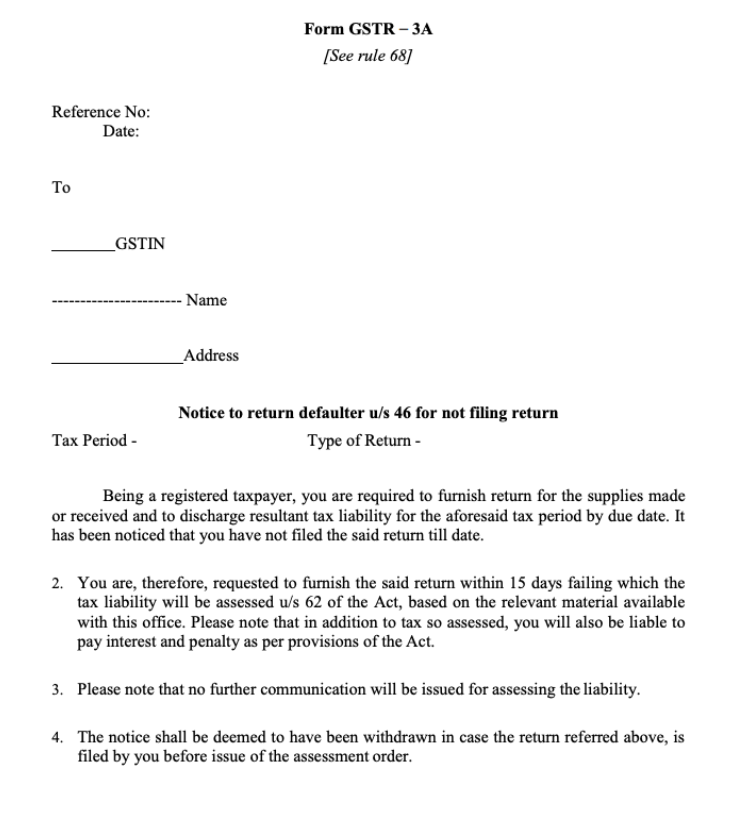

New standard procedures issued by the CBIC requires the proper officers to issue a notice under GSTR-3A within 5 days of due date of return. As per Section 46 of CGST Act, a period of 15 days is to be given to taxpayer to file returns. If the taxpayer still not files the returns within 15 days of notice, the officer can do best judgment registration under Section 62 of CGST Act.

Best Judgement Assessment under Section 62

A person who fails to file returns under Section 39 (monthly and quarterly returns) or Section 45 (final return) even after service of notice under Section 46 in Form GSTR-3A, the proper officer may proceed to assess the tax liability to the best of his judgment.

The order can be passed within 5 years from the due date of filing the annual return as per Section 44 for the year to which the tax not paid relates.

He has to take into account all the relevant material which is available or which he has gathered and issue an assessment order. For the purpose of assessment, the proper officer may take into account, Form GSTR-1 and Form GSTR-2A, information available in e-way bills or any other information available.

Such an assessment is to be made in Form GST ASMT-13. A summary thereof shall be uploaded electronically in FORM GST DRC-07 specifying therein the amount of tax, interest, and penalty payable by the person chargeable with tax.

In case defaulter furnishes return within 30 days of service of assessment order in Form GST ASMT-13, the said assessment order shall be deemed to be withdrawn. If the said return remains unfurnished within the statutory period of 30 days from the issuance of an order in FORM ASMT-13, then the proper officer may initiate proceedings under section 78 and recovery under section 79 of the CGST Act.

Liability for payment of interest and payment of late fees will continue even if returns are filed within 30 days and the assessment order is withdrawn.

Deputy/Assistant Commissioner of Central Tax has been designated as ‘proper officer’ for the purpose of assessing tax liability with best judgment- CBE&C circular No. 3/3/2017-GST dated 5-7-2017.

GSTR-3A Format

Assessment of Unregistered Person

If a person

- fails to obtain registration if he is liable to take registration or

- whose registration has been canceled under Section 29(2) but liable to pay tax

The proper officer shall issue a notice to a taxable person in FORM GST ASMT-14 containing the grounds on which the assessment is proposed to be made on best judgment basis and shall also serve a summary thereof electronically in FORM GST DRC-01. 15 days will be given to the person to furnish a reply. After 15 days, the officer passes an order in FORM GST ASMT-15 and summary thereof shall be uploaded electronically in FORM GST DRC-07.

Summary Assessment

The proper officer may assess the tax liability of such taxable person to the best of his judgment for the relevant tax periods.

The order can be passed within 5 years from the due date of filing annual return as per Section 44 for the year to which the tax not paid relates.

An opportunity of being heard is required to be given before passing such an order.

Summary assessment is permissible only to protect the interest of revenue if delay is likely to adversely affect revenue. Summary assessment is exceptional power.

The proper officer may, on any evidence showing a tax liability of a person coming to his notice, with the previous permission of Additional/Joint Commissioner, proceed to assess the tax liability of such person to protect the interest of revenue. He will issue an assessment order, if he has sufficient grounds to believe that any delay in doing so will adversely affect the interest of revenue- section 64(1) of CGST Act.

The order of summary assessment shall be issued in FORM GST ASMT-16 and a summary of the order shall be uploaded electronically in FORM GST DRC-07.

If the taxable person to whom that liability pertains is not ascertainable and such liability pertains to supply of goods, the person in charge of such goods shall be deemed to be the taxable person liable to be assessed and pay tax and any other amount due.