Eligible Assessee

Individual or HUF (Whether resident or non resident). No benefit is available to partnership firms, company, LLP, AOP etc. If the individual is a senior citizen then deduction is allowed under Section 80TTB from financial year 2018-19.

Deductible Amount

Interest on deposits in saving account up to a maximum of rs. 10,000. The limit of Rs. 10,000 is collectively for interest from all saving accounts held by a person.

Saving account held with a banking company, a co-operative bank or a post office is eligible for deduction. Deduction is not available on interest from fixed deposits (FD).

This is not an exempted income, therefore while filing return total interest earned is to be shown as income under the head “Income from other sources” and then deduction under section 80TTA is to be taken subject to maximum limit of rs. 10,000.

TDS under section 194A is not applicable on saving bank interest. Therefore no tds is liable to be deducted on interest from savings account irrespective of the amount of interest. Therefore even if you earn Rs. 1,00,000 as saving account interest, no TDS will be deducted from that amount.

When interest is received on any deposit in savings account held on behalf of firm, association of persons or body of individuals then no deduction is available in respect of such interest to partner of firm or member of association of persons or body of individuals.

How to take deduction of Section 80TTA in Income tax return

- In ITR – 1

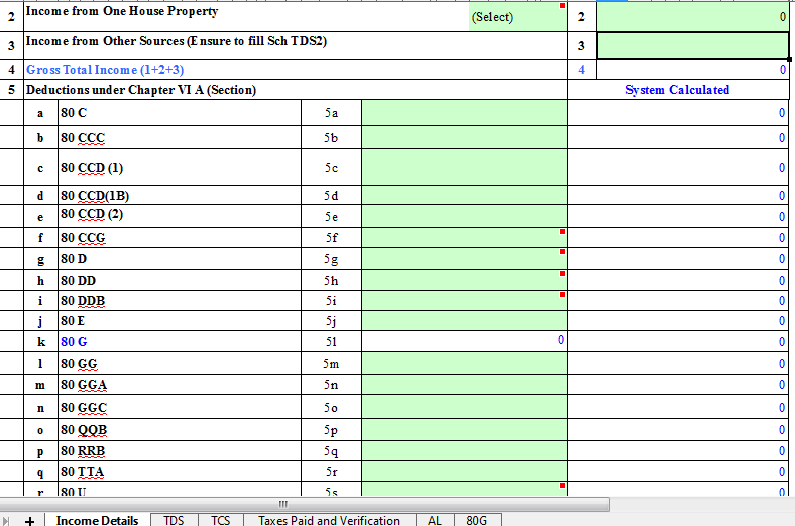

You have to fill your income from all other sources including interest from saving accounts in Point no. 4. The interest from savings account in to be filled in Point no. 5(q). The utility will auto calculate the amount allowed as deduction if amount exceeds Rs. 10,000.

- ITR -2, 2A, 3, 4, 4S

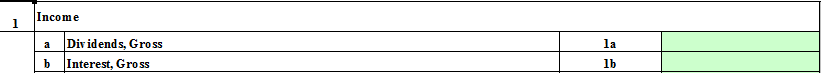

You have to fill your income from all other sources including interest from saving accounts in Point no. 1(b) in sheet “OS”.

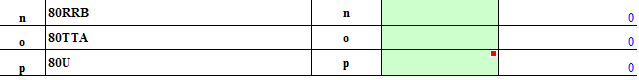

The interest from savings account in to be filled in Point no. “o” of sheet VIA. The utility will auto calculate the amount allowed as deduction if amount exceeds Rs. 10,000.

Also Read:

Rebate under Section 87A

Deduction of Rent under section 80GG