Income tax return filing process get completed once you verify your return. Verification of return can be done online (using Aadhaar one time password, EVC using net banking etc) or by sending the physical copy of ITR-V to the Central Processing Centre, Bengaluru, within 120 days from the date of filing of the return.

An un-verified return will be treated as invalid return by the department. It means no return has been filed by you for that assessment year. The assessee has to do the whole process again and re-file the income tax return again as a belated return.

As per Section 119(2)(b), Central Board of Direct Taxes (CBDT) may, if it considers it desirable or expedient so to do for avoiding genuine hardship in any case or class of cases, by general or special order, authorise any income-tax authority, not being a Commissioner (Appeals) to admit an application or claim for an exemption, deduction, refund or any other relief under this Act after the expiry of the period specified by or under this Act for making such application or claim and deal with the same on merits in accordance with law. Income tax department has been given wide authority as per above section to accept the request for condonation of delays on income tax e-filing portal.

How to request for condonation of delay in filing ITR-V online

A condonation request can be filed online by logging into the income tax e-filing portal.

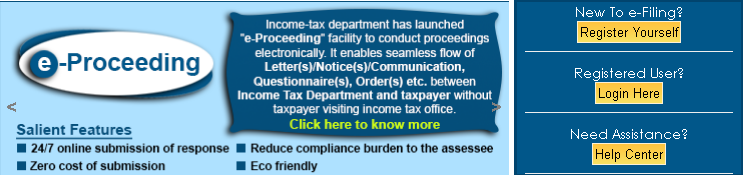

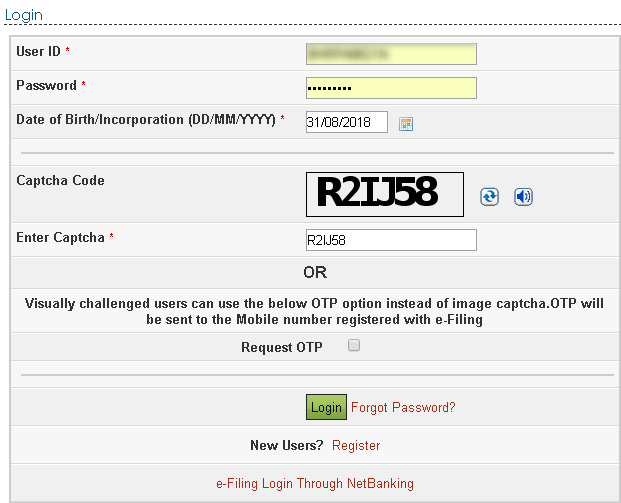

Step 1 – Visit https://www.incometaxindiaefiling.gov.in

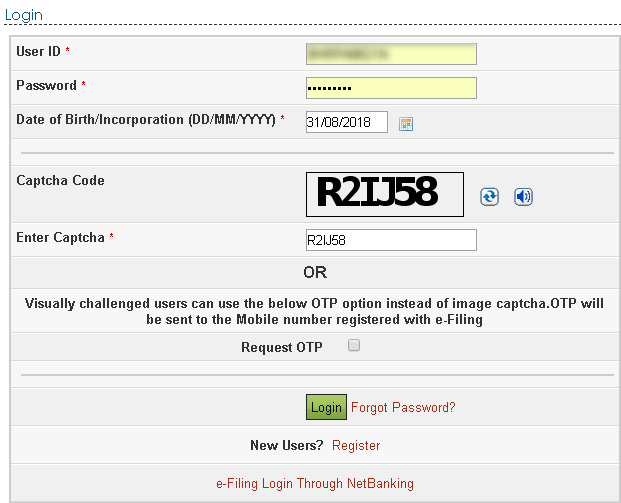

Step 2 – Select the option of Login here available under Registered User on the right-hand side panel of the website.

Step 3 – Login into your e-filing portal account.

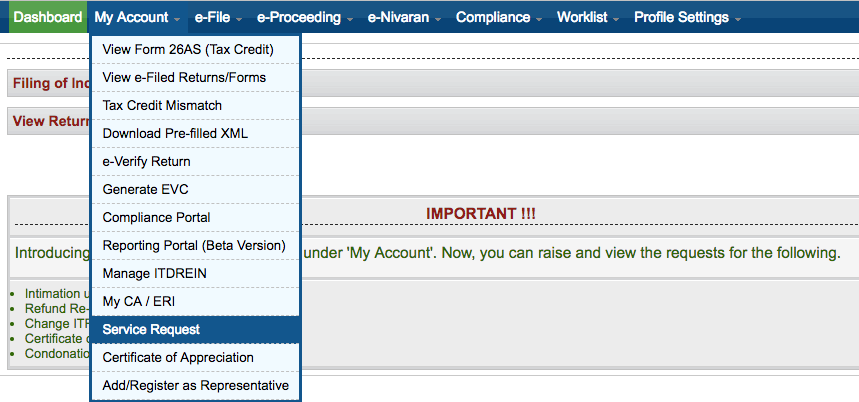

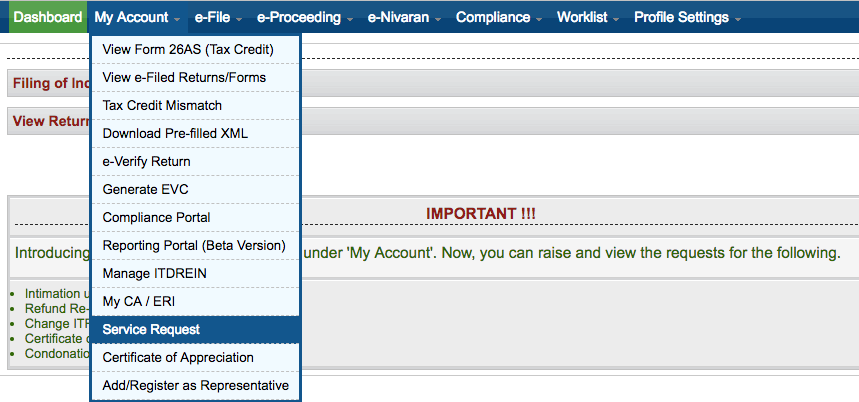

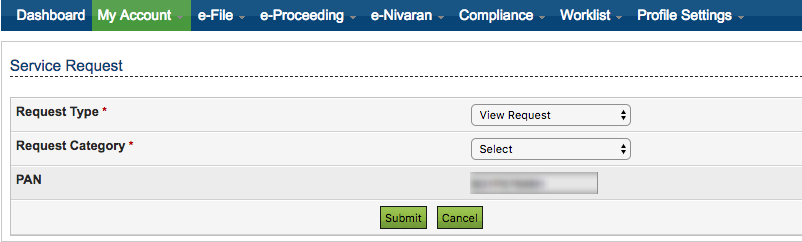

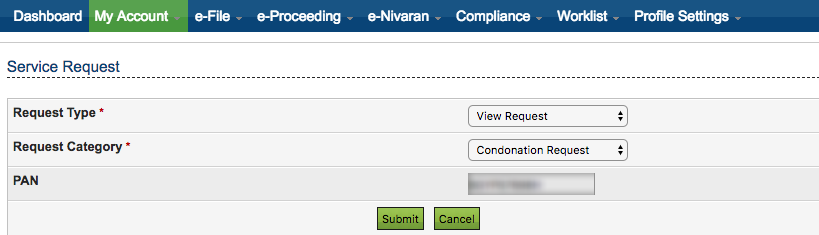

Step 4–Select the option of Service Request available under My Account.

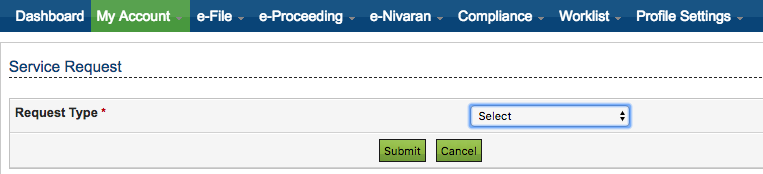

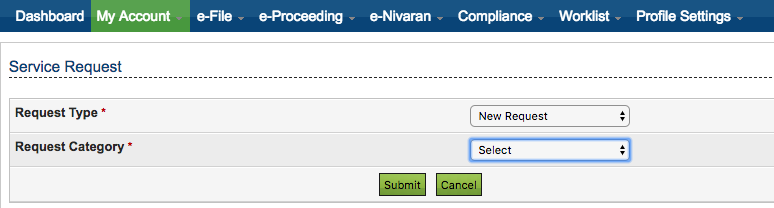

Step 5–Select the option of New Request under Request Type

Step 6–Select option of Condonation Request under Request Category and click Submit.

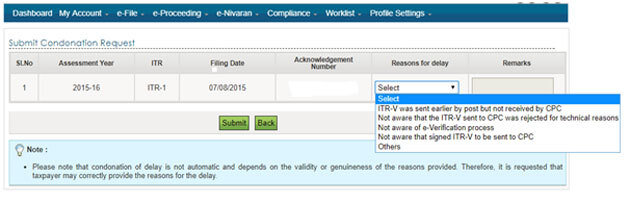

Step 7–On the next screen, you will have the listing of the relevant Assessment Year for which you can file condonation request.

Step 8–Select the relevant reason for the delay and click Submit. You will select any of the following reason for the delay: –

- ITR-V was sent earlier by post but not received by CPC

- Not aware that the ITR-V sent to CPC was rejected by technical reasons

- Not aware of the e-verification process

- Not aware that signed ITR-V to be sent to CPC

- Others (you are required to enter remarks if you select Others)

Step 9–A confirmation message shall be displayed which suggest that the request has been taken and forwarded for the approval.

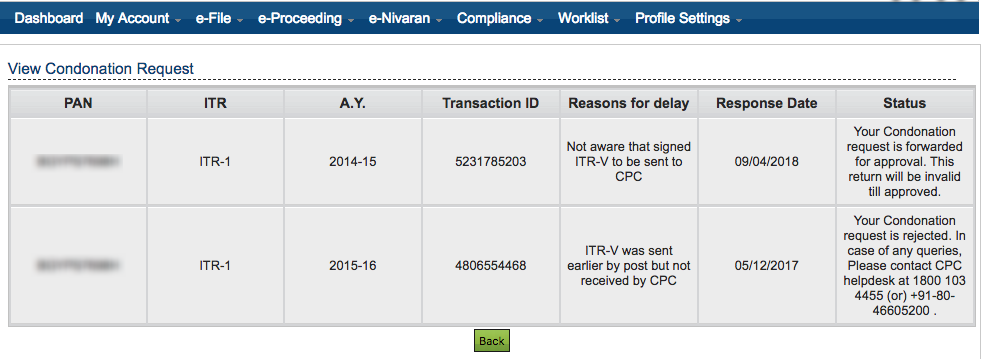

Tracking the status of Condonation request

Step 1 – Login into your e-filing portal account.

Step 2 – Select the option of Service Request available under My Account.

Step 3 – Select option of View Request under Request Type

Step 4 – Select option of Condonation Request under Request Category and click Submit.

Step 5 – On the next screen, you will have the listing of the condonation request filed along with their current status.

Time limit to file condonation delay request

No time limit has been defined for condonation request. However, it is suggestible to file condonation request as soon as you notice your mistake of not verifying ITR-V within 120 days of filing return.

Note: – In the following cases, you are also requested by Income Tax Department to file condonation request online for processing of return: –

- If the ITR-V received by CPC Bengaluru after 120 days then you will receive a communication from CPC suggesting to file condonation request electronically and return is subject to acceptance of condonation request.

- If you are trying to verify your return online then you are asked to submit condonation request at the same time.