GST for Indian freelancers on Fiverr can be confusing, especially when you’re dealing with international payments, currency conversion, and platform commissions. This guide explains everything you need to know – GST registration requirements, export of services, FIRC, LUT filing, reverse charge mechanism and more. If you’re a Fiverr freelancer in India, this blog is your complete GST compliance checklist.

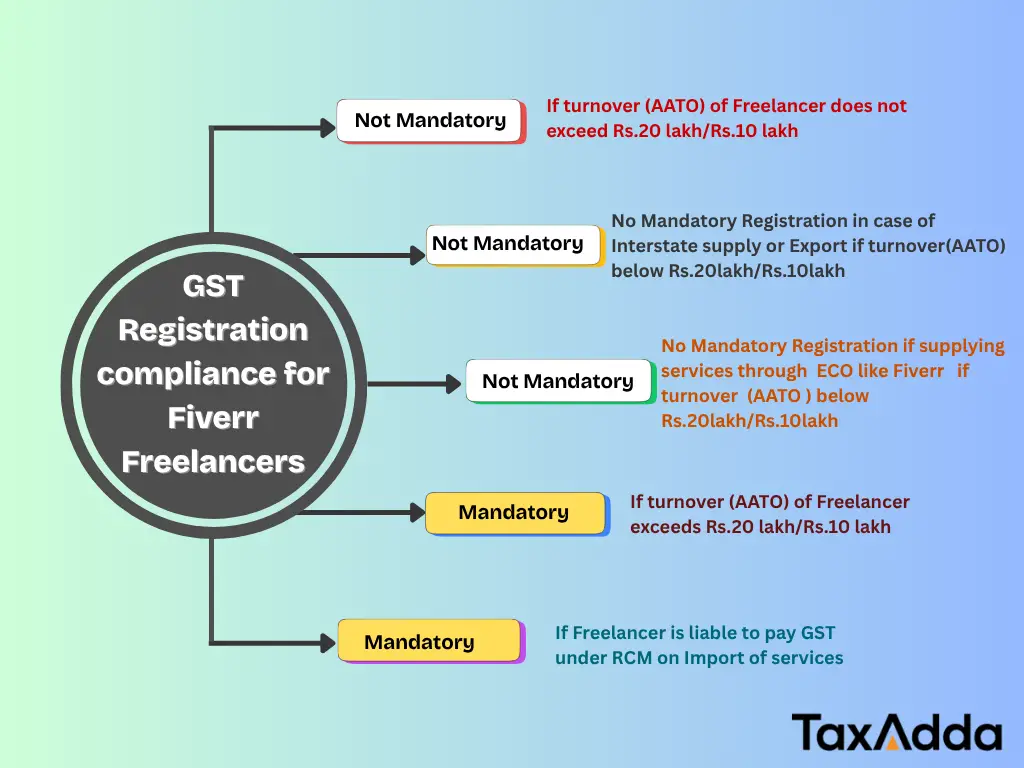

(A.) Do I need to register if my receipts are below Rs.20lakh/Rs.10lakh ?

Turnover threshold for GST Registration : A Freelancer is not required to register under GST if his aggregate turnover does not exceed Rs. 20 lakh (Normal states) & Rs. 10 lakh (Special category states) in a financial year, it is applicable even if you providing services to the clients located in same state, outside state or even outside India (i.e. export of services).

GST registration is mandatory if the turnover of Freelancer’s exceeds Rs.20 lakh for Normal category states & Rs. 10 lacs for special category states.

Important Note : This limit is for Annual Aggregate turnover (AATO) i.e. if you are also receiving any Rent, commission or any other Income which is not related to your Freelancing profession & even if it exempt under GST, will also be considered for calculating this overall turnover limit of Rs.20 Lakh/10 Lakh to check eligibility for GST Registration.

(B.) Is GST Registration mandatory if I give services to other states or other countries ?

No Mandatory Registration in case of Interstate supply or Export : Even if a freelancer provides interstate services (including export), he is not required to take mandatory GST Registration under GST under Section 24(i) provided he does not cross the registration turnover threshold of Rs.20lakh/10lakh.

Section 24(i) : GST registration is mandatory if a person is providing interstate supply of goods or services, irrespective of his turnover.

Special Exemption for Service Providers/Freelancers

A special Notification no. 10/2017 – IGST was issued to exempt the service providers if they are having turnover of less than Rs 20 Lakh/Rs.10 lakh for a financial year.

(C.) Is GST Registration mandatory if I give services through Global platforms/ECO like Fiverr ?

No Mandatory Registration if supplying services through Fiverr : Freelancers who are providing services through any ECO etc. are exempted from taking mandatory registration unless their turnover exceeds the registration threshold of Rs.20 lakh/Rs. 10lakh under GST.

Section 24(ix) : Every person who is supplying any goods or services through an e-commerce operator [except section 9(5)], is required to take mandatory registration, if such E-commerce operator is liable to collect TCS under GST u/s 52.

For this first we need to check whether Fiverr is liable to collect TCS u/s 52 of CGST Act, 2017 ?

Yes,Fiverr is liable to collect TCS & registered under GST as Tax collector. Fiverr has TCS GST Number for 28 states in India. For example TCS GSTIN of Fiverr for state of Maharashtra is 27AAECF3149G1C0

It is very important to note here that the TCS GST Number is different from the Normal GST Number.

Now, as Fiverr is registered as a TCS collector, it means every freelancer has to register mandatory even if he is providing services of Rs.1 ?

No, not mandatory if freelancer doesn’t cross the GST turnover threshold of GST.

Special Exemption for Service Providers/Freelancers

Service Providers working through any ECO liable to collect TCS are exempted from taking mandatory registration unless their turnover exceeds the registration threshold under GST via Notification 65/2017 dated 15 November 2017.

(D.) When does a freelancer need to register under GST due to reverse charge provisions?

According to section 24(iii) GST registration is mandatory irrespective of turnover threshold, if a person is required to pay GST under Reverse charge.

A freelancer providing services is need to register under GST when he is liable to pay GST under the Reverse Charge Mechanism (RCM). A Freelancer is liable to pay GST under RCM if he is receiving any services (except OIDAR services) from person located outside India. Notification No 10/2017 Integrated tax (Rate)

In other words if a Freelancer is liable to register under GST due to reverse charge provisions if he is doing import of services.

Freelancers need to check the nature of impot of services if it is OIDAR Services then Registration rules are different & if it is import of any other service (except OIDAR) then Registration rules vary.

| Import of Service | Purpose | Example | Is it Supply under Section 7(1)(b) of CGST Act ? | Recipient (Freelancer) | RCM applicable |

| Any service except OIDAR | Business | Online Business consultancy | Yes | Registered | Yes, RCM applicable |

| Any service except OIDAR | Business | Online Business consultancy | Yes | Unregistered | Yes, RCM applicable, mandatory GST Registration under RCM |

| Any service except OIDAR | Personal | Online beauty consultancy | Yes | Registered | Yes, RCM applicable |

| Any service except OIDAR | Personal | Online personal event management consultancy | Yes | Unregistered | Yes, RCM applicable, mandatory GST Registration under RCM |

| OIDAR Services | Business | Go daddy | Yes | Registered | Yes, freelancer will pay GST under RCM |

| OIDAR Services | Business | Go daddy | Yes | Unregistered | Go daddy will pay GST under forward charge |

| OIDAR Services | Personal | Canva pro | Yes | Registered | Yes, freelancer will pay GST under RCM |

| OIDAR Services | Personal | Canva pro | Yes | Unregistered | Go daddy will pay GST under forward charge |

How a Freelancer can calculate turnover threshold for GST Registration ?

To determine the applicability of GST Registration, it’s essential to understand how to calculate minimum annual turnover :

- Definition: Annual Aggregate Turnover (AATO) includes all taxable supplies, exempt supplies, exports, and inter-state supplies made by a Freelancer .

- Exclusions: It does not include supplies received under Reverse Charge,stock transfers between branches or taxes like CGST, SGST, UTGST, IGST, and cess.

For example, if a Freelancer has:

- Taxable supplies of services worth Rs.15 lakh on Fiverr

- Exempt supplies worth Rs.6 lakh

- Commission Income of Rs. 7lakh

- Taxable Rental Income of Rs. 4 lakh

The Total AATO would be

- 15+6+7+4 = Rs. 32 lakh

Since this amount exceeds Rs. 20 lakh (for services), registration would be required.

What is the GST registration threshold if a person supplies both goods and services?

When a person is supplying both goods and services, the lower threshold limit of the two will apply for GST registration purposes.

If Mr. A is based in Maharashtra and supplies:

- Goods worth Rs. 30 lakhs

- Services worth Rs. 12 lakhs

His total turnover = Rs.42 lakhs.

Although goods threshold is Rs.40L, services threshold is Rs.20L, so he must register for GST once aggregate turnover exceeds Rs.20L, because that’s the lower limit.

Benefits of taking Voluntary GST registration

Builds Professional Credibility

Registering under GST enhances your business credibility and trust in the eyes of clients—especially corporate and international ones. It shows that you’re running a legitimate, tax-compliant operation, which can be a key differentiator in competitive markets like freelancing.

Enables Work With Bigger Clients & Corporates

Many companies only work with GST-registered vendors, as they need GST invoices to claim input tax credit. Having a GSTIN opens up opportunities to work with larger businesses, agencies, or foreign clients, especially via platforms like Upwork or Fiverr where compliance is a requirement.

Input Tax Credit (ITC) Benefit

If you incur GST on purchases like laptops, software, internet bills, or office rent, voluntary registration allows you to claim input tax credit. This can help reduce your effective tax liability and overall costs, which is highly beneficial for growing freelancers.

Smooth Expansion Across States

With GST registration, you can freely offer services across India without facing state-specific compliance issues. This is especially useful if you plan to scale your freelancing into a full-fledged business or hire subcontractors from other states.

Eligible for Refunds on Export of Services

If you export services (e.g., work for clients outside India), you may be eligible to claim a refund of GST paid on input services under the LUT (Letter of Undertaking) mechanism or on a zero-rated supply basis. This can improve cash flow and reduce your effective tax burden.

Better Record-Keeping and Financial Discipline

GST returns (monthly/quarterly) encourage regular invoicing, bookkeeping, and structured financial reporting. This builds a strong foundation for credit, loan applications, or income tax compliance in the future.

Note : You can voluntarily register under GST even with zero turnover, and later cancel the registration if it’s no longer needed.

For freelancers aiming to grow professionally, work with bigger clients, or simply run a clean, scalable operation—voluntary GST registration is a smart move. While it comes with some compliance responsibilities, the benefits often outweigh the costs, especially as your freelancing career evolves.