GST for Freelancers (2025): Registration, GST Rates, Rules & Exemption

A complete comprehensive article regarding GST applicability on Indian freelancers providing services in India/outside India.

Income Tax Compliance for Ebay Sellers in India

Selling on Ebay can be a fantastic way to reach a global customer base and boost your income. However, while selling on Ebay offers immense growth opportunities, it also brings several income tax compliance responsibilities. Whether you’re a part-time seller or a full-time e-commerce business, you must understand your tax obligations under the Income Tax […]

TDS on Purchase of Property from an NRI

Applicability When any person purchases an immovable property (like land, building, flat etc) from an NRI (Non-Resident), TDS is required to be deducted at the rate of 12.5% (plus surcharge & cess) on the amount of the capital gain, arising to such non-resident as per Section 195 of the Income Tax Act. Note: – TDS […]

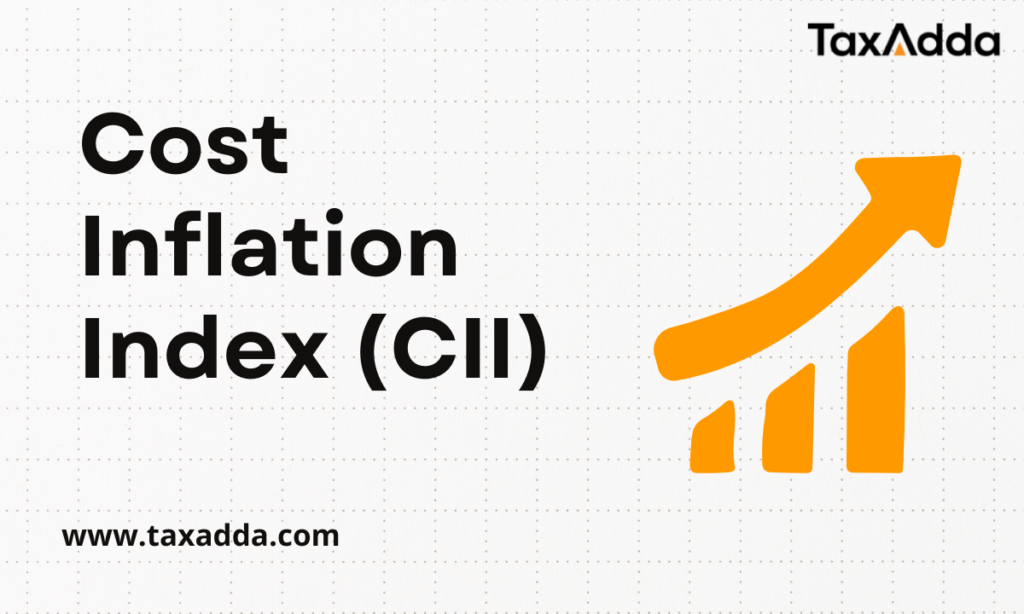

Cost Inflation Index (CII) for FY 2025-26 and Previous Years

Cost Inflation Index (CII) Applicable from Financial Year 2017-18 Financial Year (01 Apr to 31 Mar) Cost Inflation Index (CII) 2025-26 376 2024-25 363 2023-24 348 2022-23 331 2021-22 317 2020-21 301 2019-20 289 2018-19 280 2017-18 272 2016-17 264 2015-16 254 2014-15 240 2013-14 220 2012-13 200 2011-12 184 2010-11 167 2009-10 148 2008-09 […]

Order of Utilisation of Input Tax Credit Under GST

Meaning of Input Tax Credit (ITC) Input Tax Credit refers to the tax already paid by a person at time of purchase of goods or services and which is available as deduction from tax payable on sale of goods or services. It can be ITC of IGST, CGST & SGST. ITC Claim ITC claim means […]

TDS Rates for FY 2025-26 (AY 2026-27)

TDS Rate Chart as applicable for the Financial year 2025-26 (Assessment Year 2026-27) The updated TDS rates for financial year 2025-26 are given in below table Section Nature of Payment Threshold Limit (in Rs) Individual/HUF Others(Co./Firm/LLP etc.) 192 Salary Basic exemption limit Slab rates Slab rates 192A Premature withdrawal from EPF 50,000 10% 10% 193 […]

GST on Second hand goods and Margin Scheme

With the rise of the resale and refurbishment market, understanding how Goods and Services Tax (GST) applies to second-hand goods has become crucial for businesses operating in this space. Be it second hand cars, bikes, furniture, mobiles, laptops, other electronic goods & various household items etc, most of the people are exploring both online & […]

Remuneration & Interest to Partners (2025-26) Section 40b

Section 40b determines the maximum amount of remuneration and interest on capital payable to a partner under Income Tax Act. The amount over the specified limit is not allowed as a deduction to a partnership firm. Remuneration to Partners Section 40b Remuneration includes salary, bonus, commission .Remuneration in partnership firm is allowed as a deduction […]

Section 44AD – Presumptive taxation Scheme for Businesses

Section 44AD This section is for presumptive taxation for eligible small businesses to declare a fixed percentage of their turnover as taxable income, eliminating the need for detailed books or audits. This Scheme gives you an option to compute your income on a presumptive basis (deemed profit), which is as follows: The purpose of this […]

Section 44ADA – Presumptive Taxation Scheme for Professionals & Freelancers

Section 44ADA Section 44ADA was introduced for presumptive income for Freelancers & professionals. This section is similar to section 44AD for traders. Under this section Freelancers or professionals such as legal, medical, engineering, architect, accountancy, technical consultancy, interior decoration or any of the profession as given in section 44AA are allowed to presume 50% of the […]