Why Should You Consider Both Health & Life Insurance?

Relying on just one policy is no longer enough to secure your financial future. Health expenses can arise suddenly, while life remains unpredictable. Whether you’re starting or planning for your family’s future, both health insurance plans in India and life insurance offer essential protection. This blog explains the key differences between them, why they work […]

GST Compliance for Freelancers selling on Fiverr

Freelancing in India has grown rapidly, with platforms like Fiverr enabling professionals to offer services globally. But as income grows, so does the need for tax compliance, especially under the Goods and Services Tax (GST) regime. If you’re an Indian freelancer registered under GST and working on Fiverr, understanding how GST applies to your services […]

GST Registration for Indian Freelancers working on Fiverr

GST for Indian freelancers on Fiverr can be confusing, especially when you’re dealing with international payments, currency conversion, and platform commissions. This guide explains everything you need to know – GST registration requirements, export of services, FIRC, LUT filing, reverse charge mechanism and more. If you’re a Fiverr freelancer in India, this blog is your […]

GST for Freelancers (2025): Registration, GST Rates, Rules & Exemption

A complete comprehensive article regarding GST applicability on Indian freelancers providing services in India/outside India.

Decoding OIDAR Services under GST

Meaning of OIDAR Services Almost everyone uses the internet for one or other task in daily life, Be it watching videos on youtube, downloading E-books & other data from the internet, booking tickets and online shopping etc . Not all but some of such internet services are covered under OIDAR Services which is explained below. […]

Income Tax Compliance for Ebay Sellers in India

Selling on Ebay can be a fantastic way to reach a global customer base and boost your income. However, while selling on Ebay offers immense growth opportunities, it also brings several income tax compliance responsibilities. Whether you’re a part-time seller or a full-time e-commerce business, you must understand your tax obligations under the Income Tax […]

TDS on Purchase of Property from an NRI

Applicability When any person purchases an immovable property (like land, building, flat etc) from an NRI (Non-Resident), TDS is required to be deducted at the rate of 12.5% (plus surcharge & cess) on the amount of the capital gain, arising to such non-resident as per Section 195 of the Income Tax Act. Note: – TDS […]

Cost Inflation Index (CII) for FY 2025-26 and Previous Years

Cost Inflation Index (CII) Applicable from Financial Year 2017-18 Financial Year (01 Apr to 31 Mar) Cost Inflation Index (CII) 2025-26 376 2024-25 363 2023-24 348 2022-23 331 2021-22 317 2020-21 301 2019-20 289 2018-19 280 2017-18 272 2016-17 264 2015-16 254 2014-15 240 2013-14 220 2012-13 200 2011-12 184 2010-11 167 2009-10 148 2008-09 […]

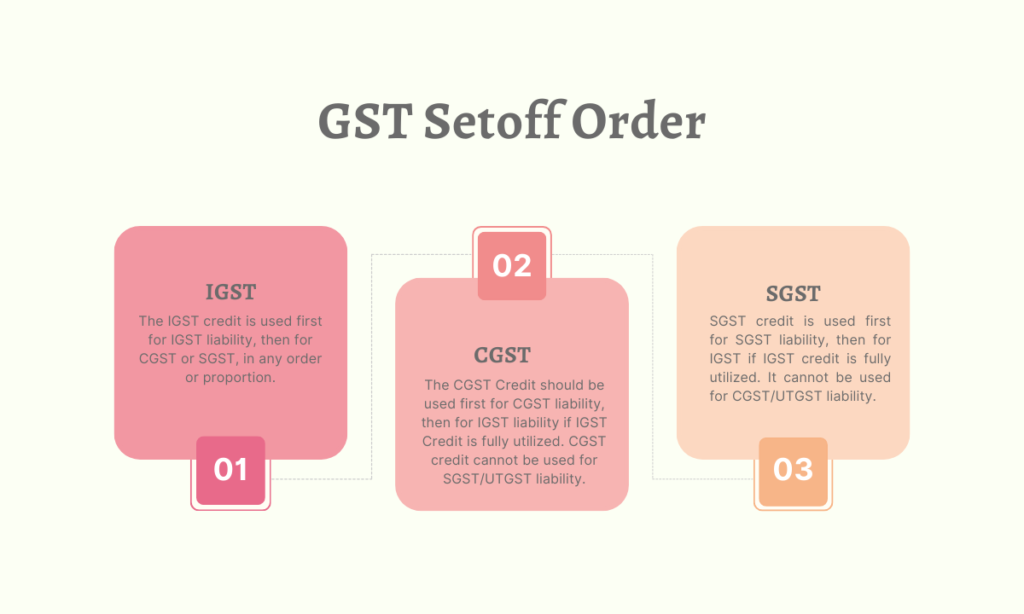

Order of Utilisation of Input Tax Credit Under GST

Meaning of Input Tax Credit (ITC) Input Tax Credit refers to the tax already paid by a person at time of purchase of goods or services and which is available as deduction from tax payable on sale of goods or services. It can be ITC of IGST, CGST & SGST. ITC Claim ITC claim means […]

TDS Rates for FY 2025-26 (AY 2026-27)

TDS Rate Chart as applicable for the Financial year 2025-26 (Assessment Year 2026-27) The updated TDS rates for financial year 2025-26 are given in below table Section Nature of Payment Threshold Limit (in Rs) Individual/HUF Others(Co./Firm/LLP etc.) 192 Salary Basic exemption limit Slab rates Slab rates 192A Premature withdrawal from EPF 50,000 10% 10% 193 […]