Freelancing in India has grown rapidly, with platforms like Fiverr enabling professionals to offer services globally. But as income grows, so does the need for tax compliance, especially under the Goods and Services Tax (GST) regime. If you’re an Indian freelancer registered under GST and working on Fiverr, understanding how GST applies to your services is crucial. From export classification and invoice requirements to refund eligibility and LUT filing, this blog explains how GST works for Indian freelancers who are registered under GST or liable to register under GST & selling services on Fiverr, ensuring you’re compliant while maximizing your tax benefits.

How GST works for Indian freelancers selling services on Fiverr

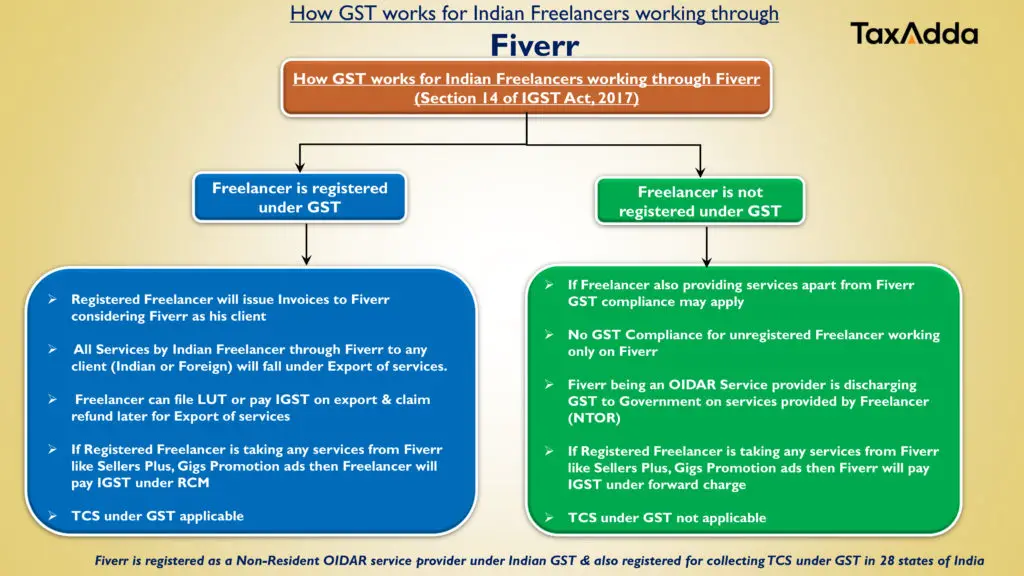

If you are a Freelancer registered under GST and selling your services through Fiverr, you must know following :

- All services provided by you through Fiverr (to Indian or foreign clients) qualify as Export of Services.

- You must issue invoices to Fiverr considering Fiverr as your client.

- You can enjoy GST benefits by filing LUT or paying IGST and claim a refund for export services.

- If you are taking services like Sellers Plus or Gigs Promotion, you need to Pay IGST under RCM & do Self Invoicing.

- You are required to file GST Returns

- You are required to check in beginning of each financial year whether E-Invoicing is applicable for you or not.

- As TCS under GST is applicable for GST registered Freelancers, claim the credit in your GST Return

Selling on Fiverr & confused whether you are liable to register under GST or not , Read this guide to clear all your doubts GST Registration guide for Indian Freelancers working on Fiverr

LUT Compliance for Freelancers on Fiverr

Freelancers in India offering services to both Indian & Foreign clients through Fiverr, are treated as Export of services under GST. To avoid charging GST on such exports, freelancers must file a Letter of Undertaking (LUT) annually on the GST portal.

You can file it online on the GST portal once you logged into your account. An LUT is filed for a whole financial year (01st April to 31 March). You need to file LUT for each financial year separately. You are allowed to do export without payment of GST only once you file the LUT. So, for example, if you file LUT for running financial year (i.e. 24-25) on 09 Nov 24 then you are required to pay GST on all the export sales made during the period 01 Apr 24 to 08 Nov 24 and you are allowed to export without payment of GST for the period 09 Nov 24 to 31 Mar 25.

Note – Right now, GST portal provide the functionality to file the LUT for the current running year as well as for next financial year in advance. So, for example, on 09 Nov 24, you are allowed to file the LUT for FY 24-25 as well as for FY 25-26.

Invoicing for Freelancers working on Fiverr

Before understanding Invoicing for Fiverr Freelancers, we need to understand GST Model of Fiverr. Fiverr is Registered as Non- Resident OIDAR service provider under Indian GST with GSTIN 9924ISR29001OSH. Fiverr issues Invoices to all Clients (Domestic & Global) in its own name showing Fiverr as the Service Provider (OIDAR) to the Client (end user) without mentioning any single detail of Freelancer (Actual supplier) according to first proviso of section 14 of IGST Act, 2017.

Fiverr does not issue invoices on behalf of freelancers , nor it shares buyer’s billing information with freelancers to issue invoices for the purchases made from their Gig.

However, Freelancers who are registered under GST are required to issue invoices to Fiverr to report their earnings in GST Returns.

Make sure you mention in your Invoice about LUT

The Freelancers who are registered under GST can use below format for issuing GST compliant Invoices

Click here to download the format of Invoice to be raised by registered Freelancer to Fiverr

Self Invoicing by Freelancers under RCM

When a freelancer uses services like

- Seller Plus

- Fiverr Ads

If Freelancer registered under GST is liable to pay GST under RCM on above services provided By Fiverr. For this Freelancer needs to do self invoicing & pay GST under RCM in cash. According to Rule 47A of CGST Rules, 2017, a self-invoice must be generated within 30 days from the date of receipt of goods or services from an unregistered supplier.

Note : If Freelancer is unregistered then Fiverr will issue invoice to freelancer by charging 18% GST. Fiverr being OIDAR service provider & unregistered freelancer will be NTOR (Non taxable online recipient)

Check applicability of E-Invoicing

According to GST Notification 10/2023-Central Tax dt. 10-May-2023 E-invoice generation is mandatory for those Taxpayers having Annual average turnover of Rs.5 crore in any of the financial years starting from 2017-18 to 2024-25 w.e.f. 01 Aug 2023 from 01 Apr 2025, even if turnover is reduced in the current financial year. So you need to check turnover at the end of each financial year to check the applicability of E-Invoicing from the coming Financial year(if not applicable before). If e-invoicing is applicable it can not become inapplicable in later years because of turnover threshold. Presently E-invoice is applicable for Business to Business(B2B), Business to Government (B2G) & Export supply transactions only.

As you are issuing all your Invoices to Fiverr, so It will be a B2B supply & E-Invoicing will be applicable if your Annual average turnover of Rs.5 crore as explained above.

Payment of GST if LUT not filed

As a GST registered Freelancer you need to pay IGST on services provided by you on Fiverr. Due date for payment of GST is 20th of the next month if you opt for Monthly filing of return. if you opt to file Quarterly GST return under QRMP Scheme the due date for payment is 25th of next month for first two months & for last month of the quarter it is due date to file quarterly return. Monthly & Quarterly filing of GST Returns is explained in next section.

Important : As services provided by you are Export of services, you can claim refund of IGST paid.

Filing of GST Returns (Monthly or Quarterly)

There are no special provisions regarding GST returns for Fiverr Freelancers. Persons with turnover up to Rs. 5 crore can file GST returns on quarterly basis. However, if your turnover is more than Rs 5 crore then it is mandatory to file GST returns on monthly basis.

An annual return is also required to be filed in Form GSTR-9. This return is mandatory for the registered person have a turnover of above Rs 2 crore. Additionally, if the turnover exceeds Rs 5 crore, then a separate reconciliation statement is required to be filed in GSTR-9C.

You can check due dates of GST return in our TaxAdda – Tax calendar .

Late fee for non compliance of GST return is different for various returns. For GSTR 1 & GSTR 3B it is Rs.50 per day per return subject to maximum limit based on turnover of freelancers. For Nil GSTR 1 & GSTR 3B it is Rs.20 per day subject to maximum of Rs.500.You can check late fees/penalty on delayed filling of various GST Returns in detail from our article Late Fees For Various GST Return.

Note : Composition Scheme under GST is not available to Fiverr Freelancers as their services are treated as Export of service which is not allowed under Composition scheme.

Other Important Points

How Fiverr releases payment to Freelancers

Fiverr Mostly uses Paypal to make payment to Freelancers. Other methods which Fiverr use include Bank transfer via payoneer, Fiverr revenue card etc. When clients make orders, they pay Fiverr. Once that order is completed, 80% of the funds (excluding GST) are applied to Freelancer’s account. Fiverr does not charge a withdrawal fee, but PayPal/Payoneer charge their payment gateway fee.

For Example : A freelancer in India receives a payout of $500 from a client via Fiverr. Fiverr charges a 20% commission ($100), Hence Freelancer receives $400 in his account.

What a Fiverr Freelancers will report in GST Returns

All services provided by Indian Freelancer through Fiverr will qualify as Export of Services irrespective of whether it is provided to Indian Client or Foreign Client. For the GST purpose Freelancer is providing services to Fiverr, who is a Non-Resident Entity, So It will be considered as Export of services.

Freelancer will report Gross amount including commission by Fiverr, Paypal charges & TDS in his GST Returns.

How to calculate GST if I didn’t file LUT & paying GST

You have to charge GST on Gross value as explained in above section. The rate of GST is 18% for most of the freelancing services. You can also use TaxAdda – Online Free GST Calculator to determine the amount of GST payable on your services.

Export of Services

For export of services, you are not required to charge GST if you have filed Letter of Undertaking (LUT). If you have not filed LUT then you have to charge GST, and thereafter you may apply for refund of such GST paid by filing GST Refund forms. LUT is a very simple form which doesn’t require many details, so it is advised to file LUT rather than going for the refund route.

Prerequisite condition for export of services: –

- Client is located outside India.

- Person providing services is located in India.

- Payment must be received in convertible foreign currency. This doesn’t mean you must receive foreign currency in your bank account. Generally, payment is received in dollars by bank and they convert it to Indian rupees and transfer to your account. This will also be considered as an amount received in foreign currency but you must have Foreign Inward Remittance Certificate (FIRC) for the transaction.

To know more on GST Return reporting by Fiverr freelancer, FIRC, LUT & refund please read GST for Freelancers (2025): Registration, GST Rates, Rules & Exemption

FIRC & E-BRC

You must have Foreign Inward Remittance Certificate (FIRC)to prove that the payment has been received in foreign convertible currency, which is a necessary condition for treating it as an export of services.

FIRC is provided by your bank (in case of wire transfer). Generally the bank emails you FIRC at the time of crediting wire transfer into your account. If the payment has been received by international payment gateways like Paypal or Payoneer or Stripe etc then you have to collect FIRC from these payments gateway. Payoneer and Stripe provide you FIRC along with the payment. Beginning from February 2021, PayPal has also started to provide your FIRC freely for all of your payments.

A Bank Realisation Certificate (BRC) is a document that serves as verification of a company’s international exporting activities. This paper is essential for a client who wishes to trade benefits under the foreign trade policy in India. The e-BRC is a digital version of the certificate. Now the Exporters can generate & self certify their BRC w.e.f 15 November,2023 Trade Notice 33/2023 dated 10-11-2023.

TDS (withhold tax) by Fiverr on Freelancer’s earning

Freelancer earning through Fiverr in India, you should know about TDS (Tax Deducted at Source) under Section 194O of the Income Tax Act. Fiverr, being an online platform (or e-commerce operator), is required to deduct 0.1% TDS on your total earnings before sending the payment to you. This deducted amount is shown in your Form 26AS or AIS, and you can claim it as a tax credit while filing your income tax return. However, if you don’t provide your PAN, Fiverr may deduct TDS at a higher rate of 5%. So, always update your PAN in Fiverr records to avoid extra deductions.

TCS under GST by Fiverr

If you’re a freelancer providing services through platforms like Fiverr, it’s important to understand the concept of TCS (Tax Collected at Source) under the Goods and Services Tax (GST) regime in India.

What is TCS under GST?

TCS stands for Tax Collected at Source, and under GST, it applies to e-commerce operators (ECOs) like Fiverr. As per Section 52 of the CGST Act, ECOs are required to collect 0.5% TCS (0.25% CGST + 0.25% SGST or 0.50% IGST) on the net value of taxable services provided through their platform.

This means, if you’re a freelancer selling services through Fiverr and you are registered under GST, Fiverr will deduct 0.5% of your earnings as TCS before releasing the payment to you.

How is TCS Reflected for Freelancers?

Fiverr deposits the collected TCS to the GST department under your GSTIN. This amount gets reflected in your GSTR-2A or GSTR-2B auto-drafted return on the GST portal. As a freelancer, you can claim this amount as Input Tax Credit (ITC) while filing your monthly GST returns.

Example:

If you earn Rs 50,000 through Fiverr, ₹Rs 250 (0.50%) may be deducted as TCS. This Rs 250 will appear in your GSTR-2A and can be claimed as credit while paying your GST liability.

What a freelancer needs to select in tax form of Fiverr for “How is your service taxed ?”

Taxable

If a Freelancer is registered under GST & providing taxable services. TCS under GST will be applicable at 0.50%

Export

Even if you are exporting services (to clients outside India), Fiverr may still deduct TCS due to its obligations as an ECO. Export of services under GST is zero-rated, meaning no GST is payable. However, TCS may still be deducted and you can still claim the TCS credit, or adjust it against future GST liabilities.

Reverse Charge

When a freelancer is required to pay GST under the Reverse Charge Mechanism, TCS does not apply, as Fiverr is considered the actual supplier of services instead of the freelancer—going beyond its role as just an e-commerce operator (ECO).

Exempt

If all services provided by freelancers on Fiverr are exempted or Nil rated under GST then this option is to be selected. No TCS is applicable on exempt supplies under section 52 of CGST Act.

Important points for TCS under GST

- The rate of TCS is changed from 10 July 2024 from 1% to 0.5%

- TCS is applicable only on taxable supplies u/s 52 of CGST Act.

- TCS is applicable only if you’re registered under GST.

- Fiverr deducts TCS at 0.5% on your net earnings.

- You can view and claim this TCS in your GSTR-2A/2B.

- Even for export services, TCS may be deducted.

- Regular reconciliation is crucial to avoid mismatches and ensure proper credit claim.