There are various ways in which you can verify your e-return, one of which is using bank account details. This option comes handy when you do not have a mobile number registered in your Aadhar card and even do not use net banking which is the most commonly used method for verifying income tax return.

Various Benefits of Pre-Validating Bank Account

- You can use it to generate EVC code for verifying your income tax return even you do not have net banking activated on your bank account. The only requirement is to have a mobile number and email register with your bank.

- You can use the option for resetting the password using PAN and the bank account number using OTP to the mobile number linked to the bank account.

- Sometime Income Tax Department withheld your refund and ask you to verify your bank account by sending a cancelled cheque along with address proof before processing the high-value If you have a pre-validated bank account then you do not have to worry about sending the cancelled cheque. This also helps in faster processing of refunds.

- You can activate a higher security option for logging into the e-Filing portal of Income Tax using PAN, password, and OTP send to your mobile number linked to the bank account.

Also Read – How to reset the password of Income Tax E-filling account

Step by Step Guide for Pre-Validate Bank Account

Step 1 – Login to your Income Tax Portal – https://www.incometaxindiaefiling.gov.in/home

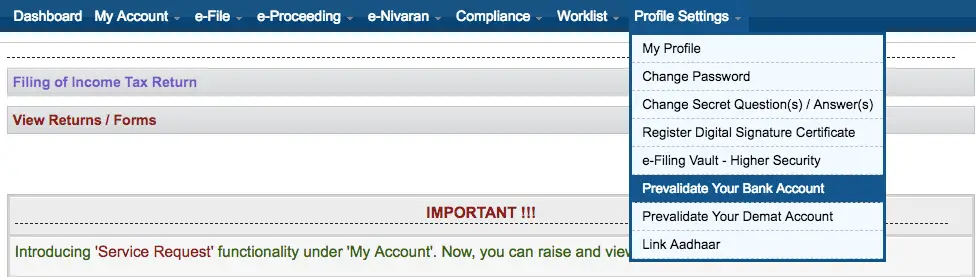

Step 2 –Select Profile Settings ->Prevalidate Your Bank Account option.

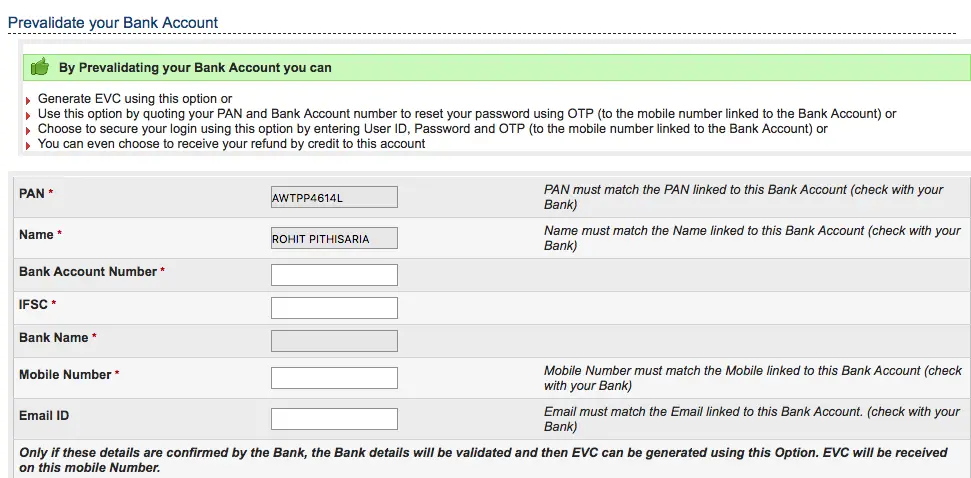

Step 3 – If you do not have any pre-validated bank account then you will get an option to add your bank account details. Enter the following bank details to pre-validate your bank account: –

- Bank Account Number

- Bank IFSC Code

- Bank Name

- Mobile Number

- Email ID

Note: – You are required to enter that mobile number and email address which are registered with your bank, not the mobile number and email associated with your e-Filing login.

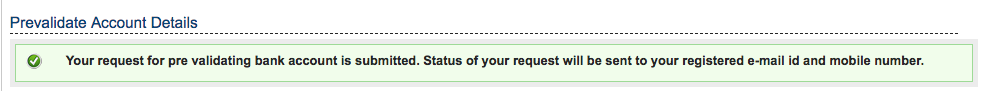

Step 4 – Click on Prevalidate button once you enter all the required information. A confirmation message will appear on the screen.

Note: – You will be only able to validate those bank accounts which have been linked using exactly same PAN number.

Step 5 – If the details entered are correct then your account will get pre-validated instantly. To check the status of the request just navigate to Profile Settings ->Prevalidate Your Bank Account option: –

- Validated – The bank account details are correct and validated.

- Validated and EVC enabled – The bank account details are validated and this bank account is enabled for EVC. So when you request EVC code you will get it on the mobile number registered with the bank for this account automatically.

- Validation Failed – PAN not linked with the bank account or the details entered are incorrect.

Note: – You can remove or add multiple bank accounts. However, only one bank account can be used at a time for generating EVC code.

Also Read – 18 Transactions in which quoting PAN is mandatory