There are number of tools and softwares for Chartered accountants and tax professionals to ease their work.

Almost all CAs are using software like Computax, KDK, Taxmann, Genius etc to prepare and file income tax returns. But in GST, most of CA are using the reports generated by accounting softwares like tally and marg.

Other than GST and Income tax softwares there are also some tools which can help them to save time and efforts to a great extent. Here is a list and details of such tools.

Disclaimer: Some are developed and maintained by TaxAdda

1) Practice Management Software by TaxAdda – Cloud Based

Managing tasks, allocating them to team members is a hectic task to be done each day. This application let you manage your GST and Income tax task with ease. While other such software are more like project management, this software is specifically designed for small and medium firms.

This application also helps you in maintaining all client’s data in one place. The USP of this application is the practical features and reasonable pricing.

Pricing: Free up to 25 GST clients and then starts at Rs. 1999 per year.

Details: Practice Management Software for CA & Tax Practitioners

2) Octa GST Assistant

This chrome extension enables you to download GSTR-2A, GSTR-3B, GSTR-1 in json and excel formats for multiple months in one click.

You has to login in the GST portal gst.gov.in to download files. Generally, you have to select each month one by one to generate and download file.

Using this extension, you can generate files of desired type in one click and after generation, download files in one click.

Price: Free

Download Link – https://chrome.google.com/webstore/detail/octa-gst-assistant/ljnadbaeifgbakekpdcecdiefpbooihh

3) TaxAdda Login Tool

To login in gst portal in client’s account, CA has to enter client’s username and password. And password needs to be typed as it cannot be copied and pasted.

This login tool comes with chrome and firefox extensions. After installing extension, you has to login in extension. And then it works like chrome password manager works.

Whenever you login in a client account for first time after installing extension, it asks whether you want to save client. You enters the name of client and it’s username and password will be saved. And when you next time you comes to gst portal login page, it shows a top bar in which you can simply search and select client name and username and password will be autofilled. The details gets synced between all computers in which extension is installed and login with same credentials.

This extension works on income tax portal also. Also, you can import all the clients via one excel file through the portal.

Price: 499 per year for unlimited clients for unlimited computers

Details: https://www.taxadda.com/gst-income-tax-login-tool/

4) GST Return Status Bulk Checker

This tool allows you to check status of GSTR-3B or GSTR-1 of any GSTIN without username and password.

Many a times, CA or their employees forget to marks a return as filed or wrongly marks a return as filed when it is due to be filed or verify by OTP/DSC. This tool comes handy at that time.

You can import all their clients by just entering GSTIN, and their trade name and legal name will be fetched from GSTN servers. The clients gets saved in the software.

After that you can check all clients status for a particular return type and particular month/quarter in one click. If you want then you can check stats of each client one by one.

You can also use it as your mini gst return task manager. Keep on checking the status of client you had filed return and it will be marked as Filed.

Price: Rs. 999 for one year with 4000 credits. Checking GST Return Status of 1 GSTIN for 1 month/quarter consumes 1 credit. For Example, if you check all your 100 client’s status for October 2019 for GSTR-3B then 100 credit will be used. Suppose, 80 client’s status will be marked as Filed. Now user again check for status then only 20 client’s status will be checked, so 20 credits will be used.

Details: https://www.taxadda.com/gst-return-status-checker/

5) JSON to Excel Convertor by GSTZen

Many a times we has only json file imported from the portal and wants to check an entry in it. GSTN offline tool provides limited functionality in this regard.

This JSON to Excel convertor can help you in such times which enables you to convert files to readable excel format.

Price: Free

Details: https://my.gstzen.in/p/

6) GSTIN Validator and Search

You can get GSTIN details like name, registration date, address, registration type (regular, composition etc) and other details from GSTIN from this tool and also from many similar tools available online.

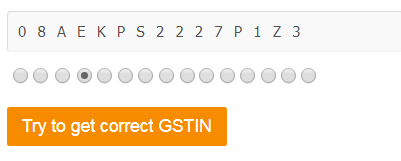

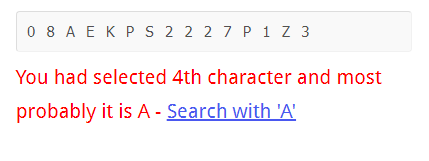

But this tool do one more work. Many a times, another person gives an invoice in which GSTIN is written but not clear. This tool enables you to select the character in which you has doubt and it will tell you the correct GSTIN. Then you can search the GSTIN in this tool to confirm the name.

Price: Free

Details: https://www.taxadda.com/gstin-search-and-validator/

Know about more tools which are beneficial for CA and tax practitioners? Let us know in comments.