As per new section 139AA and judgment of Supreme Court dated 9 June 2017, following thing shall apply from 1st July 2017 :-

- Every person who wants to file Income Tax Return or wants to apply for PAN card shall require to quote their Aadhaar Number. If the person do not possess Aadhaar Number, the Enrolment ID of Aadhar application form issued to him at the time of enrolment shall be quoted.

- Every person who is having Aadhaar Number along with PAN card shall intimate it to income tax authorities for the purpose of linking with Aadhaar.

Person Covered under section 139AA

The Aadhaar card linking is only applicable to Individual. HUF, Partnership. LLP and Companies are not required to link Aadhaar card as they cannot get Aadhaar number. Also this new section 139AA shall not apply to the following individuals:-

- residing in the States of Assam, J&K and Meghalaya

- a non-resident as per the I.T. Act, 1961

- of the age of 80 years or more at any time during the previous year

- not a citizen of India

Last Date for linking Aadhaar with PAN Card

Last date for linking is still to be announced by Central Government. 1st July, 2017 is just the beginning date from which linking is become mandatory.

Also Read – 18 Transactions in which quoting PAN is mandatory

Consequences if Aadhaar is not linked with PAN Card before last date

Your PAN will become invalid if it is not linked with the Aadhaar Number before the last date for linking which is still to be announced by Central Government. Other provisions of Income Tax Act shall apply as if the person had not applied for allotment of PAN.

Different ways in which you can link your Aadhaar card with your PAN number

- Without logging in Income Tax E-filling Portal

This is the easiest way for linking your Aadhaar card with PAN card

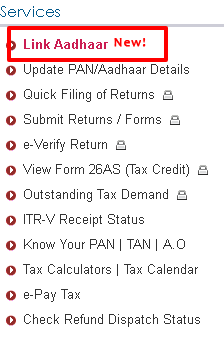

Step 1 :- Go to https://incometaxindiaefiling.gov.in/ and select Link Aadhaar option under services.

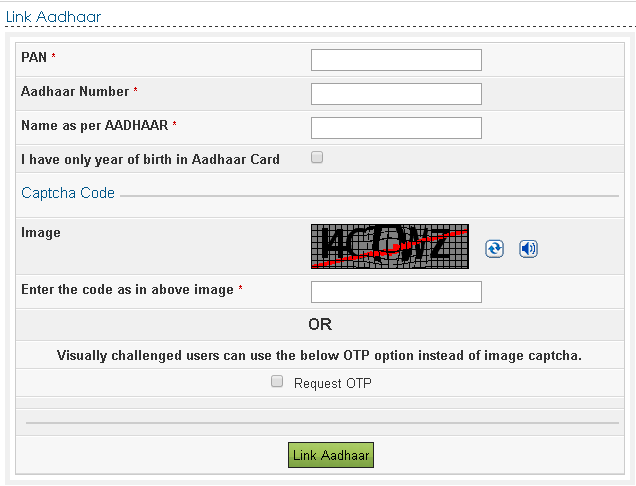

Step 2 :- Enter PAN, Aadhaar Number, name as per Aadhaar (exactly as printed in your Aadhaar Card). You can also select the option of I have only year of birth in Aadhaar Card if complete date of birth is not mentioned in your Aadhar Card.

Step 3 :- Enter captcha image and click on Link Aadhaar button.Step 4 :- A confirmation message will appear if all the details are correctly entered. Aadhaar will get linked only when Date of Birth and Gender is exactly similar with the PAN card. User will also require to provide OTP for linking Aadhaar if there is mismatch in the spelling of the name. However this OTP will be generated when Date of Birth and Gender is exactly matching with the PAN card.

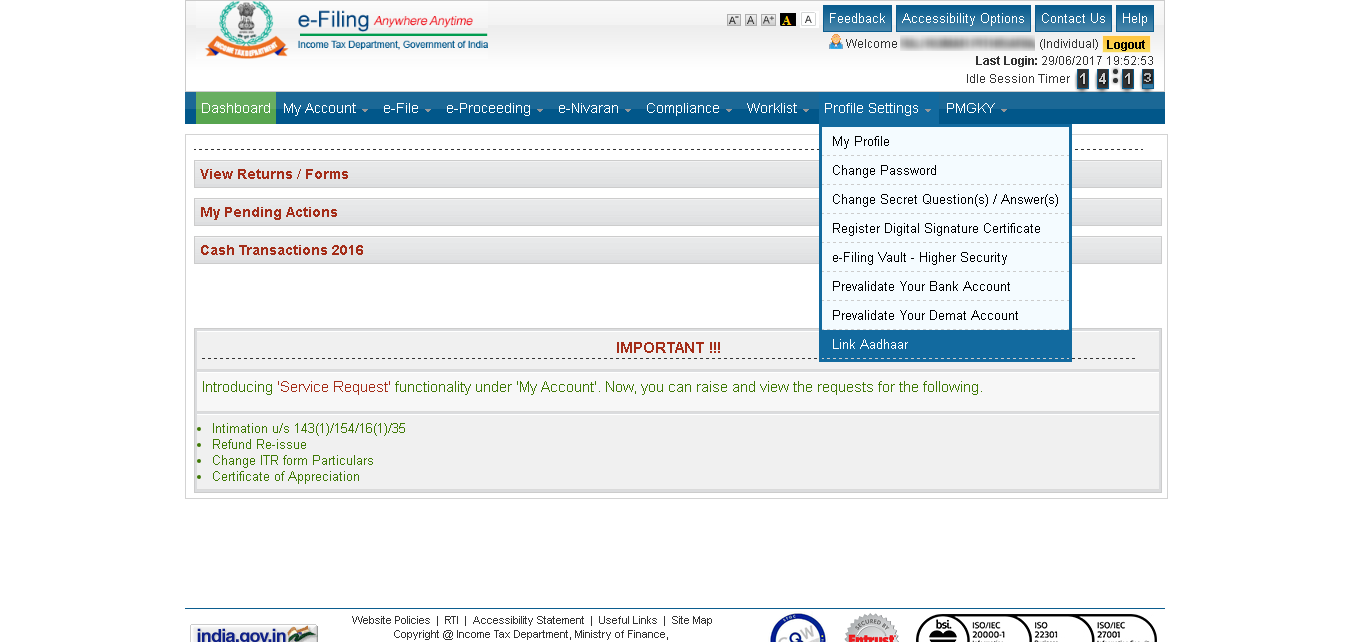

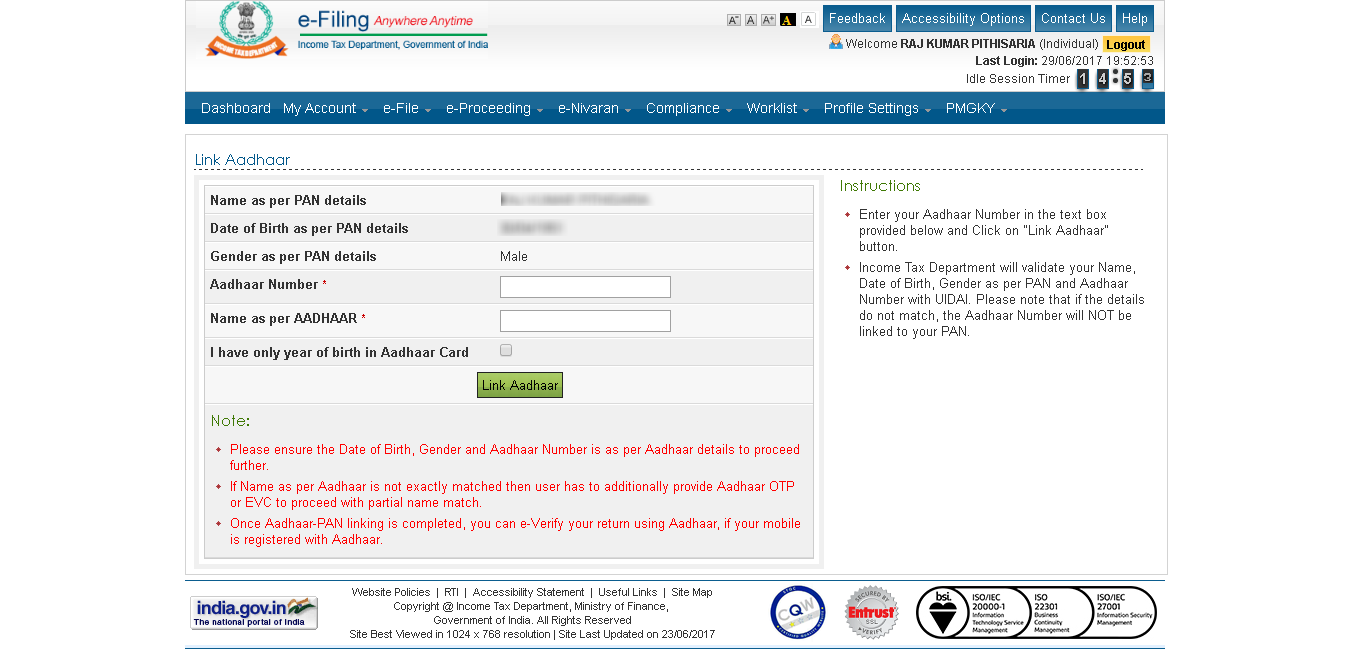

Step 3 :- Enter captcha image and click on Link Aadhaar button.Step 4 :- A confirmation message will appear if all the details are correctly entered. Aadhaar will get linked only when Date of Birth and Gender is exactly similar with the PAN card. User will also require to provide OTP for linking Aadhaar if there is mismatch in the spelling of the name. However this OTP will be generated when Date of Birth and Gender is exactly matching with the PAN card. - After logging in Income Tax E-filling PortalStep 1 :- Login to e-Filing portal from https://www.incometaxindiaefiling.gov.in/e-Filing/UserLogin/LoginHome.htmlStep 2:- Select Link Aadhaar option available under Profile Setting.

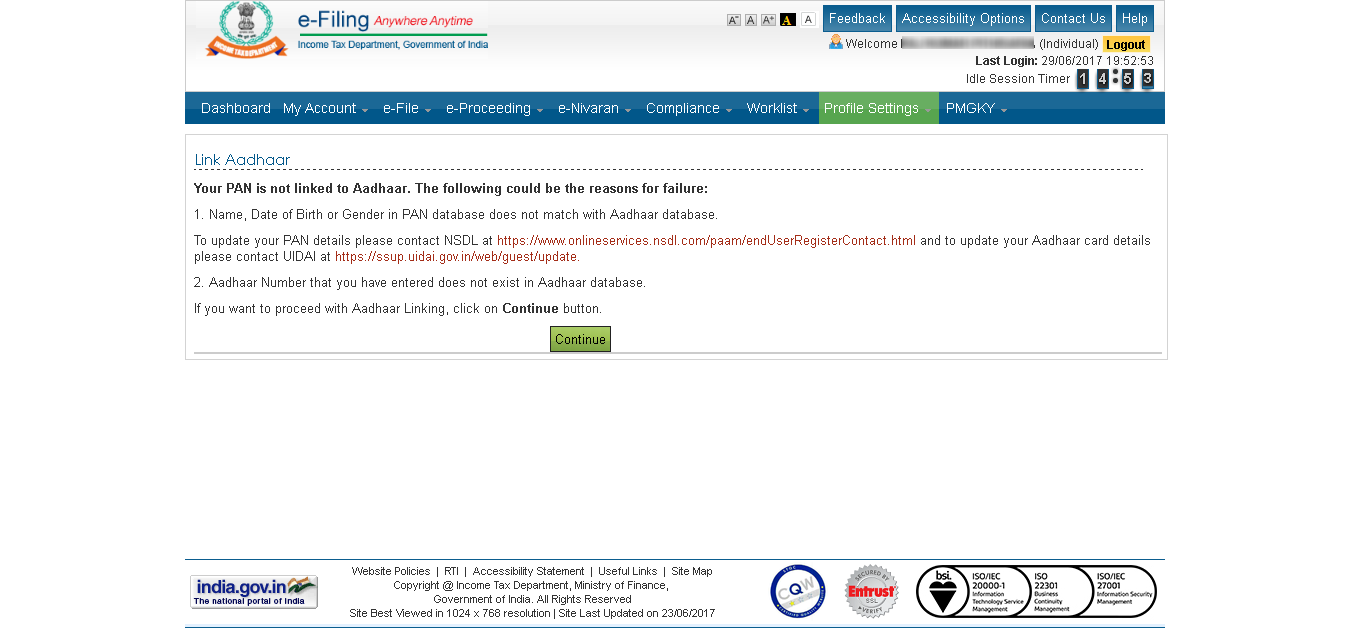

Step 3 :- Click on Continue button.

Step 3 :- Click on Continue button.

Step 4 :- Enter your Aadhaar Number, Name as per Aadhaar. Select option I have only year of birth in Aadhar Card if complete Date of Birth is not printed in Aadhar Card.

Step 4 :- Enter your Aadhaar Number, Name as per Aadhaar. Select option I have only year of birth in Aadhar Card if complete Date of Birth is not printed in Aadhar Card.

Step 5 :- A confirmation message will appear if all the details are correctly entered. Aadhaar will get linked only when Date of Birth and Gender is exactly similar with the PAN card. User will also require to provide OTP for linking Aadhaar if there is mismatch in the spelling of the name. However this OTP will be generated when Date of Birth and Gender is exactly matching with the PAN card.

Step 5 :- A confirmation message will appear if all the details are correctly entered. Aadhaar will get linked only when Date of Birth and Gender is exactly similar with the PAN card. User will also require to provide OTP for linking Aadhaar if there is mismatch in the spelling of the name. However this OTP will be generated when Date of Birth and Gender is exactly matching with the PAN card. - Using SMSStep 1 :- Type message in the following format

UIDPAN<SPACE><12 digit Aadhaar><Space><10 digit PAN>

Example: UIDPAN 123456789012 ABCDP0000EStep 2 :- Send this SMS to 567678 or 56161 from your registered mobile number.

What if I do not have Aadhaar Card

If you do not have Aadhaar Card then you do not fall in the ambit of section 139AA. Supreme Court, in its judgement dated 09 June 2017, relaxed the compulsory norm for linking the Aadhaar Card when PAN card holder do not have Aadhaar number for the time being.

Having different details in Aadhaar Card & PAN Card

If there is difference in the details mentioned in Aadhaar Card & PAN Card then such person is require to make correction in either Aadhaar Card or PAN card.

Changing details in Aadhaar card – You can file correction in your Aadhaar card online if your mobile number is registered with Aadhaar. Link – https://ssup.uidai.gov.in/web/guest/ssup-home

Changing details in PAN card – You can file correction request for you PAN card online. Link – https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

Having more than one PAN card

Having more than one PAN card (having different PAN number) is illegal and such person should surrender such multiple PAN card. You can easily surrender multiple PAN card online.