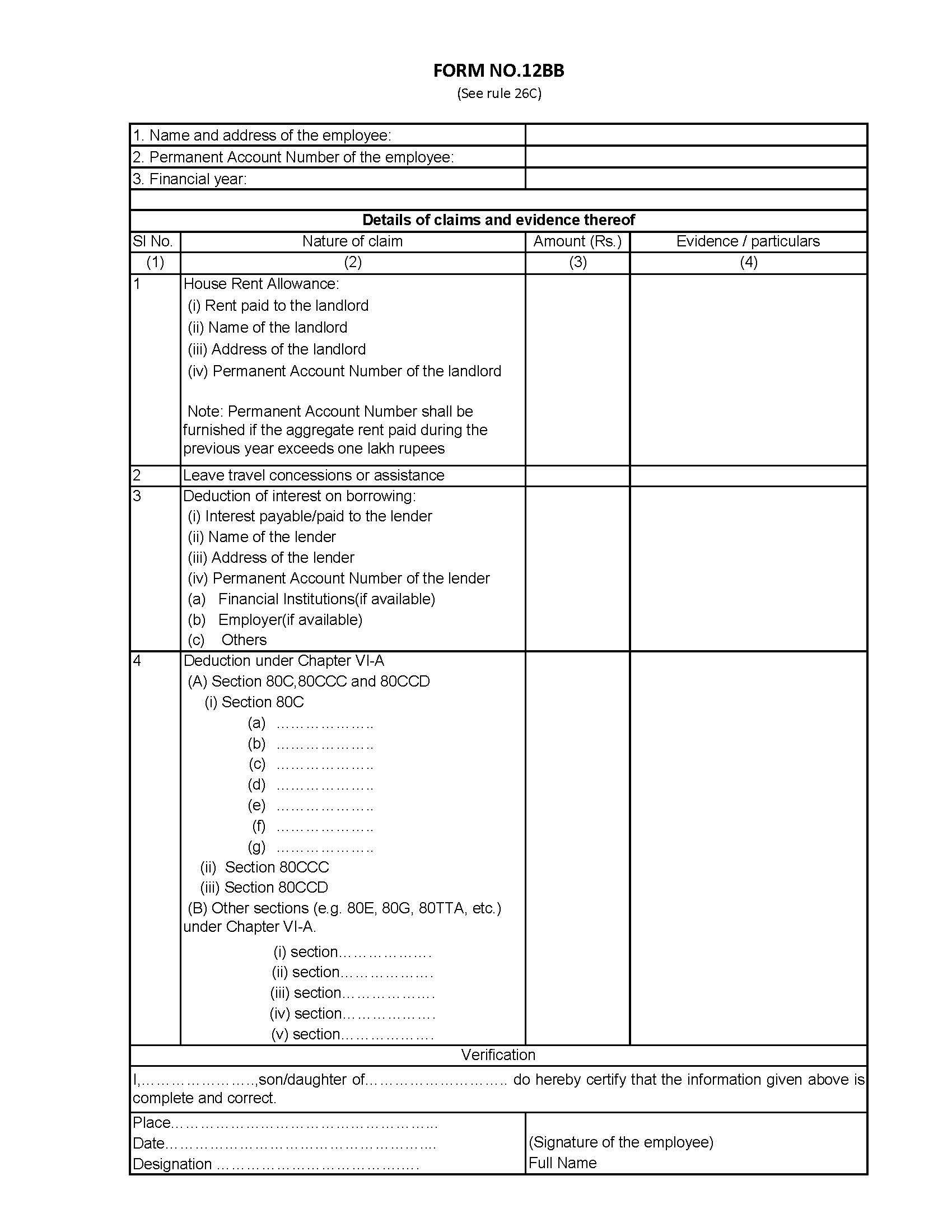

Form 12BB of income tax act is required to be filed with the employer if you want him to consider the HRA, LTA, Section 80 and interest paid on home loans under section 24 and thus deduct lower amount of TDS from your salary. This form is applicable from 1st June, 2016.

The form has to be submitted for every financial year (April to March) and at time of joining a company. It is highly advisable to submit it in April only so that employer starts deducting lower amount of tds from april only.

The details regarding the claims made are required in the following manner.

| S No. | Nature of claims | Evidence or particulars |

| 1. | House Rent Allowance | Name, address and permanent account number of the landlord/landlords where the aggregate rent paid during the previous year exceeds rupees one lakh. |

| 2. | Leave travel concession or assistance | Evidence of expenditure |

| 3. | Deduction of interest under the head “Income from house property” | Name, address and permanent account number of the lender |

| 4. | Deduction under Chapter VI-A | Evidence of investment or expenditure |

Source: Income-tax (11th Amendment) Rules, 2016

Source: Income-tax (11th Amendment) Rules, 2016

Also Read:

Deduction under Section 87A

Deduction for Medical Insurance Premium under Section 80E