Every person responsible for deduction of tax shall file quarterly TDS return as per section 200(3) of Income Tax Act, 1961. However no TDS return is required to be filed if TDS is not required to be deducted during that quarter.

Due to this, the Income Tax Department has been finding it difficult to differentiate between below types of deductors:-

- Deductors who are required to file TDS return and has not filed.

- Deductors who are not required to file TDS return due to NIL TDS

So, Department introduced a new functionality in the TRACES, for filing a declaration of non-filing of TDS statement beginning from Financial Year 2013-14 onward. This functionality has been introduced way back in 2013 but still lots of assessee are not aware of this and skip TDS return without filing any declaration which leads them to intimation or show cause notice from the Department for non filing of TDS return.

Also Read – Procedure for Online Submission of Statement of TDS/TCS

Step by step guide to file declaration of non-filing of TDS statement

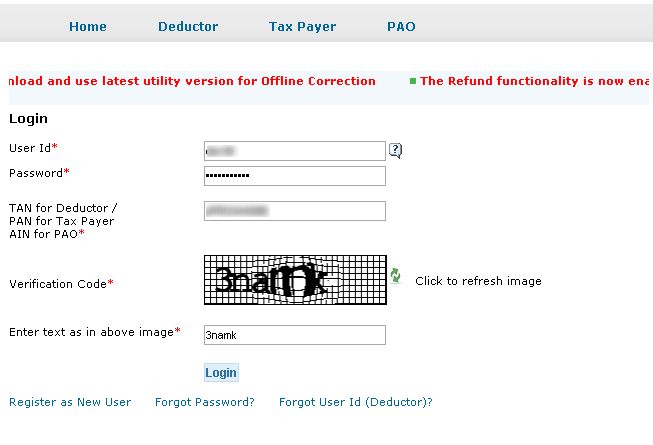

Step 1 – Login into Traces

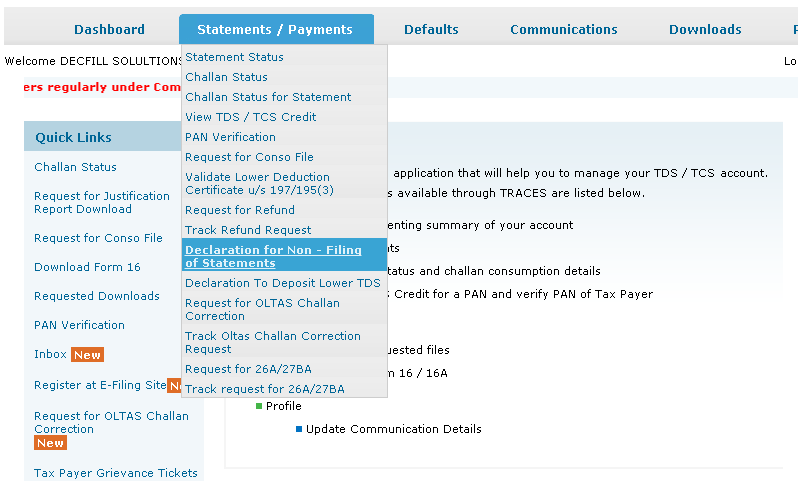

Step 2 – Select the option of Declaration for Non-filing of Statement under Statements/Payments

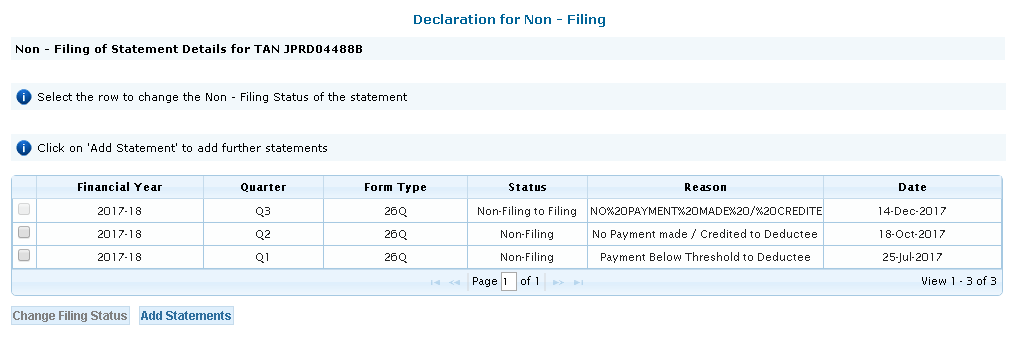

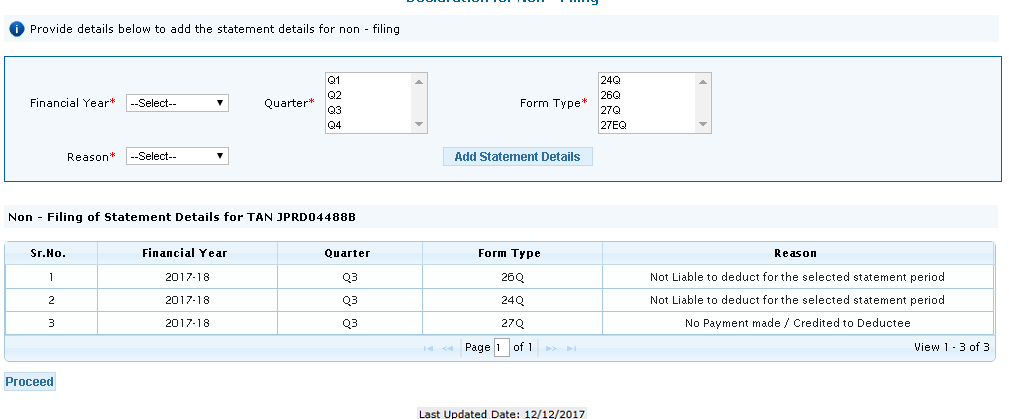

Step 3 – Click on Add Statements

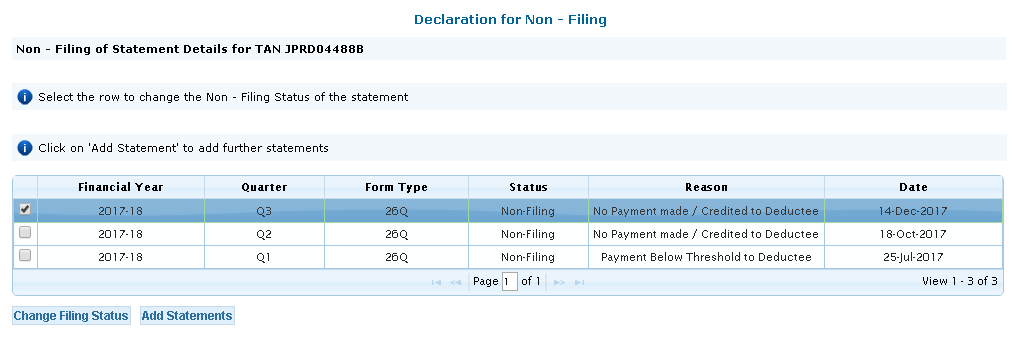

The above page also shows all the declaration previously filed for Non-filing of statement.

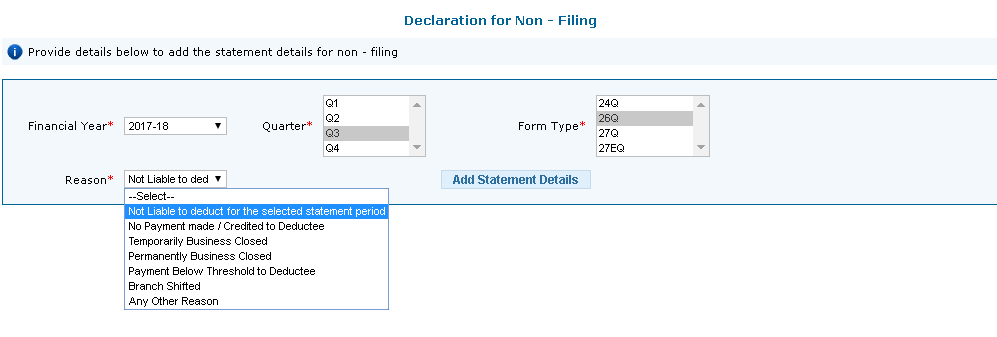

Step 4 – Add details for Non-filing of Statement

Select the financial year, quarter, form and relevant reason for declaration. You can select any one of the following reason:-

Select the financial year, quarter, form and relevant reason for declaration. You can select any one of the following reason:-

- Not liable to deduct for the selected statement period – When you are not required to deduct any TDS under the Income Tax Act 1961.

- No payment made/Credited to Deductee – When no payment has been made or credited to the deductee.

- Temporarily business closed – When the business is temporarily closed

- Permanently business closed – When the business is permanently closed

- Payment below threshold to Deductee – When the payment made or credited is below the threshold limit

- Branch shited – When the branch is shifted

- Any other reason – You are require to enter the reason (apart from the reason which are not available above) if you select this option.

You can also file multiple declaration in a single time by clicking on option of Add Statement Details.

Step 5 – Click on Proceed

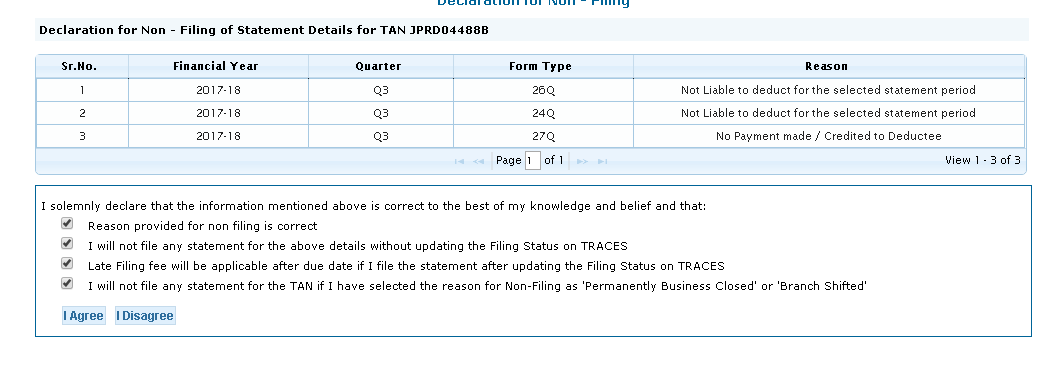

Step 6 – Click on I Agree

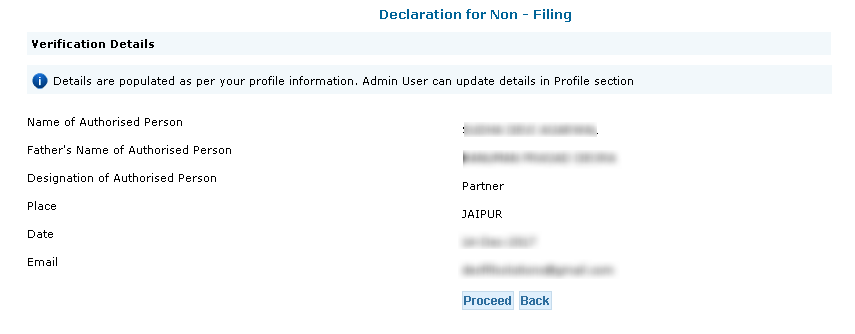

Step 7 – Click on Proceed

Step 7 – Click on Proceed

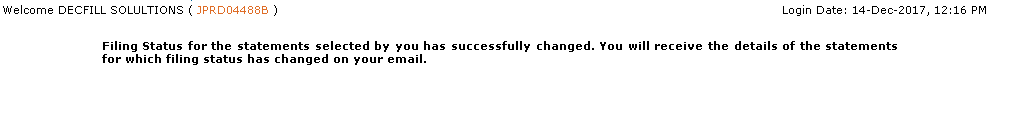

Step 8 – Confirmation message shown for Non-filing of Statement

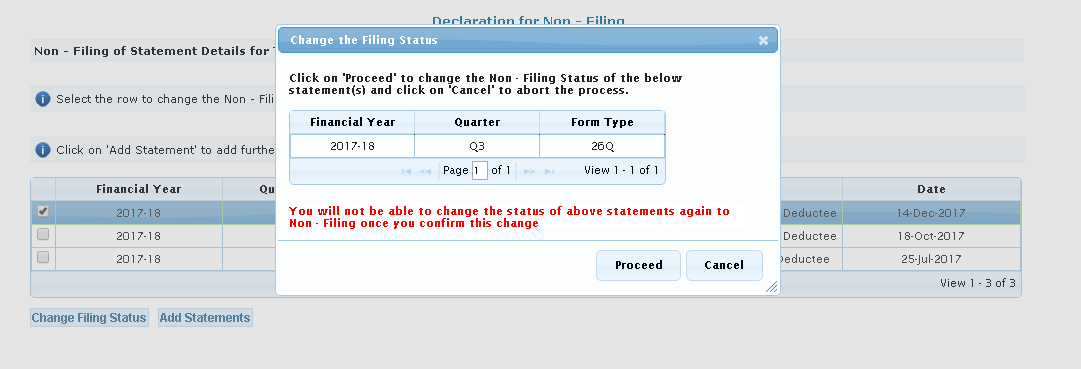

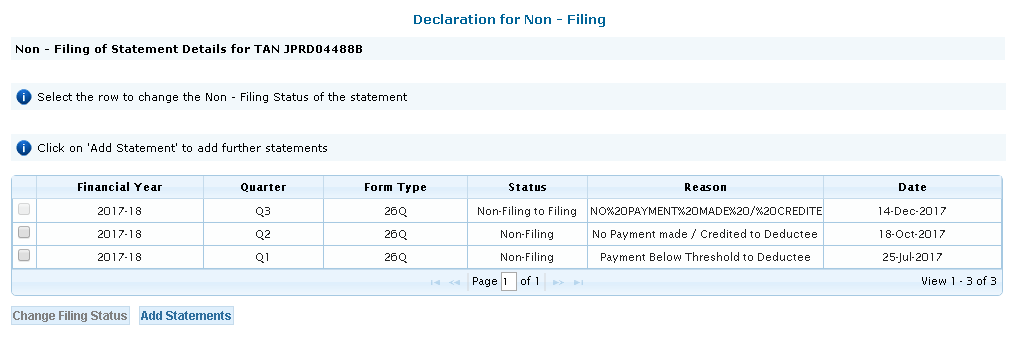

Traces also provide a functionality to revert the declaration of Non-filing of Statement. This is required if user want to file TDS statement for which declaration of Non-filing has already been done. Also user cannot re-file declaration for Non-filing of Statement, once user revert the status of declaration for that period statement.

Traces also provide a functionality to revert the declaration of Non-filing of Statement. This is required if user want to file TDS statement for which declaration of Non-filing has already been done. Also user cannot re-file declaration for Non-filing of Statement, once user revert the status of declaration for that period statement.

Step by step guide to revert declaration of non-filing of TDS statement

Step 1 – Select the statement for which you want to change Non-filing status.

Step 2 – Click on Change Filing Status option and select Proceed.

Step 3 – The next screens show the change in status from Non-Filing to Filing.

Note :- You cannot revert the status of declaration if you select Permanently business closed or Branch shifted as reason for Non-filing of statement.

Also Read – Online Correction Facility to Add/Modify Deductee in TDS Return