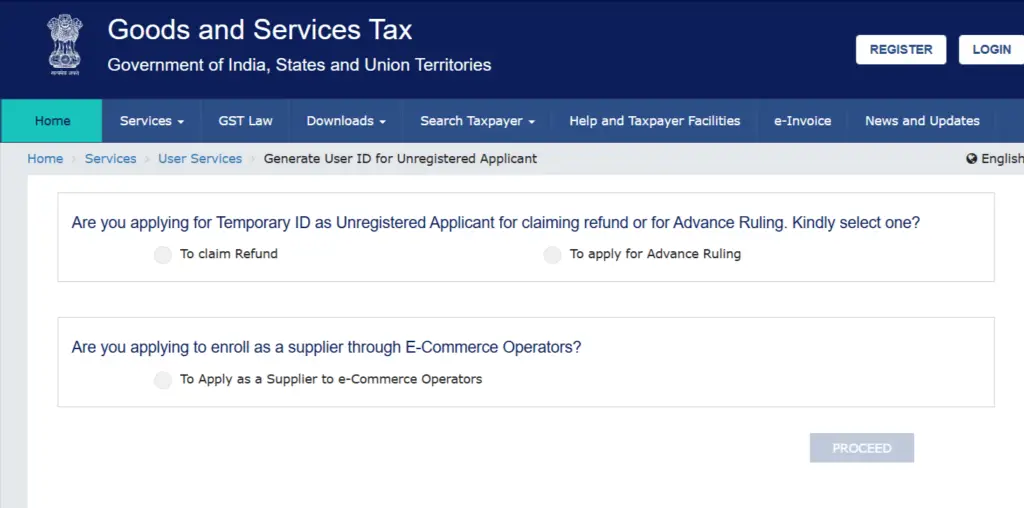

2. Temporary ID for filing Refund application/Advance Ruling : It is issued to those who are not liable to register under GST but either want to claim refund or file application for Advance Ruling. The Registration process for temporary id is comparatively easy.

For Example structure of temporary id 072500001678ARF, obtained for Advance Ruling is as follows

| Character | Description | Example |

| 1 to 2 | State Code | 07 |

| 3 to 4 | Year of registration of temporary id | 25 |

| 5 to 12 | 8 digit serial no. per year of Advance Ruling for that state | 00001678 |

| 13 to 14 | Purpose of obtaining temporary id ( “AR” for Advance Ruling) | AR |

| 15 | Check Digit (may be number/alphabet) | F |

Another Example of Temporary id is 242100000001RFZ which is for filing Refund application by Unregistered person (Section -54 & Circular 188), composition of which is as follows

| Character | Description | Example |

| 1 to 2 | State Code | 24 |

| 3 to 4 | Year of registration of temporary id | 21 |

| 5 to 12 | 8 digit serial no. per year of Advance Ruling for that state | 00000001 |

| 13 to 14 | Purpose of obtaining temporary id (“RF” for Refund application ) | RF |

| 15 | Check Digit (may be number/alphabet) | Z |

3. Enrollment ID for Suppliers of ECO : The Central Board of Indirect Taxes and Customs (CBIC) issued Notification No. 34/2023 – Central Tax on July 31, 2023 for small suppliers & composition dealers selling goods through Electronic Commerce Operators (ECOs) like Amazon, Flipkart & Meesho etc. To know more click here Everything about GST on Online Sellers of Amazon, Flipkart etc.

For Example structure of Enrollment id 292400000065EST is as follows

| Character | Description | Example |

| 1 to 2 | State Code | 29 |

| 3 to 4 | Year of registration (“24” for 2024) | 24 |

| 5 to 12 | 8 digit serial no. per year for enrollment id in that state | 00000065 |

| 13 to 14 | Type of unique registration (“ES” for unregistered supplier on ECO) | ES |

| 15 | Check Digit (may be number/alphabet) | D |