Deductor can request a refund for excess TDS deposited by him via TRACES for the financial year 2007-08 onwards. An online utility is available for the Forms type 24Q, 26Q, 26QB, 26QC, 27EQ & 27Q.

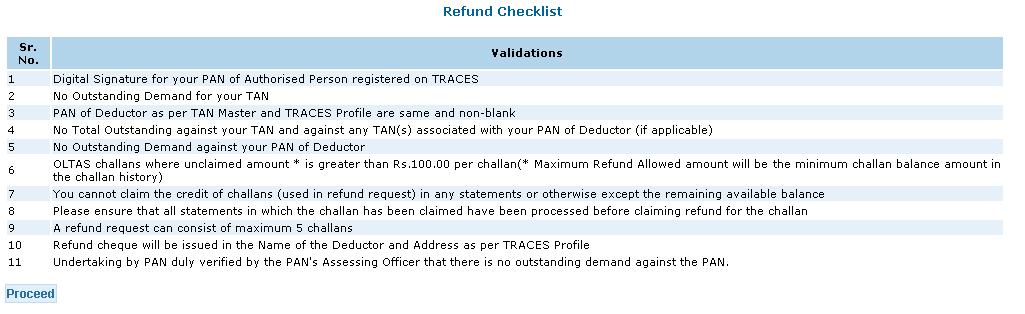

Checklist for filing raising refund request via TRACES for Form 26B

- Digital Signature should be registered for Authorised Person on TRACES

- No outstanding demand against the TAN/PAN of the deductor

- PAN of deductor as per TAN Master and TRACES profile is same

- No outstanding against your TAN and against any TAN(s) associated with the PAN of Deductor (if applicable)

- Refund can be requested only for those OLTAS challans where the unclaimed amount is greater than Rs.100.00 per challan.

- Maximum refund allowed amount will be the minimum challan balance amount in the challan history.

- You cannot claim the credit of challans (used in refund request) in any statements or otherwise except the remaining available balance

- All statements in which the challan has been claimed have been processed before claiming the refund for the challan.

Step by step guide to filing a request for refund

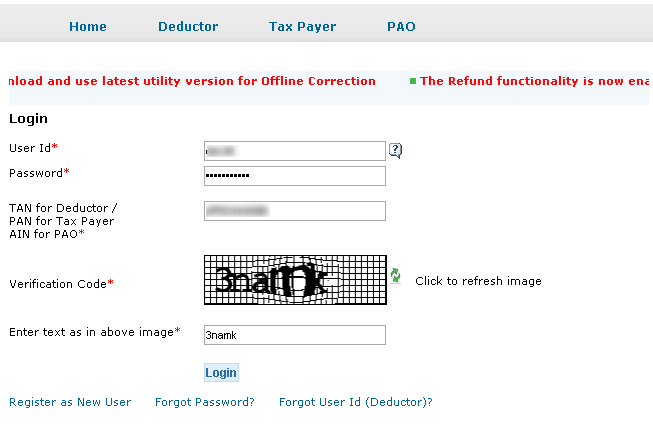

Step 1 – Login into Traces

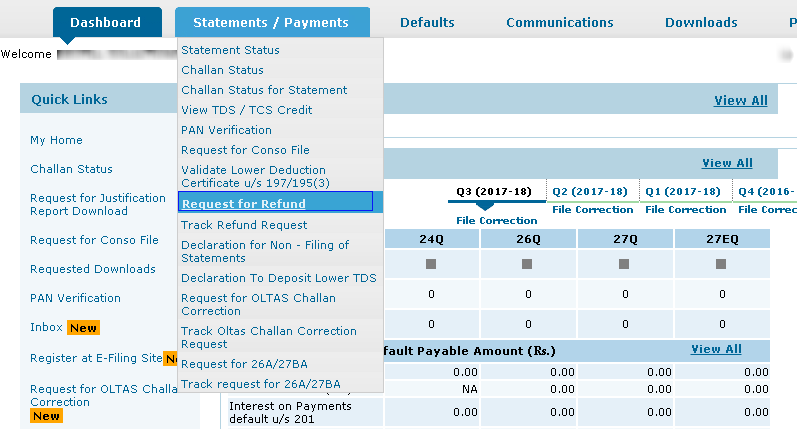

Step 2 – Select the option of Request for Refund under Statements/Payments

Step 3 – Click Proceed on the refund checklist.

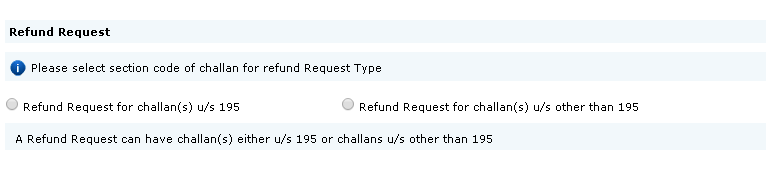

Step 4 – Select the type of challan for which refund is requested

- a) Refund request for challan(s) u/s 195

- b) Refund request for challan(s) u/s other than 195

A separate request is required for the challan u/s 195

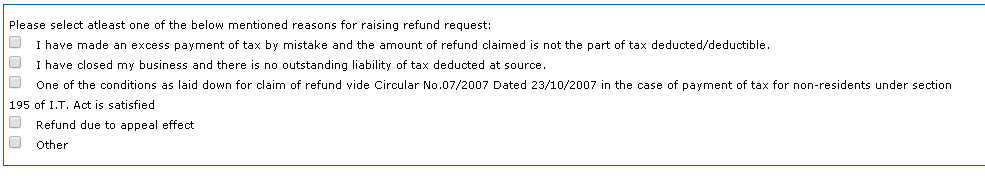

Step 5 – Select at least one reason from the below for raising refund request: –

- I have made an excess payment of tax by mistake and the amount of refund claimed is not the part of tax deducted/deductible.

- I have closed my business and there is no outstanding liability of tax deducted at source.

- One of the conditions as laid down for the claim of refund vide Circular No.07/2007 Dated 23/10/2007 in the case of payment of tax for non-residents under section 195 of I.T. Act is satisfied.

- Refund due to appeal effect

- Other

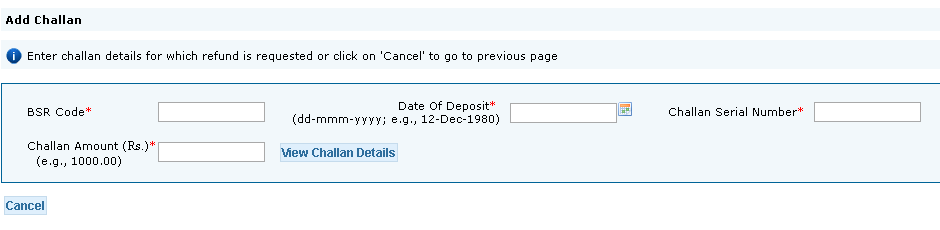

Step 6 – Click on View Challan Details after entering the challan details against which refund is requested.

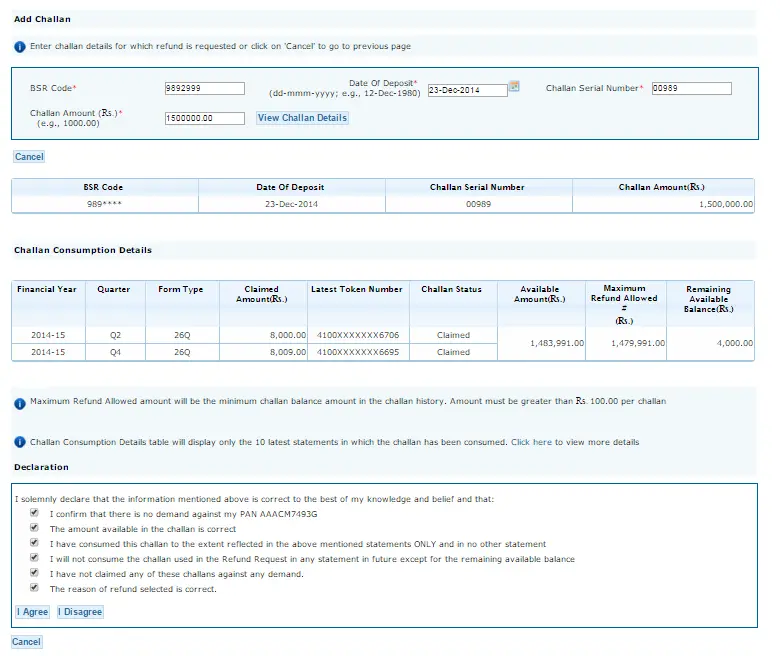

Step 7 – Review the details shows for the challan and the consumption (if any). Confirm all the checkboxes and click on I Agree to proceed ahead with the request.

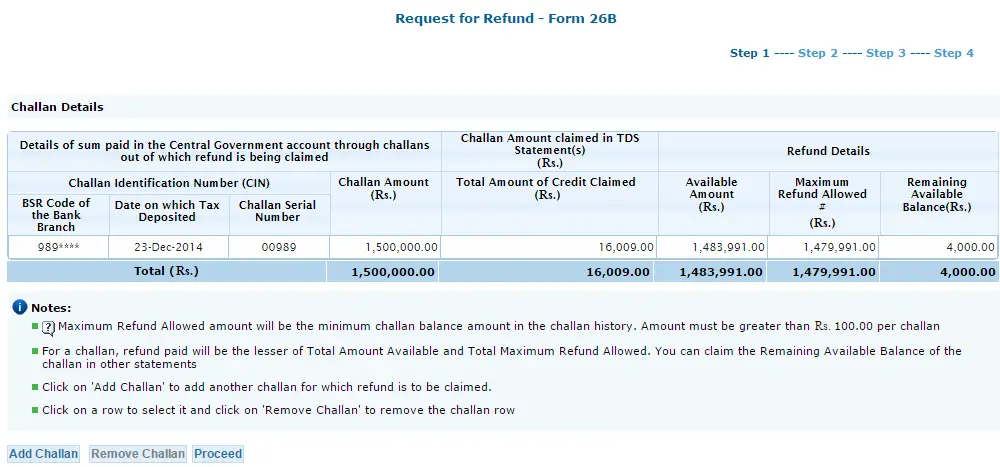

Step 8 – Challan will get added to the request. You can have the maximum of 5 challans per request. Click Proceed once all the challan is added.

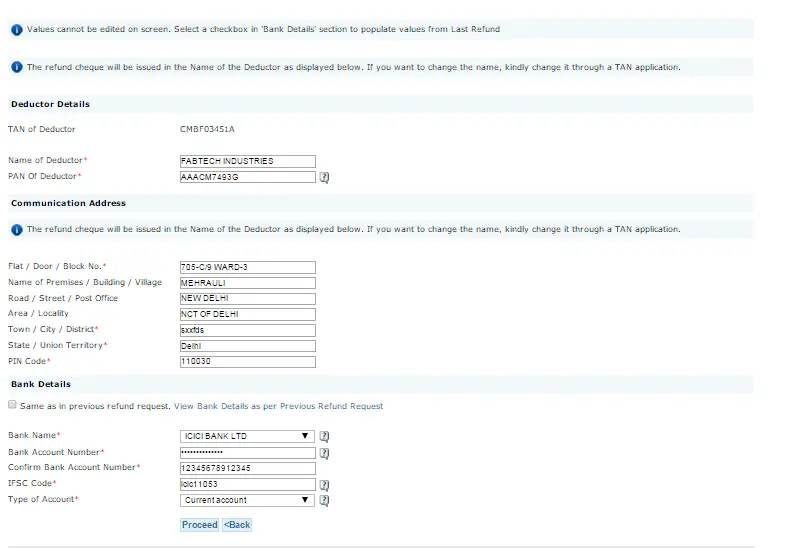

Step 9 – Review the name and communication address of the deductor show as per the TRACES profile. Enter the following bank details in which refund is requested: –

- Bank Name

- Bank Account Number

- IFSC Code

- Type of Account

Note: – Refund cheque will be issued in the Name of the Deductor and Address as per TRACES Profile. Refund will be sent to deductor by cheque if refund amount is more than 50,000 else it will be transferred to the bank account which deductor mentions at the time of submitting the refund request.

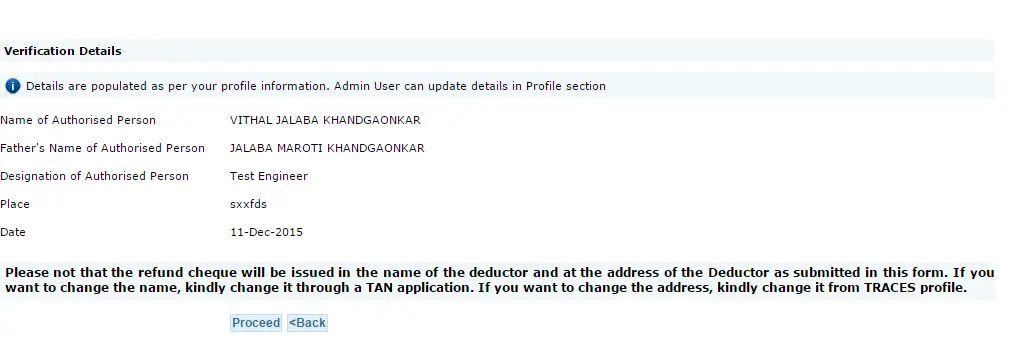

Step 10 – Verification details will be displayed of the user along with the Proceed button for final submission. Click on Proceed for submission or Back to cancel or make any changes in the refund request.

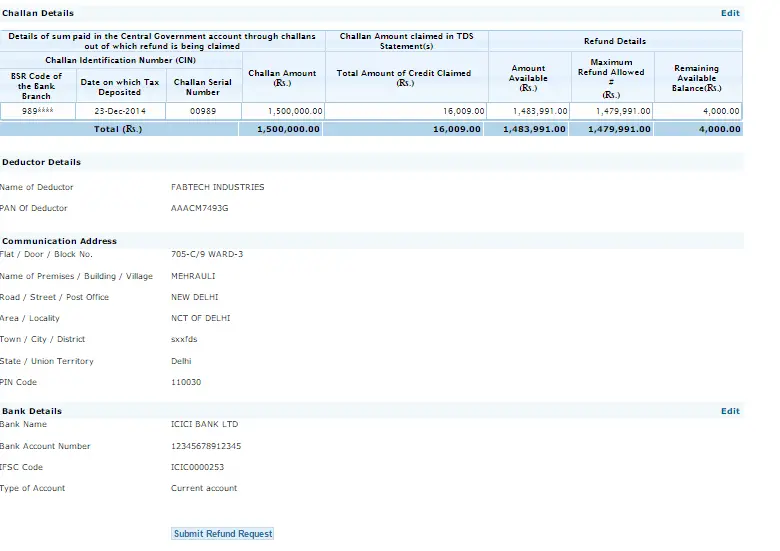

Step 11 – Review the summary shown on the screen for the refund request and click on Submit Request Refund. If you want to edit any details then click on Edit button available for specified section.

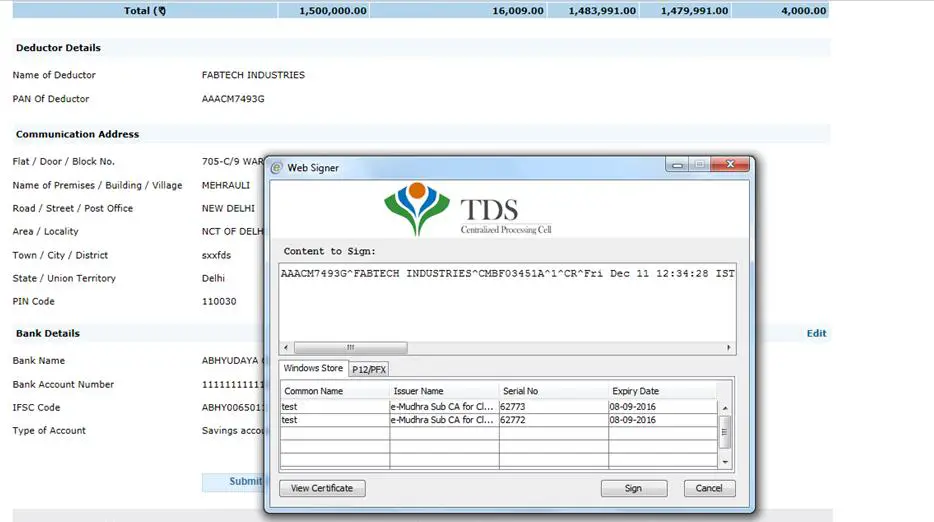

Step 12 – Sign the application using the digital signature.

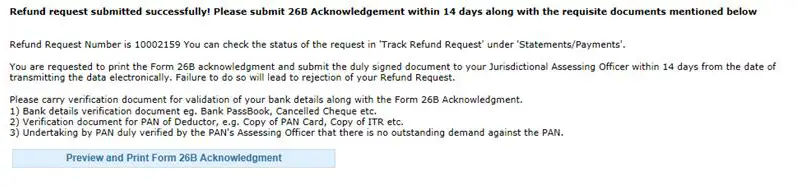

Step 13 – Print the acknowledgment generated for Form 26B.

Step 14 – Furnish this Form 26B acknowledgment to your Jurisdictional Assessing Officer within 14 days from the date of transmitting the data electronically. Failing to do so will lead to rejection of your refund request.