There are many ways in which you can reset the password of your online income tax e-return online account portal.

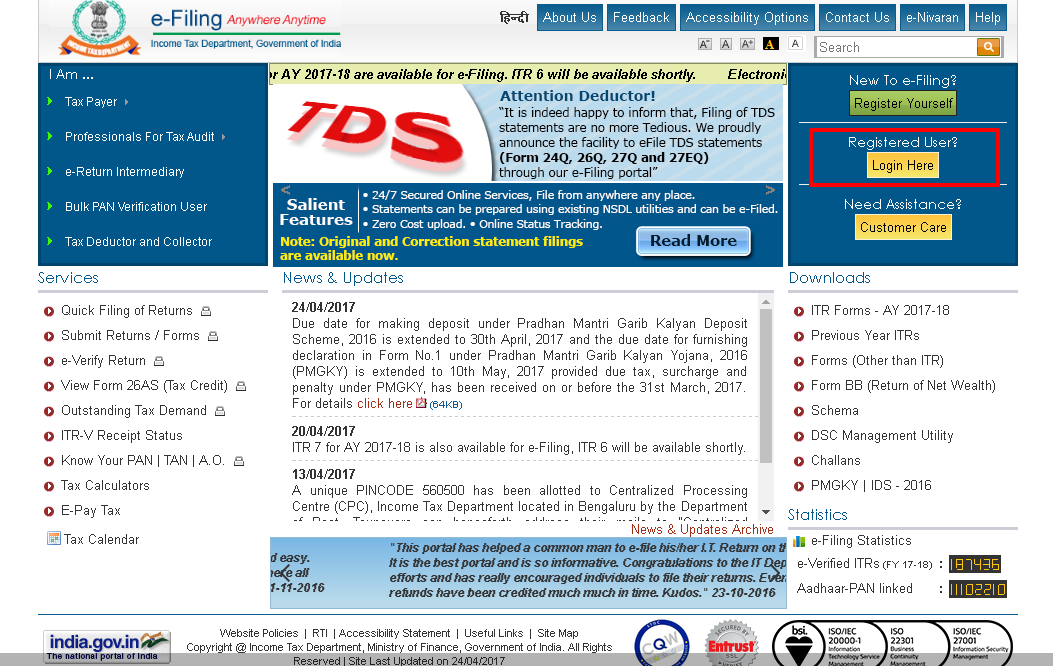

Step 1 -> Go to https://incometaxindiaefiling.gov.in

Step 2 -> Select Login Here option from the left-hand sidebar.

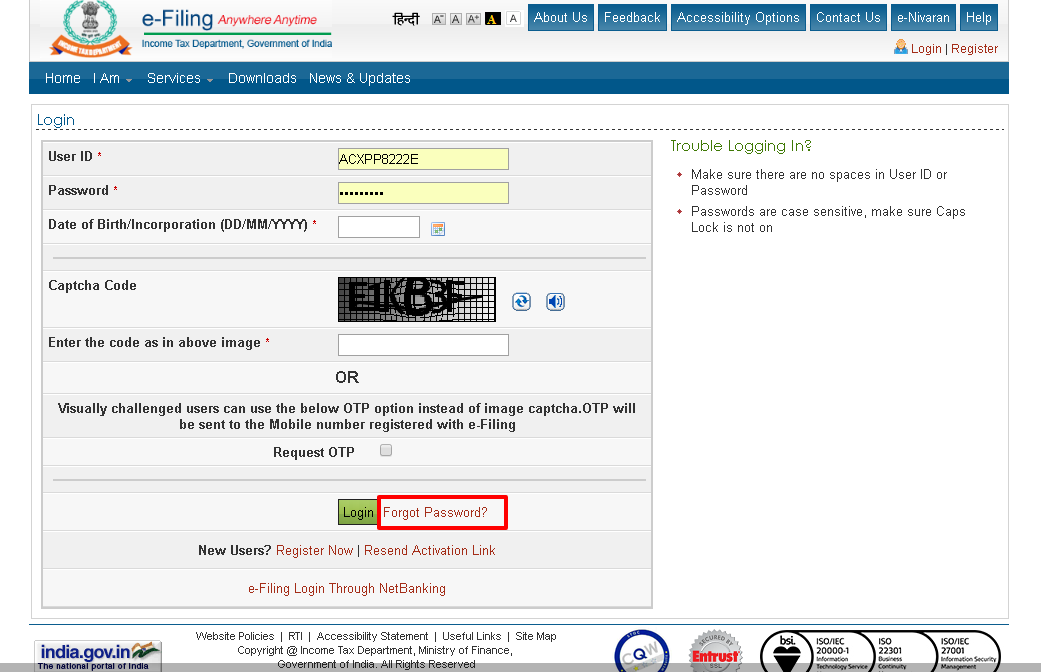

Step 3 -> Click on Forgot Password option.

Step 4 -> Enter your PAN number in the User ID and captcha image. After entering this details, click on Continue button

Step 5-> There are various options provide by Income Tax Department for resetting the password which are as follows: –

- Answer secret question

- Upload DSC

- Using OTP (PINs)

- Using Aadhar OTP

Note :- Some users will not find all the available options as they are based on the user data available in the Income Tax Department website.

Answer secret question

You can use this option if you remember the answer of the secret question setup by you previously on the website. Once you select this option, you have to provide Date of Birth/Incorporation, secret question and answer of that secret question select by you.

Using Digital Signature

Once you select this option, it will ask for Digital Signature Certificate Selection.

In this you have 2 option i.e.

-> New DSC – Select this option if you want to reset password using new Digital Signature Certificate which is not previously registered on Income Tax Department website.

-> Already registered DSC – Select this option if you want to reset password using the previous Digital Signature Certificate which is already registered in your account.

Using OTP Pins

Once you select this option, it will give you an option to send PINs on already registered email id and mobile number or on new email id and mobile number.

-> Registered email id and mobile number – Select this option if you have access to your registered email id and mobile number. Once you click on Validate, you will receive 2 PINs (one on email id and other on mobile) which is required to enter for resetting password.

-> New email id and mobile number – Select this option if you do not have access to your registered email id and mobile number and wish to register new email and mobile number. However you are require to validate your details using anyone of the available method

a) 26ASTAN

Use this option if TDS has been deducted during the current or previous financial year. You are require to enter TAN of deductor, assessment year as well as total tax deducted by that deductor.

b) OTLAS CIN

You can use this option if you have paid any taxes. You are required to enter BSR code, challan number and challan date for validation.

c) Bank Account

In this option you are required to enter the bank account number you used in the previous return filing.

Using Aadhaar OTP

Use this option if you have registered your Aadhaar number with Income Tax Department. Once you select this option, you will find few initial and last digit of your Aadhaar number registered with Income Tax Department. You can generate Aadhaar OTP or enter already generated Aadhaar OTP for verification.

Once you Validate the details you will be able to set new password.

Also Read – Pre-validate Bank Account on Income Tax e-Filing Portal